BNB holds the 4th spot in terms of market capitalization and is perhaps the best new-age cryptocurrency that dominates as a crypto exchange. Despite its 80% circulating supply, BNB is frequently auto-burnt to maintain a degree of decentralization.

The abundance of tokens available and listed on the Binance network with the lowest transaction fees has been a primary reason for repeated customer action for the Binance network creation of an expansive ecosystem for BNB. After the crash of the FTX exchange, Binance has once again showcased its dominance and a progressive ecosystem capable of handling cash crunches and managing customer funds with proper governance.

BNB coin made a strong up move during the last weeks of October, but the concerns regarding the takeover of FTX seem to have created higher-than-expected volatility. BNB dropped close to $100 from its token value in just a couple of weeks. The outlook for BNB’s expansion into cryptocurrency domination is outshining its competitors by a much higher margin, but despite the growth, BNB is unable to show similar uptrends.

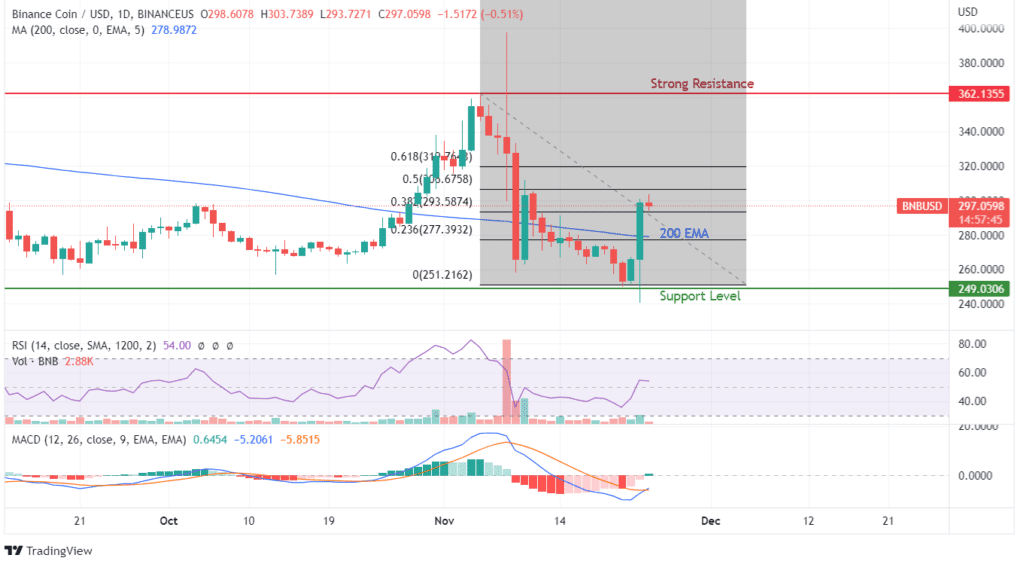

BNB dropping back to the $250 mark is rather taken as a discounted price to make a fresh entry into the token. Similar buying trends were seen on November 10 and November 22, which confirms BNB to be trading at a discounted value. Despite the condition of BNB, the primary challenge is to overcome the developing rejection and resistance near the $362 mark.

The sooner BNB can touch down to the $400 mark, the higher probability it would carry to continue with the bull run. Since the crypto crash in May 2022, BNB has failed to overcome the psychological resistance level of $350 on three different occasions, led by different crypto concerns. Read our Binance coin prediction to know when it will cross the $350 mark.

RSI at current levels indicates a healthy above-neutral stance trading at 54, which bears proximity to the overbought zone of 75. At the same time, MACD has already marked a bullish crossover; hence a buying rally could be witnessed any time before the end of November 2022.

Coincidentally, it also marks an entire year of crypto weakness. The last two days of price movement have seen a huge jump, which brings BNB back to the 38.3% Fibonacci retracement level. The battle between the next two Fibonacci levels would be interesting to witness as RSI has started to dive down.

cryptonewsz.com

cryptonewsz.com