A recent survey on the topic of central bank digital currency (CBDC) development in Africa gives some fresh insight into their evolution and regulators’ motivations and concerns. Nonetheless, analysts worldwide are raising questions about CBDC implementation, be it in Africa, China, or the U.S.

Central bank digital currencies, popularly known as CBDCs, have been touted as the next step toward financial inclusion. They have the potential to transform the financial system specific to a region. So much potential that government bodies are collaborating with regulatory bodies to solidify their control over their respective payment systems.

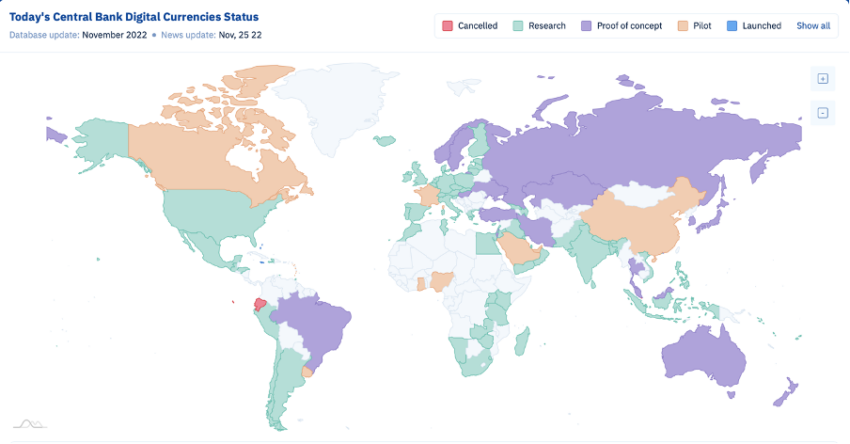

From central banking and tech-driven institutions to politicians—many have their fingers on the pulse of this latest payment innovation. Places like China and Russia have already launched pilot programs, while others, such as the U.S., are in the research phase. BeInCrypto has extensively covered the pros and cons of CBDC implementations in China and the United States.

But another critical area for CBDC development is in Africa. Severe cracks have emerged in CBDC operations in this region, which arguably, could see the most benefits.

African CBDCs: The What and Why

CBDCs are envisioned as a tool to bolster the monetary system with the central bank at the core to support safe, low-cost, and inclusive payments while promoting innovation.

CBDCs could bring financial services to people who previously didn’t have bank accounts, especially if designed for offline use. In remote areas without internet access, digital transactions can be made at little or no cost using simple feature phones. This has to potential to further foster cross-border transfers and payments.

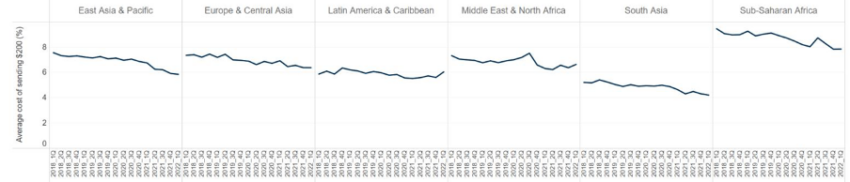

Sub-Saharan Africa remains the most expensive region to send and receive money, with an average cost of just under 8%t of the transfer amount.

CBDCs could ideally help counter this setback and promote financial inclusion within the African region, especially compared to other EMEs (emerging market economies).

