The WallStreetBeats Dapp has completed an Initial Dex Offering to launch the $WSB token. The IDO was completed on the new BSCstarter platform. The platform is a community-governed launchpad for raising capital for Binance Smart Chain projects.

The DApp

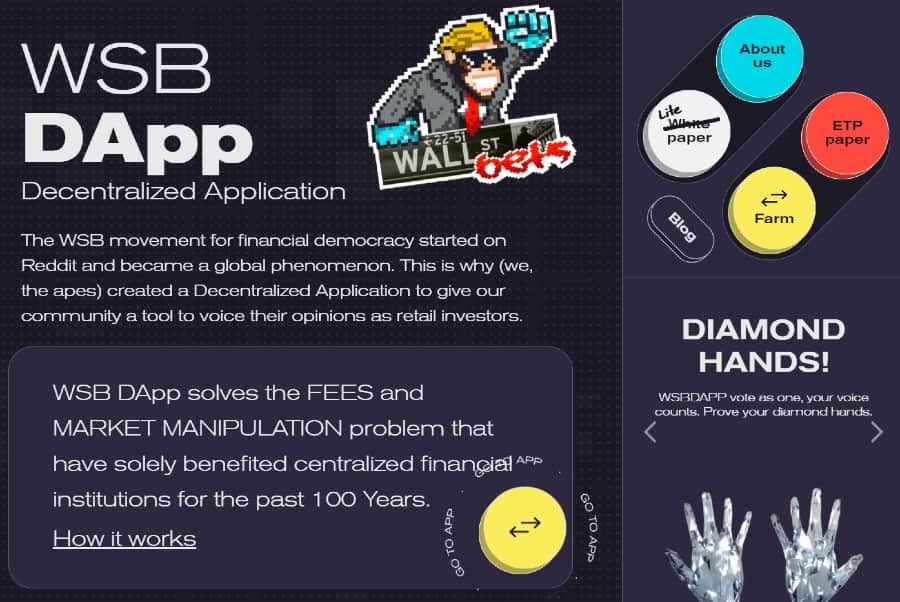

The WallStreetBets DApp can be understood as a decentralized application that represents the ethos of the popular subreddit /r/wallstreetbets. The WSB DApp was founded in 2021 by BTCVIX, a crypto trader. Jaime Rogozinski, the original founder of the r/wallstreetbets subreddit is an adviser. The idea is that the WSBDApp will decentralize traditional finance by making it possible to create a version of ETFs entirely on the blockchain. The WSBDApp community can then vote through a DAO to decide which investments to make.  *WSBDApp.com*

*WSBDApp.com*

Rogozinski says the WSB DApp aims to provide financial instruments on the blockchain that resemble index funds, which can provide portfolio diversification at low costs with the possibility of strong long-term returns. He says the DApp will sit at the heart of the $WSB ecosystem and will reallocate the “special privileges of closed-door institutions to the individuals in our community.”

The IDO

In a blogpost following the successful completion of the WSB IDO, the WSB team said the IDO sold out very quickly. In fact, the BSC Blockchain was congested for the first time ever due to the high amount of interest in the WSB IDO.

The WSB token was then listed on PancakeSwap 1 min after the IDO completed. Within 30 minutes of the IDO its participants were able to claim their tokens — this included an IDO allocation for Zero exchange and an IDO allocation for BSCStarter influencers.

The BSCStarter influencers claimed separately with a 3rd party smart contract from BSCStarter.

$WSB yield farming begins

The team is now focused on development. The next milestone is today’s launch of WSB Farming on the WSBDApp.com. Farming will be for six months. There are 100M WSB tokens in total. 50M WSB tokens are available in month one with a halving every month thereafter - ie: month 2: 25m, month 3: 12.5m etc with the last two months being flat. *WSB token yield farming has begun*

*WSB token yield farming has begun*

Liquidity mining, also known as yield farming, is the act of providing liquidity via cryptocurrencies on decentralized exchanges (DEXs). One of the primary goals of a DeFi project is to amass liquidity, so projects seek to reward users willing to bring capital to their platform.

What does farming mean for WSB?

Users that provide WSB-BNB, WSB-CAKE or WSB-BUSD liquidity can stake their LP tokens to earn WSB. This further ensures WSB has sufficient liquidity to support its ecosystem.

To add liquidity to either the WSB-BNB pool, WSB-BUSD pool or the WSB-CAKE pool go to https://farm.wsbdapp.com or read the tutorial.

WSBDApp’s Exchange Traded Portfolios

The WSB DApp allows for index-fund type instruments or ETPs to exist on the blockchain. $WSB governance token holders will vote to decide on the rebalancing and exposure of each community controlled instrument. The ETPs are wholly collateralized, instantly redeemable and self-custodial. At present these are scheduled to go live in June or July.

The ETP whitepaper explains. “The WSB YOLO Stonks ETP (Exchange Traded Portfolio) is a physical representation of a defined Basket of Stocks, (stocks made available on-chain via Synthetix.io), tokenized utilizing the Balancer Protocol, rebalanced according to $WSB token holders on-chain voting for both participation in the ETPs and their rebalance voting.”

The ETP mimics the constitution and weights of the basket/thesis. It is rebalanced in alignment with the basket methodology, providing traders an opportunity to get non-synthetic exposure to the assets that comprise the basket, and/or speculate on arbitrage between the price parity of the underlying spot markets (or derivatives) and the ETP itself.

The WSB YOLO Stonks ETP tracks the real-time market performance of a basket of stocks. The underlying basket methodology comprises between 2 and 8 assets (reviewed fortnightly) typically based on their free float market capitalisation weighting and ideally with a cap of 25%.

However, in the spirit of WSB and embracing crowd-driven decisions, $WSB token holders will act as the rebalancing committee and vote on the rebalancing of this basket each rebalancing cycle, using the Ethereum or BSC blockchains.

The whitepaper states that the WSB YOLO Stonks basket will initially comprise the following assets (represented in synthetic and/or tokenized form), and weighted in accordance with their current market cap, subject to a cap of 25%. The starting weighting of the stonks will be voted upon by the WSB Dapp community before launching the ETP.

The assets are: GameStop (GME), AMC Entertainment (AMC), Nokia, (NOK), Blackberry (BB), iShares Silver Trust (SLV), Tesla (TSLA), Apple (AAPL), and Virgin Galactic (SPCE)

Finally, the team revealed that the WSB DApp is already cash-flow positive, producing 250k USD per quarter in revenues. These will be integrated into the DAO once the DAO is developed — then it’s over to the community to vote on the use of these funds. The DAO is expected to launch by the end of August.

bravenewcoin.com

bravenewcoin.com