Digital payments heavyweight Circle Inc. shared the first details of its novel product. EuroCoin (EUROC) stablecoin will unlock new trading, liquidity management and value transfer opportunities for crypto holders all over the globe.

Circle launches EuroCoin (EUROC) stablecoin: Basics

Amid a massive bearish recession, Circle, an operator of second-largest stablecoin USD Coin (USDC), has unveiled its plans to roll out EuroCoin (EUROC), a new asset with its price pegged to the Euro.

What do we know about this initiative so far?

- On June 16, 2022, Circle Inc. announced the release of Euro Coin (EUROC), a Euro-pegged cryptocurrency (stablecoin);

- First Euro Coins (EUROC) will be available on Ethereum (ETH) blockchain as ERC-20 tokens on June 30, 2022;

- Euro Coin (EUROC) asset release is already supported by a number of world-leading institutions in crypto;

- Despite the Euro being the world's second reserve currency, no EUR-pegged stablecoin - even the one issued by Tether - has managed to gain wide adoption so far.

In this comprehensive guide, U.Today is going to share the details of its upcoming launch and look at the prospect ghe EUR-backed stablecoin has in times of great market instability.

What is Circle Inc.?

Circle Inc. is a private Massachusetts-based fintech company focused on the development and promotion of peer-to-peer digital payments for retail and businesses. Circle Inc. (or Circle) was founded by Jeremy Allaire and Sean Neville in October 2013 in the first phase of massive cryptocurrency adoption.

Circle is among the first fintech companies to receive a BitLicense from the New York State Department of Financial Services (NYSDFS) and a virtual currency license from British watchdogs.

Initially, Circle had been focused on building solutions for Bitcoin (BTC) storage and crypto wallets with built-in buy/sell functions (Circle Pay), but in 2020, all trading instruments were sold to TSE-listed Voyager Digital.

Largely, Circle is known thanks to its USD Coin (USDC), the second largest stablecoin, a fourth digital asset by capitalization and the fastest-growing USD-pegged asset in Web3. Launched in 2018, it is among the core elements of global DeFi infrastructure.

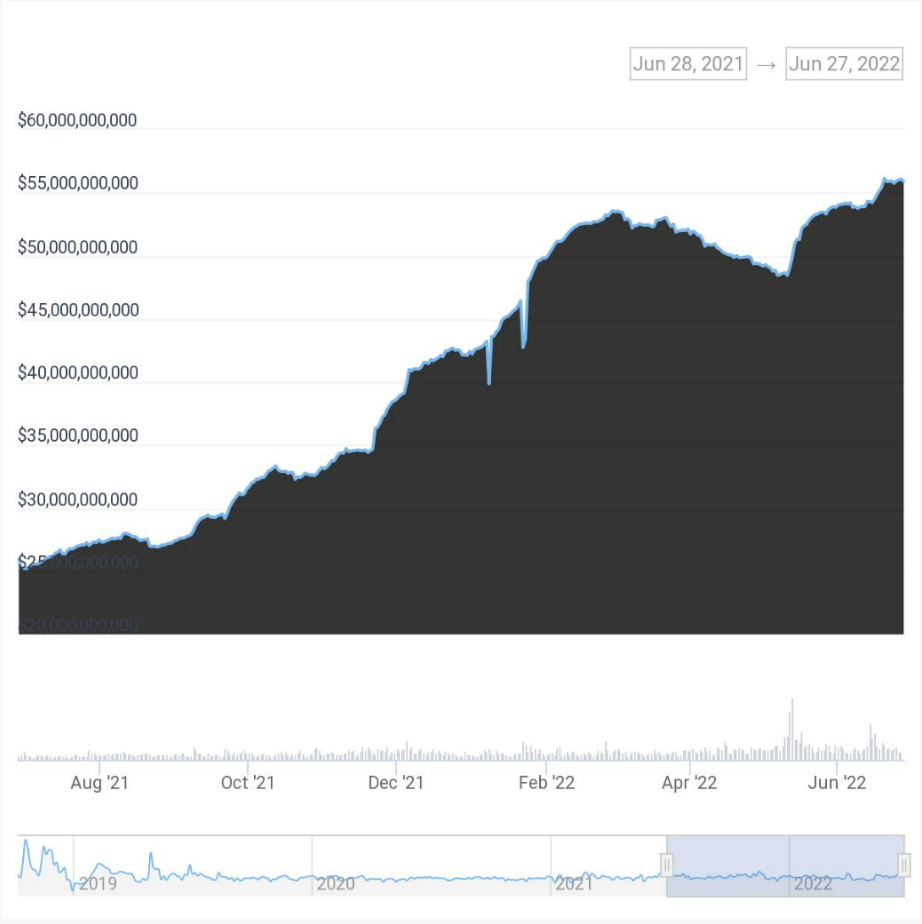

USD Coin (USDC) capitalization is over $50 billion; in the last two years, it rocketed more than 40x. The cryptocurrency is used on various platforms, including Ethereum, Solana, Tron and Polygon smart contracts majors.

