Cryptocurrencies were mostly lower on Tuesday as declining volume suggests a pullback is near. Bitcoin was trading around $45,418 at press time and is down about 1.6% over the past 24 hours.

Some analysts are optimistic about the long-term recovery in crypto prices, although the pace of the upside will likely slow over the short term.

“While many of the technical and on-chain indicators confirm this rebound’s strength, it may still be early to say we are out of the woods,” Nathan Cox, chief investment officer at digital asset management firm TwoPrime, wrote Tuesday in an email to investors.

Latest prices

Cryptocurrencies:

- Bitcoin (BTC) $45,418, -1.59%

- Ether (ETH) $3,103.5, -1.98%

Traditional markets:

- S&P 500: 4448, -0.7%

- Gold: $1,785.01, -0.08%

- 10-year Treasury yield closed at 1.263%, down from 1.268% on Monday.

Traders are also monitoring the ongoing regulatory crackdown in several nations, which could damp bullish sentiment.

On Tuesday, the Shenzhen branch of the People’s Bank of China plans to “promptly clean up and rectify” 11 companies for providing illicit crypto trading activities, state-owned Shanghai Securities Journal reported.

In Spain, the National Securities Market Commission issued a warning notice for 12 companies, including crypto exchanges Huobi and Bybit, for providing investment services without being registered with authorities, CoinDesk’s Eliza Gkritsi reported.

And in South Korea, a crypto exchange subsidiary of Japanese tech giant LINE, is reportedly limiting its services next month, according to a report by Yonhap News.

For now, technical charts suggest bitcoin remains in breakout mode with support around $42,000. The loss of short-term momentum could trigger a brief period of profit taking.

Bitcoin mining revenue rise

Miners are experiencing greater revenue as the Bitcoin blockchain’s hashrate recovers from July lows. This is a positive sign for the blockchain network and could point to further bitcoin accumulation by miners.

“Over the course of the last two months, hashrate has increased by around 25% from the lows, suggesting hashrate equivalent to around 12.5% of the affected miners have come back online,” Glassnode analysts wrote in a blog post.

The hashrate refers to the total combined computational power that is being used to mine and process transactions.

“In response, the Hash-Ribbons, which attempt to model where stress enters the mining market, have commenced another positive cross-over,” Glassnode wrote. “The Hash-Ribbons are formed by taking the 30-day and 60-day moving average of hashrate with the following signals,” as shown in the chart below.

Decreasing volume

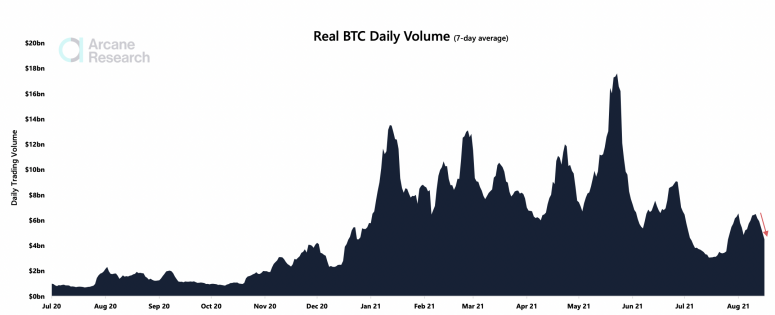

Bitcoin’s trading volume on leading spot exchanges declined over the past week as the short-squeeze rally stalls.

“After the seven-day average real BTC trading volume pushed towards $7 billion last week, we’re now back to $5 billion,” Arcane Research wrote in a Tuesday report.

If bitcoin continues to trade higher on declining volume, “it can signify an exhausted market, and it will probably not be a sustainable move,” Arcane wrote. “We want to see a clear uptick in volume if the BTC price jumps up towards $50K again.”

Latest on Poly Network hack

The Poly Network cyberattack saga has dragged into its second week with the hacker or hackers yet to provide the key for the multi-signature wallet needed to complete the full return of the roughly $600 million that was stolen, with the exception of the $33 million worth of the stablecoin USDT that was frozen by Tether, reports CoinDesk’s Nelson Wang.

China-based Poly Network had previously offered $500,000 to the attacker or attackers as a reward for returning the money taken on the Binance Smart Chain (BSC), Ethereum and Polygon platforms in what is likely the largest-ever hack of a decentralized finance (DeFi) site.

In a message posted to the Ethereum blockchain at 1:45 p.m. UTC on Monday, the attacker, who the Poly Network is calling “Mr. White Hat” but who some others doubt is a true white-hat hacker, said that they were considering taking the bounty and using it to reward anyone else who can hack the cross-chain platform. A “white hat” attacker is one who tries to exploit vulnerabilities in a protocol to help expose and ultimately fix bugs or loopholes in the underlying code.

”MONEY MEANS LITTLE TO ME, SOME PEOPLE ARE PAID TO HACK, I WOULD RATHER PAY FOR THE FUN,” the attacker or attackers wrote.

Altcoin roundup

- AUDIO Market Cap Surges Past $1B: Prices for AUDIO, the governance token of decentralized music streaming protocol Audius, nearly doubled in the past 24 hours, pushing its market capitalization above $1 billion for the first time. The price surge comes after Audius announced its partnership with popular video-sharing app TikTok. Data from TradingView and FTX shows that AUDIO’s price started pumping around 16:00 UTC on Aug. 16 and reached a high at $4.04 at approximately 6:00 UTC on Aug. 17. News of the TikTok tie-up first emerged at 15:00 UTC on Aug. 16.

- Dfinity’s ICP Rebounds: The blockchain company Dfinity made headlines in May when its internet computer (ICP) tokens were officially released for public trading at a price of $630, giving the project a $45 billion market capitalization. The enthusiasm quickly evaporated as the token plunged 95% over the following month to as low as $27. Since then, the token’s price has doubled to more than $60, according to data from Messari, signaling renewed appetite from investors. Some traders are feeling fresh enthusiasm for the token thanks to a recent increase in developer activity taking place on the network. That’s despite lingering ill will among some investors and developers, including dissidents who have formed a splinter group as well as plaintiffs in a class-action lawsuit filed in a U.S. federal court.

- 1inch Network Launches on Ethereum Optimism: 1inch Network, a platform that aims to find the best deals across multiple decentralized exchanges (DEXs), has expanded to the Optimistic Ethereum mainnet. The move to the layer 2 network makes 1inch Network the second decentralized finance (DeFi) app on Optimistic Ethereum, with the first being Uniswap, 1inch spokesperson Sergey Maslennikov told CoinDesk.

Relevant news:

- US Mortgage Lender UWM Plans to Accept Bitcoin Payments

- Galaxy Digital Files for US Bitcoin Futures ETF

- Crypto Exchange Bitpanda Raises $263M at $4.1B Valuation

- Eqonex Launches Peer-to-Peer Crypto Lending Marketplace for Institutions

Other markets

Notable winners of 21:00 UTC (4:00 p.m. ET):

the graph (GRT) +4.69%

Notable losers:

eos (EOS) -6.86%

stellar (XLM) -6.56%

ethereum classic (ETC) -6.12%

coindesk.com

coindesk.com