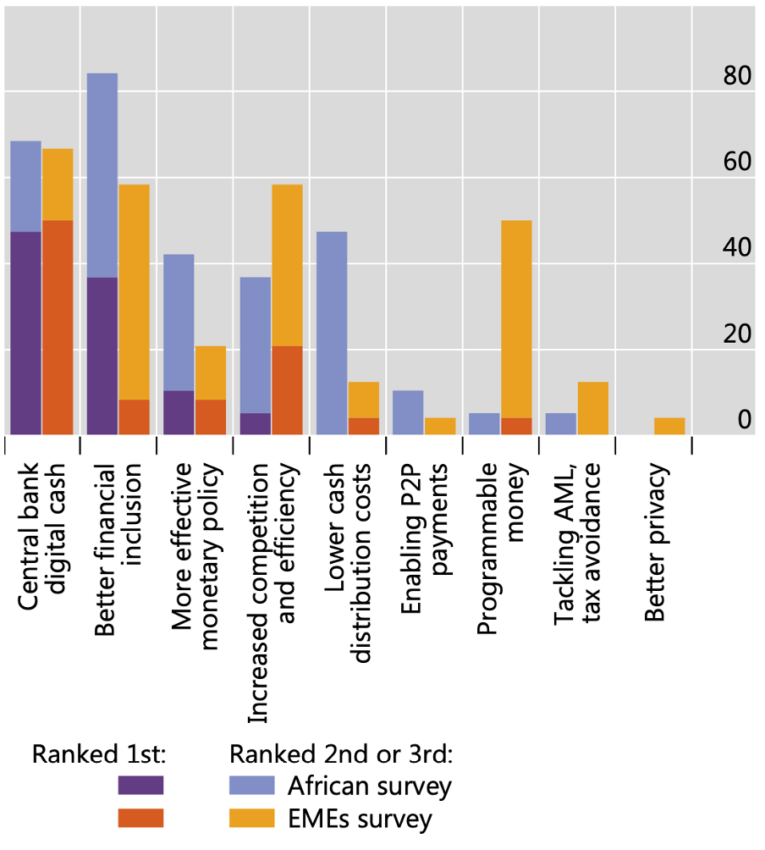

Compared to the latter, financial inclusion ranks above digital cash, among other motivations, as seen in the chart below:

While many regions across the African continent are exploring CBDC implementation, Nigeria and Ghana are leading the pack.

Status report on CBDCs in Africa

The interest of African central banks in CBDCs has recently shot up. While all those surveyed are analyzing CBDCs, only a few have projects at advanced stages (pilot or live).

Several sub-Saharan African central banks are either researching or are in the pilot phase of a digital currency following Nigeria’s introduction of the e-Naira and Ghana’s e-cedi.

There are still many risks and challenges, including data privacy, cyber-attacks, and public access to digital infrastructure.

Visible cracks in the infrastructure

A recent report highlighted some key differences and varying motivations in the African CBDC movement. The Bank for International Settlements (BIS) surveyed 19 African central banks that served as the report’s base:

