Crypto markets fell sharply on Tuesday following an August Consumer Price Index (CPI) Report showing hot inflation numbers.

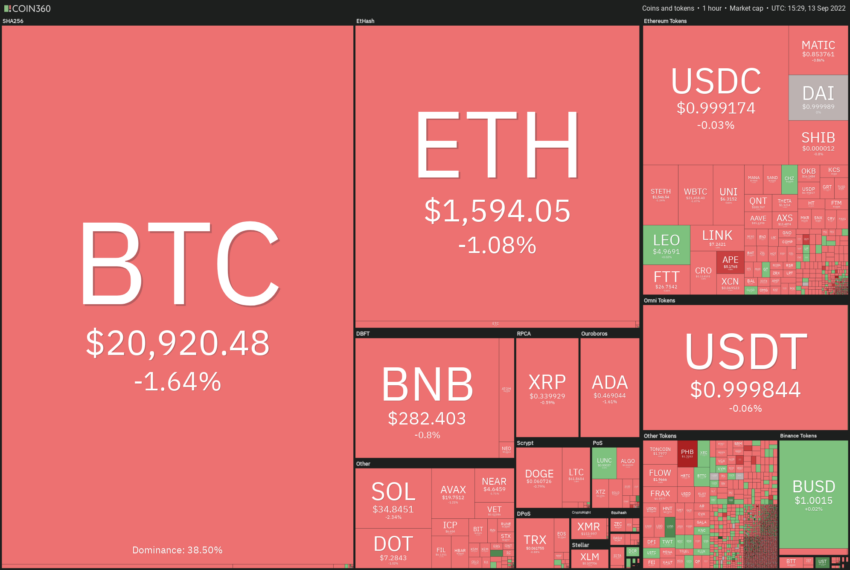

Bitcoin dropped roughly 6% from 12:30 p.m. UTC, with ETH falling almost 8% in the same timeframe. Cardano (ADA) is down nearly 9% in the last 24 hours, with Solana close behind at 6.76%. The crypto market cap dipped 5.9% in the last 24 hours.

According to crypto influencer BIBI, Bitcoin lost $1,000 in 1 minute following the announcement of inflation numbers.

The drop has erased bitcoin and ether gains accrued over the last two weeks, fed in part by bullish sentiment surrounding the upcoming Ethereum Merge slated for later this week and the launch of a new ETH options product from CME Group.

Before the announcement, bitcoin had touched a month-long high of $22,764.49.

Stock market suffers same fate

The stock market did not fare any better following the release of CPI Numbers. Notable stocks such as Microsoft (MSFT), Google (GOOG), and Apple (AAPL) all saw price drops of over 4%, with one trader referring to the sea of red stocks as a “stock picker’s market again”

Winklevoss says we are still early

Bitcoin bull and internet entrepreneur Tyler Winklevoss emphasized that this dip shows how early we are in the maturity of bitcoin as an asset. “Bitcoin is down on the news that inflation for August came in higher than expected (8.3% instead of 8.1%). Bitcoin should be up today. Its properties dictate that it should be inversely correlated to inflation. The fact that it is down shows just how early it is,” the billionaire tweeted.

The August U.S. consumer price index report defied the expectations of economists who believed inflation would drop 0.1%. Instead, inflation rose 0.1% for Aug. 2022 and 0.6% since July, despite lower gas prices, increasing the likelihood of further Fed tightening at its next meeting a week from now.

“The CPI report was an unequivocal negative for equity markets. The hotter than expected report means we will get continued pressure from Fed policy via rate hikes,” opined Matt Peron of Janus Henderson investors. “…we are not out of the woods yet and would maintain a defensive posture with equity and sector allocations,” he added.

Ominous warning from trader

Crypto has followed equity markets downward following the announcement of the CPI numbers. While bitcoin is especially correlated with stocks, explaining its plunge together with the Dow Jones Industrial Average and Facebook parent Meta, the tanking of the broader cryptocurrency market could be the result of a dump as investors get rid of riskier assets, anticipating a possible recession in the face of increasing interest rates.

Trader ARTSY warned on Twitter, “Don’t say I did not warn you. Let’s test the 17k again. Capitulation is near.”

beincrypto.com

beincrypto.com