Macro expert and former Goldman Sachs executive Raoul Pal says Ethereum (ETH) and the rest of the crypto markets could witness wild price swings in the coming weeks.

Pal says his DeMark technical indicator, which aims to detect the directional trend of an asset by comparing the most recent maximum and minimum prices to the previous period’s price, is flashing reversal signals for a number of asset classes.

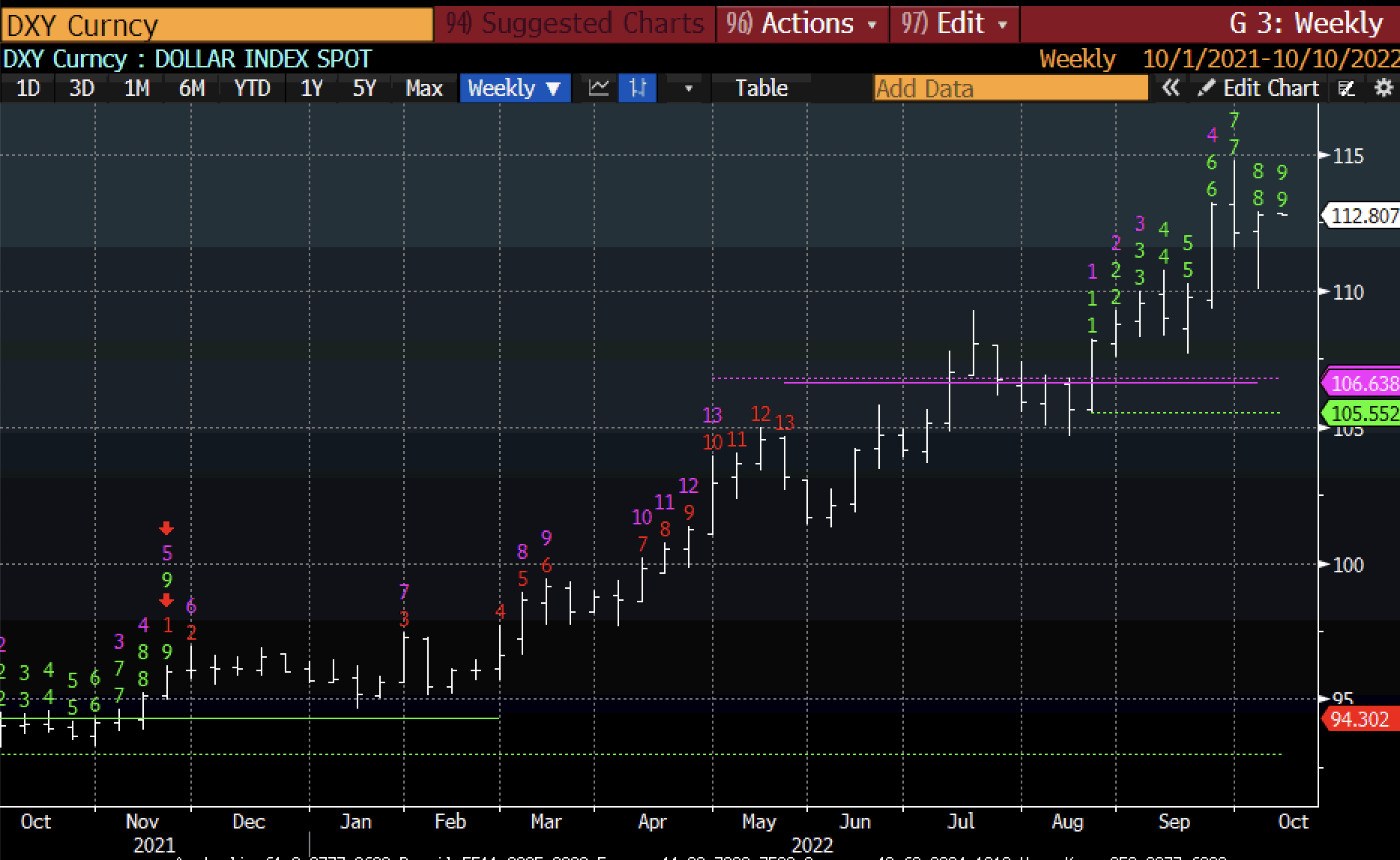

The macro guru first looks at the US dollar index (DXY), which measures the value of the dollar against a basket of fiat currencies. According to Pal, the DXY appears poised for a trend reversal this week after printing a DeMark nine count in an uptrend, indicating a sell setup.

“I like DeMark technical indicators for market timing, particular weekly DeMark and monthly as they suit my time horizons and tend to set larger moves/reversals.