USD Coin is backed by cash, cash equivalents and commercial paper; it is monthly attested by Grant Thornton accountants.

What are stablecoins?

Stablecoins (stable assets, stable cryptocurrencies) constitute the class of cryptocurrencies (blockchain-based assets) that have their prices pegged to this or that fiat currency, index or precious metal.

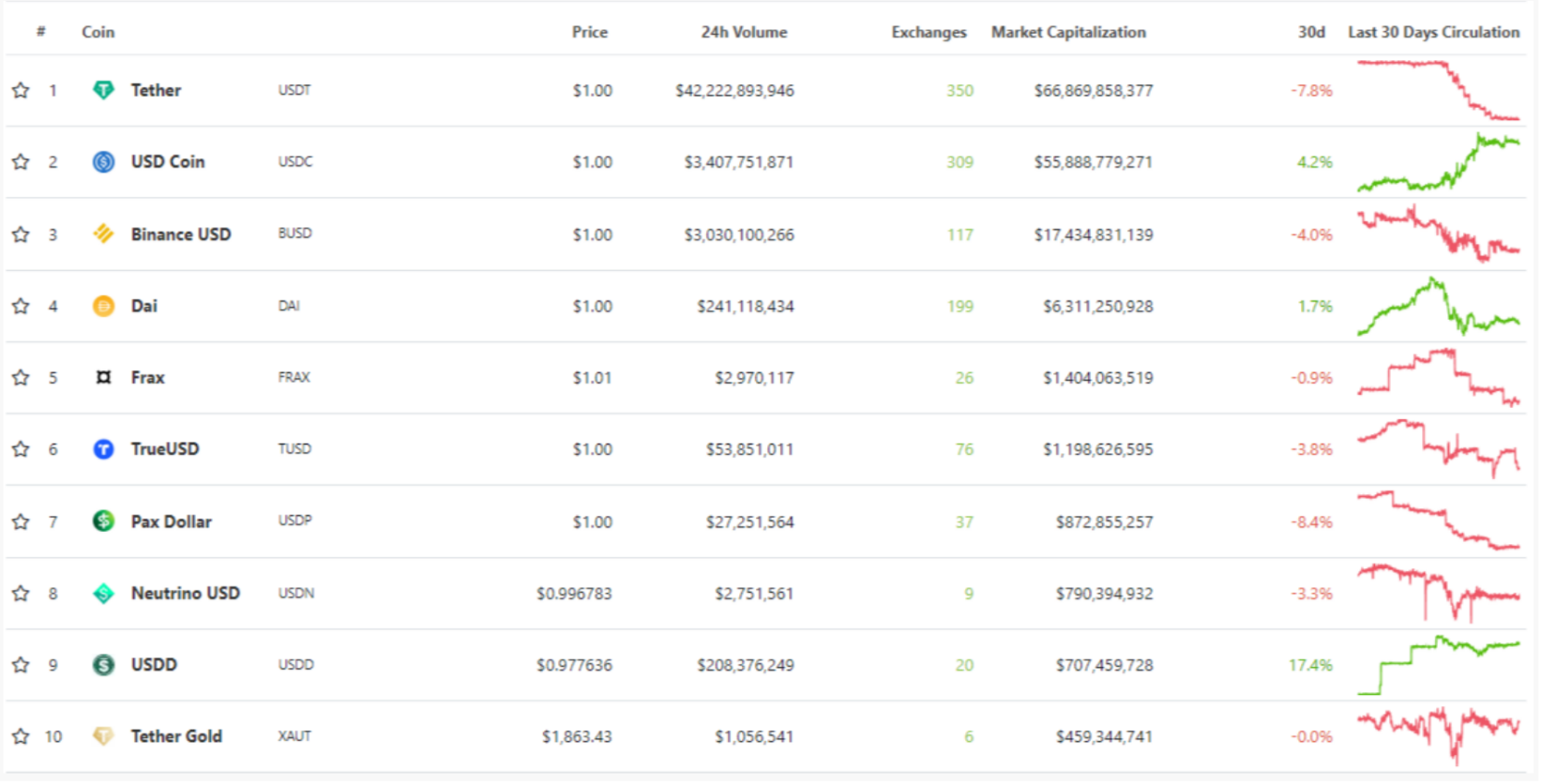

The majority of stablecoins are pegged to the U.S. Dollar as a global world reserve currency. U.S. Dollar Tether (USDT) by Tether Limited is the most popular stablecoin, with leading capitalization over $63 billion, as of June 2022.