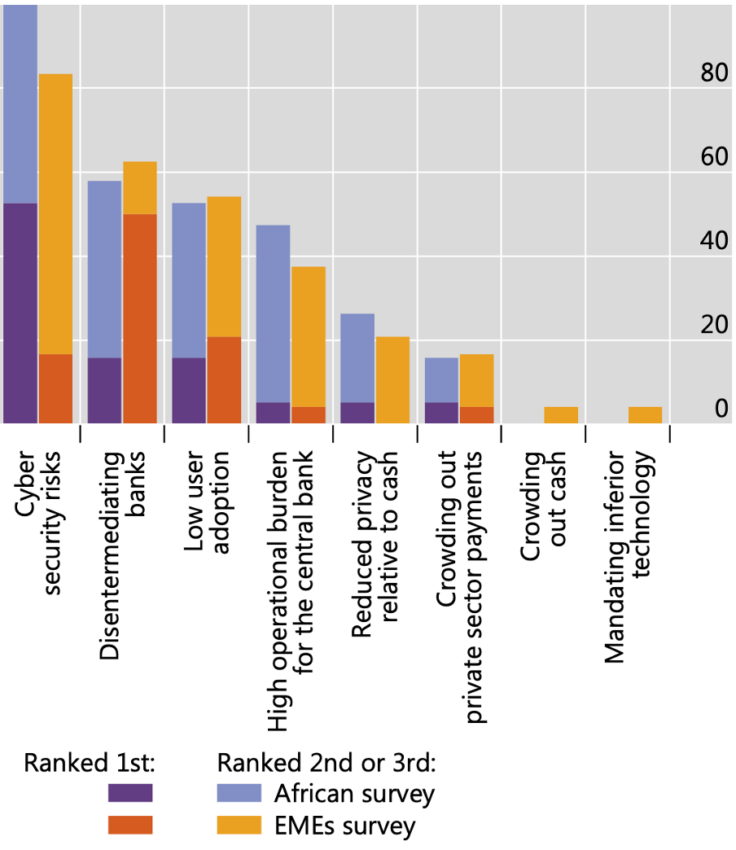

A direct threat to freedom that a CBDC might pose is closely related to its threat to privacy. Per the report, the main operational challenge noted is cyber risk, even more in Africa than elsewhere.

A successful cyberattack on a CBDC could cause severe and widespread damage and erode the basis of an entire region’s economy. Attacks on credit card systems and databases containing consumer credit profiles already offer a glimpse of the potential threats involved.

You might remember an infamous hack on the central bank of Bangladesh in 2016. The perpetrators compromised Bangladesh Bank’s computer network, observed how transfers were done and gained access to the bank’s credentials for payment transfers.

Another significant challenge is the operational burden of maintaining a CBDC. The BIS survey notes:

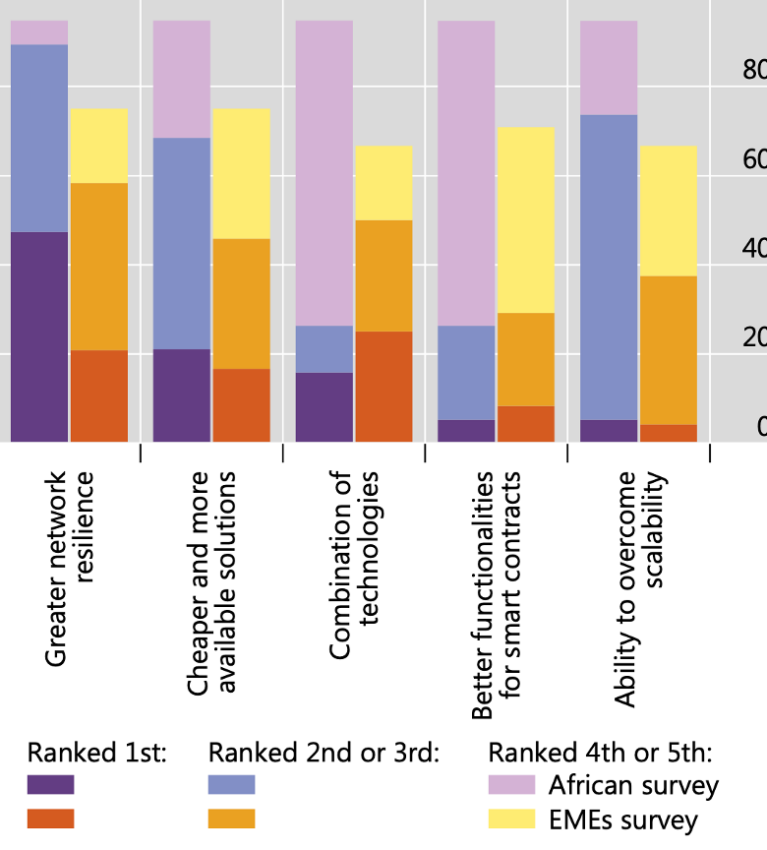

“Here African central banks highlight aspects very similar to other EMEs: network resilience, the cost, availability, and combinability of technologies, and their scalability and functionalities. The operational cost of such a complex system is high.”

Meanwhile, the risk of low adoption and bank disintegration also ranked among the top concerns. As BeInCrypto reported, Nigeria’s central bank digital currency has been adopted by just 0.50% of the country’s population. Following this, different analysts proclaimed that “the eNaira has been a massive failure.”

These setbacks could potentially even complicate monetary policy.

