The survival of the Terra ecosystem has been one of the most intriguing developments in the cryptocurrency market this year. Despite being nearly obliterated due to the market downturn and eventual depegging of the UST stablecoin, Terra Classic (LUNC) and Terra Luna (LUNA) have been putting up a valiant fight against the bears.

Both coins have seen impressive gains in the last week. Their communities were determined to keep them alive, and the broader crypto market embraced them even more. Unfortunately, the rally seems to be over, as both coins have fallen.

Big Gains for LUNC & LUNA

The previous week was pivotal for LUNC and LUNA. Both coins experienced massive price increases, even as most cryptocurrencies struggled amid a broader short-term rout. Earlier this month, Luna Classic even trended on Twitter for some time.

LUNC was the biggest gainer, increasing by more than 300% thanks to increased adoption from exchanges and an influx of buyers looking to capitalise on its growth.

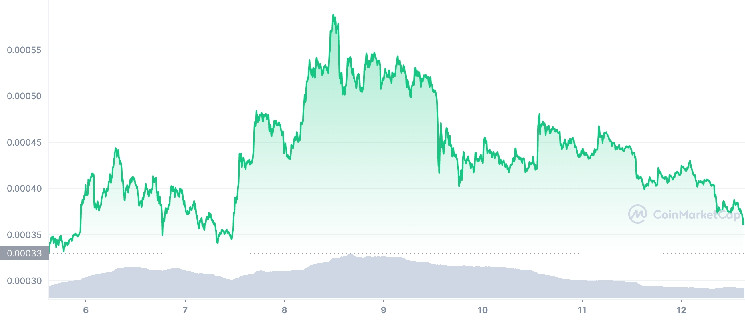

Last week, the asset, formerly known as LUNA, saw its price rise from $0.00020 to a high of $0.00058. The gains were made possible by a "tax burn" regime approved by the LUNC decentralised autonomous organisation (DAO). The tax burn is expected to reduce LUNC's incredibly large circulating supply, which currently stands at 6.1 trillion tokens.

Once implemented, the proposal will impose a 1.2% tax on all Terra Classic blockchain transactions. The "tax" will be sent to a burn wallet, gradually reducing LUNC's bloated circulating supply. The rule change is set to go into effect on September 20, and it appears to have sparked a lot of excitement amidst the Terra Classic community.

Tax cannot be applied to LUNC trades conducted on centralised exchanges. Several exchanges, including MEXC and Binance, have indicated support for it. Furthermore, Binance announced on Thursday that it would reintroduce the LUNC/USDT trading pair to its exchange, indicating that demand for the asset has been increasing. Previously, LUNC could only be traded against Binance's BUSD stablecoin. The exchange also announced that it would add lUNC to its Convert feature, allowing investors to trade in and out of it easily.

These announcements fueled angst in the LUNC community, resulting in the rally mentioned above. Furthermore, with a market cap of $2.5 billion, LUNC is now the 30th most valuable cryptocurrency.

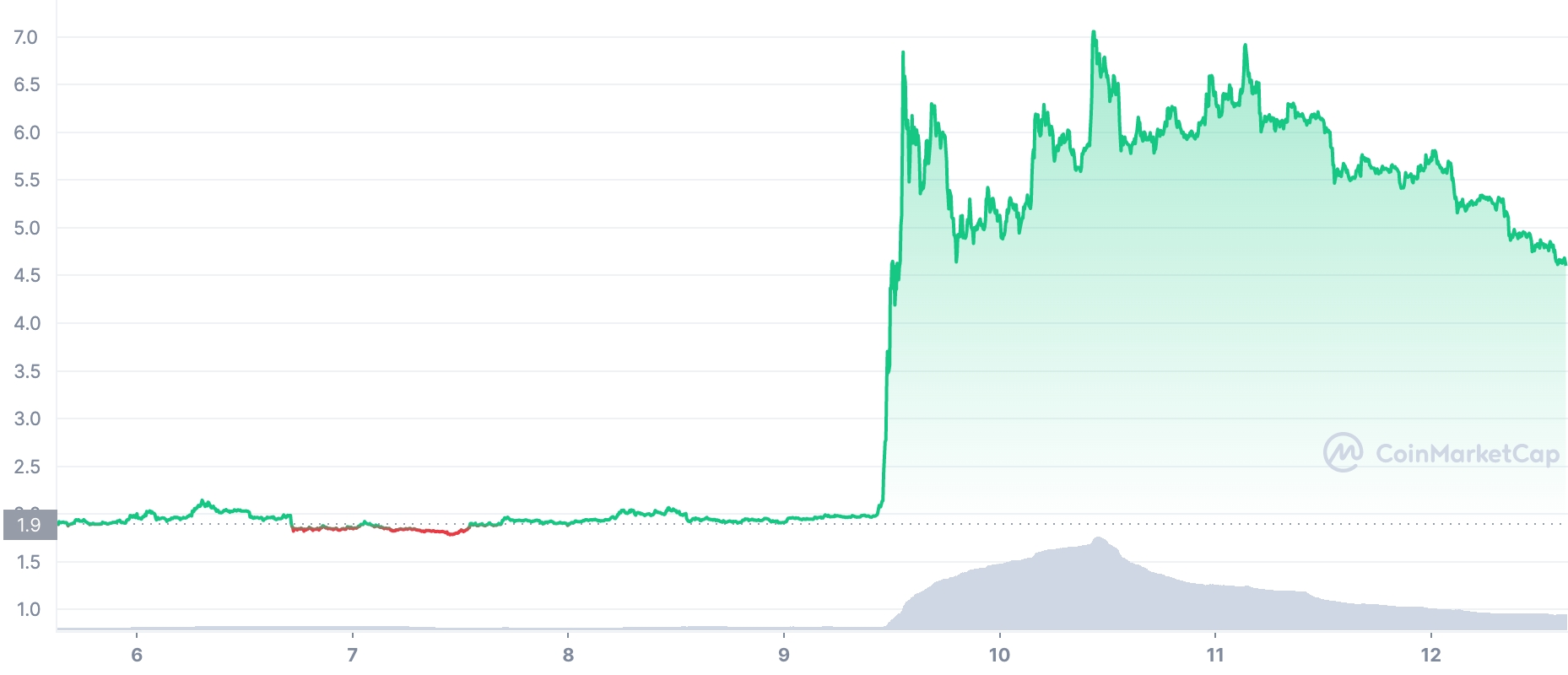

As a result of LUNC's rise, LUNA, the new token created after the fork of the original Terra blockchain, appeared to have enjoyed a rally. The asset's price increased from $1.9 to a high of $7.05 last week, propelling it to the 71st position on CoinMarketCap's rankings.

It All Comes Down

Unfortunately, the rally in both assets appears to have been short. While the broader market has gained ground this week, LUNC and LUNA are currently trading lower.

LUNC, the biggest winner from last week's rally, is currently down 12.37% in the last 24 hours. Its current price of $0.00038 is a 345% drop from last week's high, while LUNA is trading at $4.80, a 19.69% drop in the last 24 hours and a 31.9% drop from last week's high.

While these drops are concerning, many Terra residents have dismissed them as simple market corrections. According to them, the drops are simply the result of prices adjusting as several investors appear to have taken their profits.

For the time being, the market appears to be anticipating the burn tax's implementation later this month. One of LUNC's biggest weaknesses right now is its high circulating supply, and a shift to a more deflationary structure should help it from a tokenomic standpoint. In the case of LUNA, the asset appears to be inextricably linked to LUNC. As a result, a rise in LUNC's price should also cause LUNA to rise.

cryptonews.com

cryptonews.com