Ethereum has been going through a series of upgrades toward its next version, Ethereum 2.0. Unfortunately for Uniswap, the upgrades are taking a long time and affect Uniswap in terms of long processing time and high gas fees. However, there are means by which the price impact could be reduced but before we get into these methods, let’s have a backgrounder on Uniswap and its token UNI.

The live Uniswap price today is $11.01 USD with a 24-hour trading volume of $428,766,396 USD. Uniswap has been down 10.95% in the last 24 hours. The current CoinMarketCap ranking is #24, with a live market cap of $7,590,869,553 USD. It has a circulating supply of 689,262,524 UNI coins and a max. supply of 1,000,000,000 UNI coins. The price of Uniswap has risen by 6.64% in the past 7 days. The price declined by 4.21% in the last 24 hours. In just the past hour, the price shrunk by 0.26%.

A 2021 study by Bancor, a decentralized trading protocol, has shown that more than 50% of Uniswap liquidity providers are losing money due to a phenomenon known as impermanent loss (IL). Let’s look at the potential of UNI by going through its background.

Uniswap is the world’s most popular decentralized exchange (DEX). Every month, more than $70 billion in trading volume is executed on the Ethereum-based exchange. However, users who provide liquidity in the expectation of earning fee rewards may not be raking in the profits they anticipated.

Uniswap Overview

Uniswap was created on 2 November 2018 by Hayden Adams, a former mechanical engineer at Siemens. He informed his followers through Twitter that it is only a few weeks since the launch of the Uniswap v3 and is already the highest volume DEX protocol on OxPolygon.He further noted that its price is only $45million on TVL too.

Uniswap (UNI) is one of the most prominent decentralized finance (DeFi) exchanges. The DeFi protocol was founded in 2018 by former mechanical engineer Hayden Adams. The Uniswap exchange functions as a 100% on-chain automated protocol market maker on the Ethereum blockchain. It allows DeFi users to swap ether (ETH) for any ERC-20 token without intermediaries, solving a massive chunk of the liquidity problems faced by most exchanges.

How does Uniswap work?

Uniswap pioneered the Automated Market Maker model, in which users supply Ethereum tokens to Uniswap “liquidity pools” and algorithms set market prices based on supply and demand (as opposed to order books, which match bids and asks from users on a centralized exchange like Coinbase).

By supplying tokens to Uniswap liquidity pools, users can earn rewards while enabling peer-to-peer trading. Users supply tokens to liquidity pools, trade tokens, or even create and list their own tokens (using Ethereum’s ERC-20 token protocol). There are currently hundreds of tokens available on Uniswap, and many popular trading pairs are stablecoins like USDC.

Some of the potential advantages of decentralized exchanges like Uniswap include:

- Self-governing: Funds are never transferred to any third party or are generally subject to counterparty risk (i.e. trusting your assets with a custodian) because both parties are trading directly from their own wallets.

- Global and permissionless: There is no concept of borders or restrictions on who can trade. Anyone with a smartphone and an internet connection can participate.

- Ease-of-use and pseudonymity: No account signup or personal details are required.

Is Uniswap a good investment?

Uniswap (UNI) is a native token, which serves as the platform’s governance token and currently has a market capitalization of $17.4bn. On 5 May, the project’s team deployed Uniswap v3 on the second layer of Ethereum via Optimism.

The introduction of the v3 factors could help propel Uniswap cryptocurrency prices skywards, especially considering the available data shows that the update has already helped Uniswap become the largest DEX on the Ethereum network. It has also made Uniswap more accessible to a new class of users due to lower transaction fees.

Uniswap is a decentralized exchange built on Ethereum’s blockchain. Decentralized exchanges (DEXs) like Ethereum let investors or users swap cryptocurrency and data without needing to make an account with a centralized cryptocurrency platform like Coinbase or Binance. The platform transacts north of a billion dollars in cryptocurrency daily, and it’s the most used exchange for crypto and data transfer in the world.

How to reduce price impact on UNI

- Change the Uniswap Exchange Version. Choose among he Uniswap versions, V1 (old version) and V2 and new version V3. On the bottom navigation bar, you will select V1 as the version you want to use to transact the swap. You will check that you understand the disclaimer and click on continue with V1 for the transaction.

- Break down transactions and reduce the number of purchases. The price impact mechanism are problematic for big transactions. This problem can be solved by reducing the number of assets for trade and buy or sell the desired amount of transactions.

- Changing the price slippage tolerance. Due to excessive price fluctuations and the lengthy process of registering a buy or sell transaction in decentralized exchanges, an increase in price slippage helps to complete the transaction.

Uniswap Technical Analysis

Uniswap Technical analysis for 4-hours suggests that the cryptocurrency is following a bearish movement as of right now. The market volatility declines to make the cryptocurrency less susceptible to variable change.

Uniswap Pool

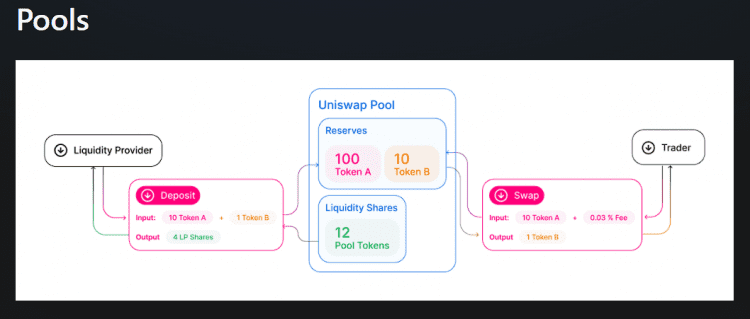

Essentially, Uniswap is just a bunch of smart contracts that work together to make the decentralized exchange. Smart contracts are uploaded to the blockchain, and since it’s on the blockchain, the code has the same immutable, decentralized, and borderless capabilities that cryptocurrencies have. Smart contracts can transfer money autonomously based on the parameters in the code, allowing for highly efficient financial services.