Over the next three weeks, we have some VERY important signals setting up…

1. DXY – This week is the weekly nine reversal.”

Traders keep a close watch on the DXY as weakness in the index tends to translate to strength for risk assets like Ethereum and crypto.

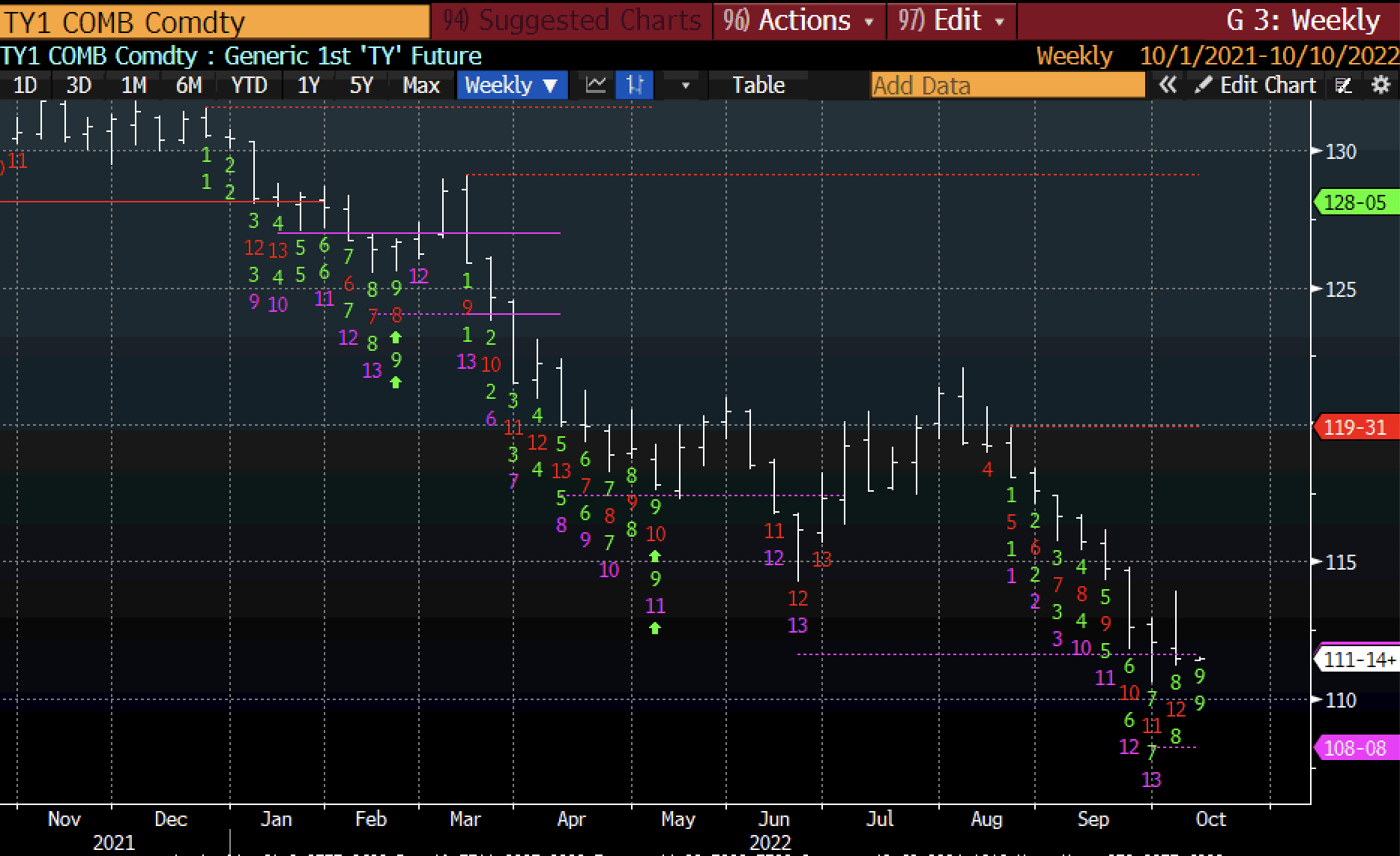

With the DXY showing signs of a potential trend shift, Pal says that the bond market is primed to print multiple reversal signals.

“The week after is even bigger with bonds setting up for a low… Nine this week and week after a second 13.”

A DeMark 13 count is often associated with more pronounced market reactions.