Concerns in the US and around the globe

BeInCrypto reached out to Nick Anthony, a policy analyst at the Cato Institute, via Twitter to comment on the ongoing CBDC situation.

The fellow analyst raised similar red flags over CBDCs adoption, including cybersecurity risks as a whole in the U.S. Given the power that the US holds, CBDCs implementation can have direct/indirect effects across the globe. Anthony opined:

“A CBDC would most likely be the single largest assault on financial privacy since the creation of the Bank Secrecy Act and the establishment of the third-party doctrine.”

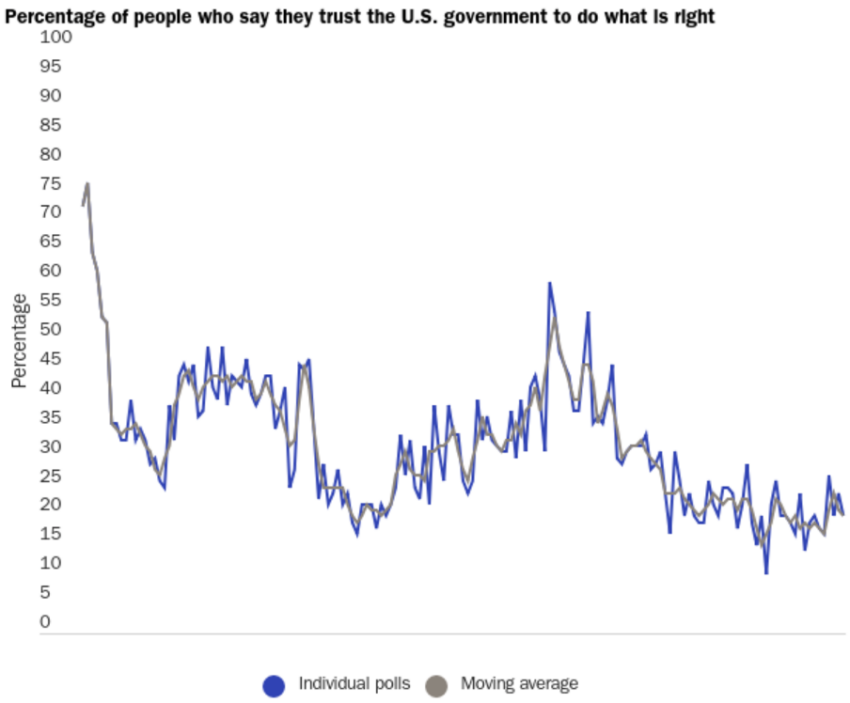

Moreover, he countered the financial inclusion attribute about the US, as was the case for Africa discussed earlier in the article. He added, ‘considering privacy and distrust for banks are the top three reasons for being unbanked, it’s hard to imagine how a CBDC would remedy the issue when trust in the government is at historic lows.’

There is also a risk that a CBDC could undermine both the foundation and the future of financial markets.

“Not only would it risk disintermediating the banking system, but countries around the world have shown that they want a CBDC specifically to hold their monopoly over money.”

Suggestions to consider

Congress should explicitly prohibit the Federal Reserve and Treasury from issuing a CBDC in any form to prevent financial privacy, financial freedom, free markets, and cyber security risks. To do so, Congress could amend the Federal Reserve Act, as highlighted in a research paper shared with BeInCrypto.

Lastly, in a concluding narrative, the policy analyst asserted:

“A U.S. CBDC poses substantial risks to financial privacy, financial freedom, free markets, and cybersecurity. Yet the purported benefits fail to stand up to scrutiny. CBDCs have certainly made central banks the talk of the town and thrown a splash of life into an otherwise dense policy field. But there is no reason for the U.S. government to issue a CBDC when the costs are so high and the benefits are so low.”

But again, these are suggestions. While the U.S. possesses a different economic strength and power than Africa, CBDC concerns remain at the forefront.

beincrypto.com

beincrypto.com