Chainlink made headlines after Grayscale announced that it would launch a new LINK trust fund for institutional investors, with the token’s price surging by 14%.

Chainlink Pumps on Grayscale News

Decentralized oracles token Chainlink resumed its uptrend after Grayscale revealed that it would allow accredited investors to issue trust shares backed by LINK. The shares will come with a lock-in period and are non-redeemable, similar to the other prior altcoin listings.

Chainlink had endured a two-week-long consolidation period before Grayscale’s announcement. As the tenth-largest cryptocurrency by market capitalization made a series of lower highs and higher lows, a symmetrical triangle developed on its 4-hour chart.

The news from the world’s largest digital asset manager catalyzed LINK to slice through the triangle’s upper trendline to hit a high of $31.40.

Now, Chainlink could be preparing to advance to new all-time highs if the recent buying pressure persists. The height of the triangle’s y-axis suggests that its market value can rise by 37.50%, which puts LINK at a target of $41.

No Resistance Ahead

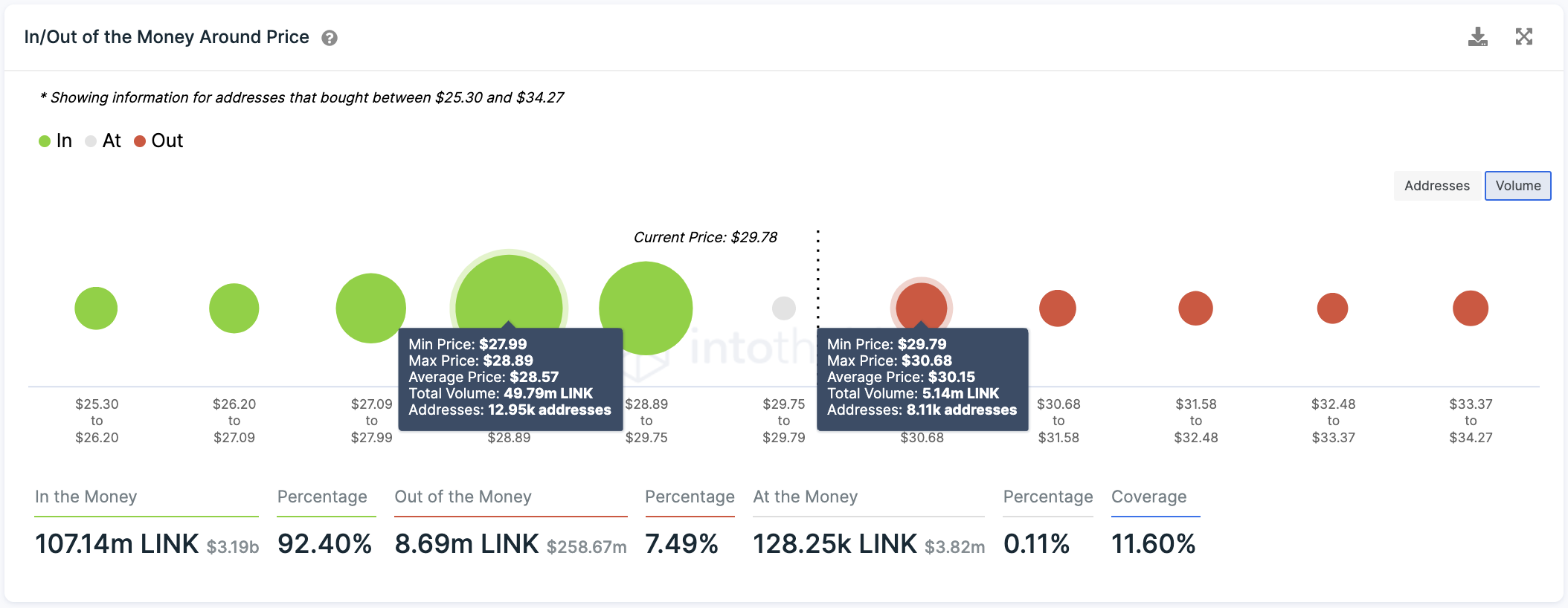

Transaction history shows that Chainlink sits on top of a large demand wall with little to no resistance.

Roughly 13,000 addresses had previously purchased nearly 50 million LINK at an average price of $28.60. Such a massive interest area could absorb any selling pressure behind this altcoin, capping its downside potential.

Given the lack of supply barriers ahead, only a 4-hour candlestick close below the $28.60 support level might have the strength to invalidate the bullish outlook.

If this were to happen, Chainlink could dive towards the 23.6% Fibonacci retracement level or late February’s low. These crucial areas of support sit at $24.80 and $21, respectively.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

cryptobriefing.com

cryptobriefing.com