Stablecoins are crucial for various Web3 economic designs; they are used as equivalents for fiat currencies to remove the need for CEXes, DEXes and lending/borrowing protocols to integrate crypto–to-fiat paygates, which usually implies regulatory issues. Also, amid bear markets, traders and holders use stablecoins as reliable and predictable "store of value" instruments.

A stablecoin’s peg to an underlying cryptocurrency can either be guaranteed by its issuer (for centralized stablecoins) or by the ecosystem of smart contracts (decentralized or algorithmically-backed stablecoins). USDT, USDC, BUSD, GUSD and TUSD are the most popular centralized stablecoins, while DAI, FEI, FRAX, MIM and USDD are key decentralized stablecoins. In turn, decentralized stablecoins can either be over- or under-collateralized.

Besides USD-pegged stablecoins, Web3 protocols use stablecoins pegged to the Chinese Yuan, Mexican Peso or British Pound, as well as Gold- and Silver-backed stablecoins.

At the same time, Euro-backed stablecoins are very illiquid; none of them has ever been represented in the top 100 cryptos by market capitalization.

Introducing Circle’s EuroCoin (EUROC), a new-gen EUR-backed stablecoin

That is why Circle’s decision to issue such an eccentric cryptocurrency made headlines in mid-June 2022.

Circle launches EUROC on June 30, 2022

According to the official announcement shared by Circle Inc. on its main website and social media accounts, the fintech operator is ready to issue Euro Coin (EUROC), a stablecoin pegged 1:1 to the Euro.

1/ Get ready for #EuroCoin!

— Circle (@circlepay) June 16, 2022

Euro Coin (EUROC) is our newest #stablecoin that will launch on June 30th.

We designed it with the same full-reserve model as #USDC so that it’s always redeemable 1:1 for euros. See how to get it https://t.co/3PclycHxPk

The new coin will be 100% backed by Euros held in euro-denominated bank accounts so that EUROC will be fully redeemable. In general, EUROC will share the technical design of USDC, a flagship Circle product.

As per the statement of its team, EUROC asset will be supported by a clutch of highly reputable Circle partners, including centralized exchanges (Binance.US, Bitstamp, FTX, Huobi Global), decentralized finance (DeFi) protocols (Compound, Curve, DFX, Uniswap Protocol), industry-level custody solutions (Anchorage Digital, CYBAVO, Fireblocks) and self-custodial cryptocurrency wallets (Ledger, MetaMask Institutional).

The first Euro Coins (EUROC) will be available through Circle Accounts. Enthusiasts and entrepreneurs can purchase them with deposits from crypto-friendly U.S.-based bank Silvergate. Shortly after initial minting events, EUROC will be sent to exchanges.

Initially, EUROC will be minted on Ethereum (ETH) as ERC-20 tokens. However, in the coming months, more mainstream blockchains are set to have their own versions of the new stablecoin.

One coin, many use cases

Circle highlights that EUROC is a multi-purpose solution that will be integrated into both crypto-centric and ForEx-oriented trading platforms. As such, EUROC listing unlocks amazing opportunities for CEXes of all types.

Institutional traders will be able to use EUROC as their paygates to the DeFi segment and the Web3 economy. Businesses will be offered to integrate EUROC as a payment method to make their operations more straightforward and user-friendly. Stablecoin integration will make cash flow faster for B2B customers.

Last but not least, individuals are poised to have one more instrument for lightning-fast cross-border transfers with close to zero fees.

Euro-backed stablecoins: EUROC alternatives

Despite no EUR-pegged stablecoin managing to gain significant traction so far, there are some projects that attempt to introduce EUR liquidity to Web3 users. Of them, EURT, EURS and agEUR are the best known.

The largest one is Euro Tether (EURT), a "sister product" of the largest stablecoin, USDT. It is issued by Tether Limited, and its market cap is over $218 million.

EURT is followed by Stasis Euro (EURS), which is the largest multi-chain EUR-backed stablecoin. Its $129 million supply is distributed between Ethereum (ETH), Polygon (MATIC), Algorand (ALGO) and xDai (STAKE) platforms.

agEUR by Angle Protocol is the largest decentralized algorithmically backed EUR-pegged stablecoin. It is over-collateralized and integrated by many DeFis, including majors Curve Finance (CRV), Aave Finance (AAVE) and novel protocols OlympusDAO (OHM) and Frax Finance (FRAX). Its aggregated market capitalization on Ethereum (ETH) is over $52 million.

Closing thoughts

Euro Coin (EUROC) will be launched by Circle on June 30, 2022. The token is set to go live on Ethereum (ETH) with more protocols to be added soon.

EUROC will address many use cases in the sphere of decentralized finance (DeFi), trading, cross-border transfers and digital payments in retail.

u.today

u.today