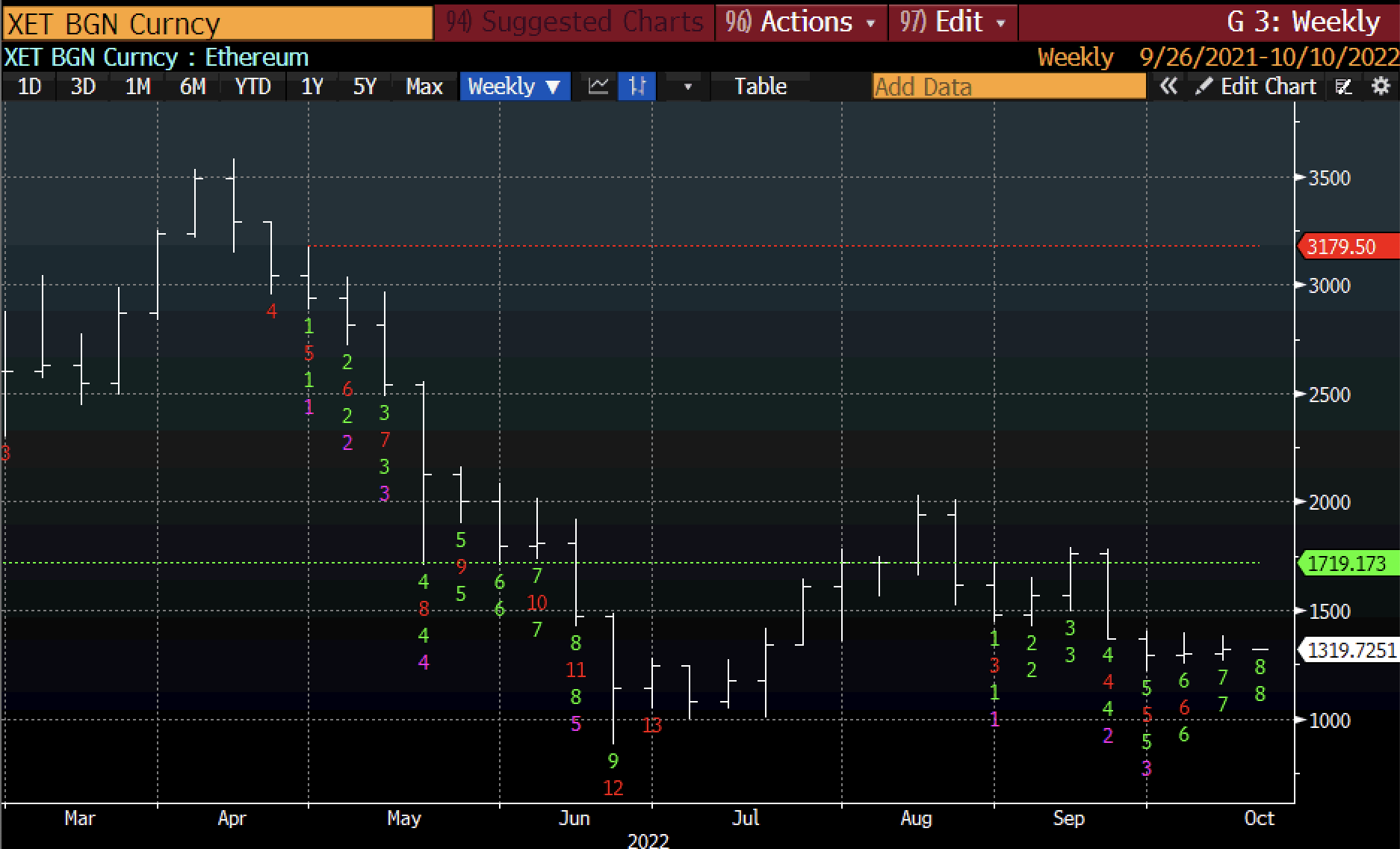

Looking at Ethereum, Pal says that the leading smart contract platform is also on the verge of flashing a DeMark reversal signal.

“ETH in a week’s time will put in a nine.”

According to Pal, the DeMark signals across multiple asset classes tell him that a meaningful low is coming this month.

However, he warns his followers that the consumer price index (CPI) print this week could trigger a sell-off event first before risk assets like crypto could stage reversals.

Traders also keep a close eye on CPI readings as they offer insight into whether the Fed will continue to pursue tight monetary policies.

Says Pal,

“The daily DeMarks suggest possible further downside first. Maybe it’s a flush-out couple of weeks? Dunno. It’s not clear. But full caution/focus is required… If anything is going to accelerate the current narrative, it’s CPI and the bond market reaction. If bonds break foreign bond markets, expect the Fed to take notice. It is very, very precarious as liquidity in bonds is SUPER low.

The Fed and the Treasury like a strong dollar as it imports deflation, but other countries are struggling, and the IMF/WB (International Monetary Fund/World Bank) meetings this week will cement the view that the Fed needs to slow this.”

At time of writing, ETH is trading for $1,280, down over 3% on the day.

dailyhodl.com

dailyhodl.com