The Polkadot price has yet to break above crucial resistance levels, and on-chain metrics for DOT aren’t suggesting much respite for holders.

The global crypto market cap took a dip below the $1 trillion mark on Nov. 8 as most of the top cryptocurrencies reversed their recent gains. Bitcoin, Ethereum, and most of the top altcoins, including Polkadot, traded in red once again.

At the time of press, the DOT price oscillated near the $6.20 mark, already down 10% since the start of the weekly candlestick.

Polkadot price struggles

Despite the crypto market’s bullish momentum (up until yesterday), there wasn’t much keeping the Polkadot price going. Recently, the Web3 Foundation tweeted, arguing that DOT has morphed from a security into software.

The tweet caused a significant stir in the market, aiding DOT in a nearly 15% price rise between Nov. 4-Nov. 6.

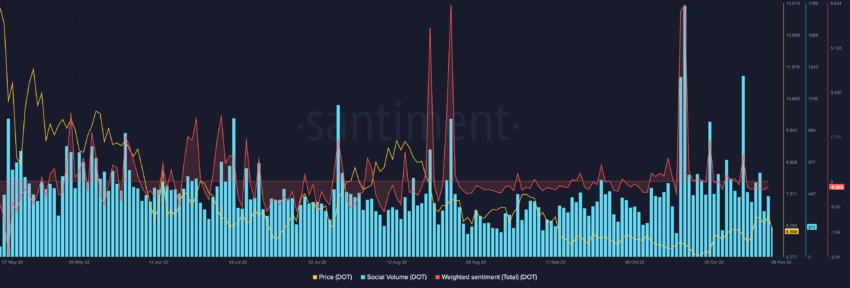

Even though Polkadot remained in the news, its weighted social sentiment had been negative for most of the last week. DOT social volumes, after peaking on Nov. 1, have also started to lose momentum.

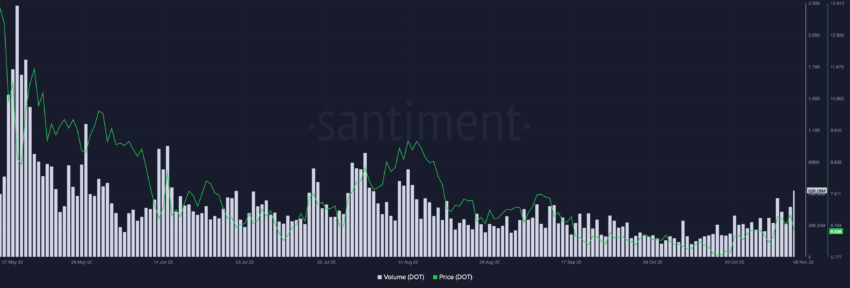

Despite the weak price momentum and negative sentiment, trading volumes maintained a high level. Trade volumes for DOT were at a similar level at this time in August when the Polkadot price was above $9.

Data from CoinMarketCap also showed a major 79.52% spike in trading volumes to $627 million. However, such high volumes alongside bearish price action, like in this case, indicate a sell-off in the market.

Long liquidations hit $1M

At press time, Polkadot’s price dropped another 1.5% on the day to $6.18. Data from Coinalyze highlighted that Polkadot long positions worth close to $1.3 million had been liquidated in the last 24 hours.

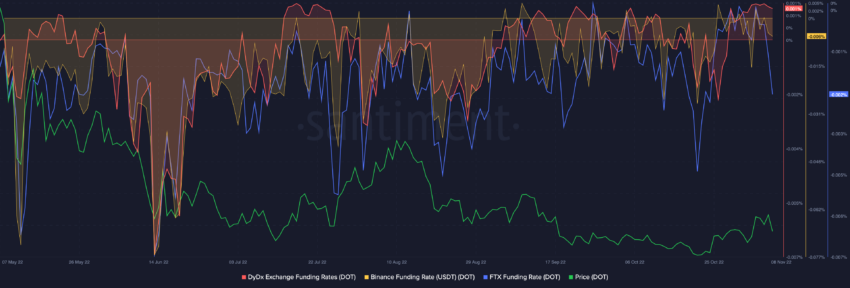

Perpetuals and futures markets also painted a bleak picture for the coin as funding rates for DOT turned negative.

Funding rates are periodic payments made by traders based on the difference between prices in the futures and spot markets.

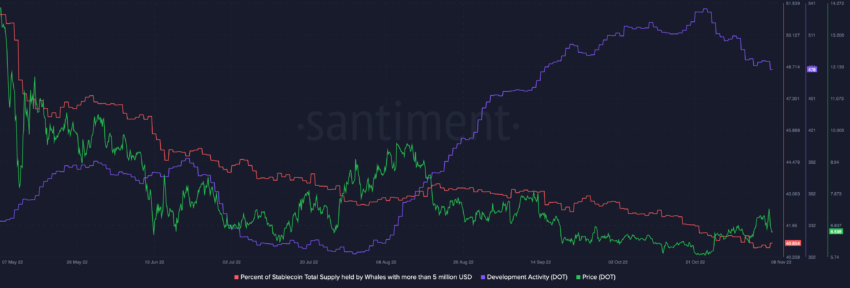

Another bearish trend for DOT was its low development activity. Notably, development activity had been falling since Oct 24 and is now nearing a 3-month low.

In addition, the percentage of stablecoin total supply held by DOT whales with more than $5 million was also in a drawn-out downtrend. This suggests lowered interest in the coin from whales.

With most of the on-chain metrics leaning bearish for DOT, it could fall back to $6 in the near term. In case of a bearish invalidation, the Polkadot price could potentially recover above the short-term resistances at $7.00 and $7.50.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

beincrypto.com

beincrypto.com