Investors send their cryptocurrency or coin funds to a Uniswap smart contract to earn interest on their holdings; these investors are referred to as liquidity providers. The smart contracts that hold their cryptocurrency are called liquidity pools.

Liquidity providers are necessary for Uniswap to operate, as it’s how they can provide liquidity to trade on the platform. Instead of ordering books, the smart contract calculates the price of each cryptocurrency market asset. This is how a Uniswap smart contract works.

Uniswap Price Prediction 2022-2030

Wallet Investor

Walletinvestor.com uses technical analysis to forecast future prices for various digital currencies, including Uniswap. UNI might be a terrible, high-risk 1-year investment option for crypto investors searching for high-return virtual currencies. On March 26, 2022, the Uniswap price was $10.679. However, your present investment may be depreciated in the future, as the Uniswap price predictions point toward declining future price.

DigitalCoinPrice

The Uniswap price forecast is projected to cross the $31.46 level, according to forecast data research. Uniswap is scheduled to achieve a minimum cost of $30.99 by the end of the year. Furthermore, the UNI price prediction has the potential to reach a high of $34.79. The Uniswap Price Prediction 2028 is essential knowledge for investors and holders of crypto assets.

PricePredictions.net

UNI trades at $10.68 in terms of its USD rate as of March 26th, 2022, with a price movement of -0.13 percent in the previous hour. The overall market capitalization of UNI is $7,357,573,016 and the 24-hour trading volume is $214,439,840.00. Uniswap (UNI) is now ranked 24th in the cryptocurrency market.

The UNI price is predicted to cross an average price level of $127.33 in 2028, according to the Uniswap projection price and technical analysis, and the expected minimum price value of Uniswap by the end of the current year should be $123.76. Furthermore, UNI has a maximum price of $147.95. The platform indicates a bullish uni price prediction.

Cryptopolitan Price Prediction 2022-2030

UNI Price Prediction 2022

According to the Uniswap price prediction technical analysis, the UNI price is likely to cross an average price level of $13.24 in 2022, with a minimum price value of $12.22 forecasted before the end of this year. Additionally, UNI has the potential to reach a high of $14.69, if it follows a strong bullish trend.

UNI Price Prediction 2023

The UNI price is expected to cross an average price level of $19.71 in 2023, with a minimum value of $18.13, according to UNI price forecasting and analytics.

Additionally, UNI has the potential to reach a high of $22.16.

UNI Price Prediction 2024

According to the forecasted price and technical analysis, the cost of UNI in 2024 is expected to exceed a minimum of $26.96. The Uniswap price may reach a maximum of $31.55 with an average trading price of $27.42.

UNI Price Prediction 2025

The UNI price is expected to cross an average price level of $42.19 in 2025, with a minimum price value of $39.94, according to the UNI price projection. Additionally, UNI has the potential to reach a high of $47.69.

UNI Price Prediction 2026

The UNI price is predicted to cross an average price level of $61.51 in 2026, according to the Uniswap projection price and technical analysis, while the expected minimum price value of Uniswap by the end of 2026r should be $59.85. Furthermore, UNI’s maximum price is anticipated to be $69.69.

UNI Price Prediction 2027

UNI is expected to reach the $91.24 average in 2027, according to Uniswap pricing research and technical analysis. Before the end of the year, UNI has the potential to get a high of $109.4. On the other hand, unexpected events and swings might in the crypto market push the cryptocurrency’s minimum price to fall below $85.6.

UNI Price Prediction 2028

The UNI price is predicted to cross an average price level of $129.57 in 2028, according to the Uniswap projection price and technical analysis, and the expected minimum price value of Uniswap by the end of 2028 should be $121.99. Furthermore, UNI is expected to have a maximum price of $150.95.

Conclusion

The crypto community has high aspirations for UNI, according to Uniswap price predictions, and it is undoubtedly a fantastic tool for developers and engineers creating more decentralized apps. Given that Uniswap is a new project with little experience in the community, it is up to the leadership team to steer it on the right path in order to maximize the goals established for a higher price. There are more promising prospects, but it all boils down to how the digital currency sector as a whole thrives.

Greater awareness of Uniswap’s impermanent loss problem probably won’t spark a mass exodus of liquidity. However, it will at least make LPs more aware of the risks of supplying liquidity in the pursuit of rewards.

We can assume that 2022 will be an excellent year for UNI because of the constant developments in the Uniswap network. As a result, Uniswap’s optimistic price forecast for 2022 is $46.34. The pessimistic UNI price estimate for 2022, on the other hand, is $44.42.

Furthermore, with the developments and enhancements to the UNI ecosystem, the stock’s performance should soon assist it to surpass its current all-time high (ATH) of $44.92. However, if investors feel that UNI is a smart investment in 2022, it may hit $50.

FAQs about UNI

Where can I buy UNI?

UNI is listed on all esteemed cryptocurrency exchanges, and these compliance exchanges allow you to directly trade UNI tokens for fiat currencies like USD, EUR, GBP, etc., or other cryptos like Chainlink on many exchanges.

Does Uniswap have a future?

If you invest in Uniswap, the UNI tokens will surely rise and have a bright future ahead. Due diligence is also advised, with all rights reserved.

cryptopolitan.com

cryptopolitan.com