Neo Global Development (NGD) has outlined its initial release schedule for FLM, Flamingo Finance’s NEP-5 governance token. The schedule is found in the recently published Flamingo litepaper, which provides new details on the Neo-based full-stack decentralized finance (DeFi) protocol.

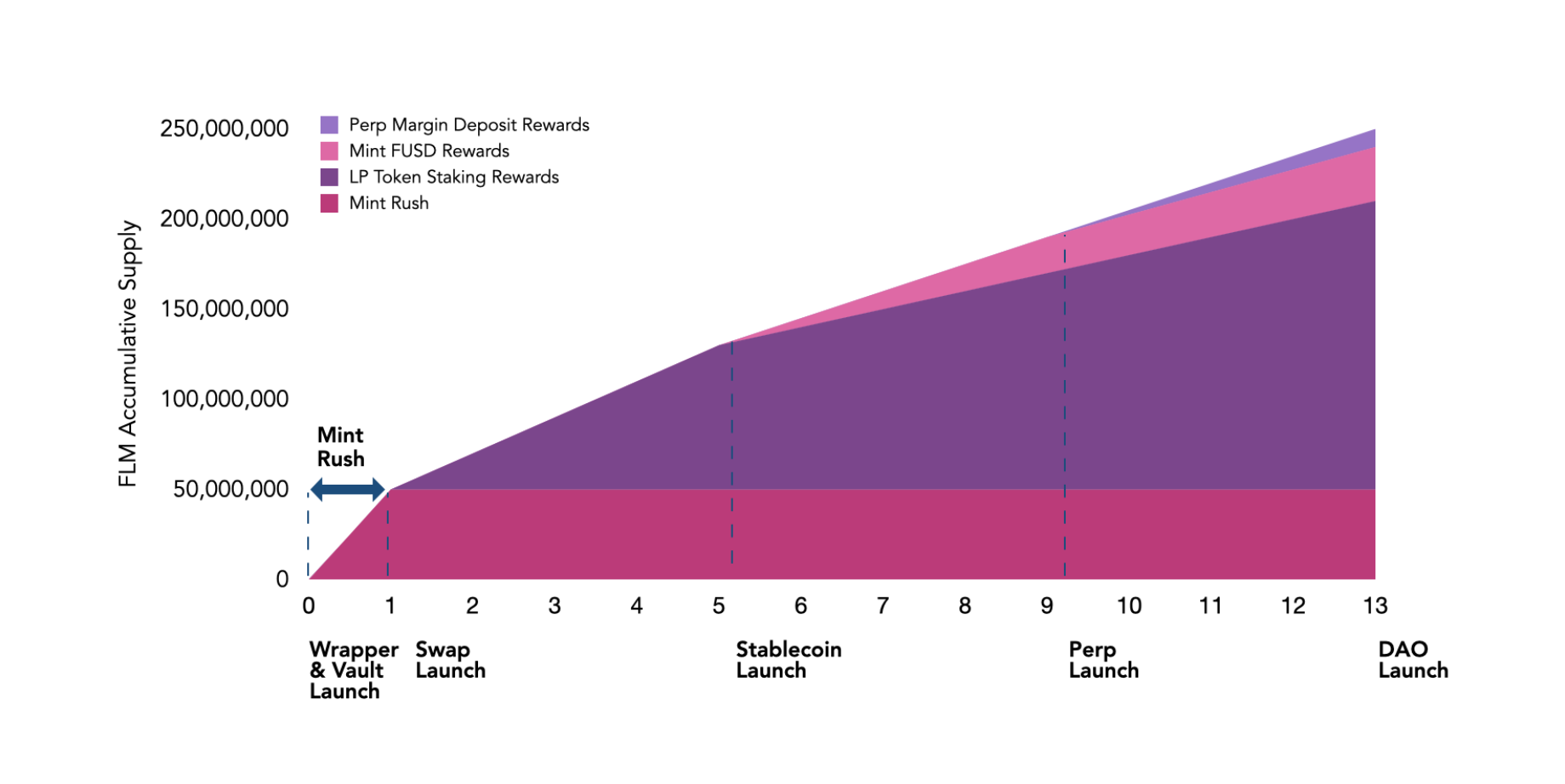

Initial FLM distribution is expected to begin with a “Mint Rush” on Wednesday, September 23rd, and continue at a decelerated rate for 13 weeks.

FLM will be distributed according to a principle of “radical equality,” meaning the token can only be obtained through contributions to the platform. No FLM will be reserved for team allocation or distributed via pre-sale or pre-mine.

Source: Flamingo Litepaper

An initial 250 million FLM tokens will be distributed in phases during the roll out of four modules. Aside from the Mint Rush, which is a one time FLM distribution event, FLM will continue to be rewarded beyond the additional phases, albeit at a reduced rate.

The initial distribution phases are as follows:

Week 1

Distribution: 50,000,000 FLM

Flamingo will open with the launch of Wrapper, a crosschain asset gateway, and Vault, Flamingo’s asset manager. To incentivise early contribution, 50 million FLM tokens will be distributed to participants over a one week “Mint Rush.” During this timeframe, users will be rewarded FLM for staking whitelisted tokens in Wrapper to create wrapped NEP-5 equivalents (i.e NEO for nNEO, ETH for nETH etc).

According to the litepaper, the initial Mint Rush will support NEO, ETH, USDT, and ONT assets.

Weeks 2 – 5

Distribution: 80,000,000 FLM

Following the Mint Rush, Flamingo will launch Swap, its on-chain Auto Market Maker (AMM). 80 million FLM will be rewarded over three weeks to users who contribute whitelisted tokens, such as those wrapped in Wrapper, to Swap’s liquidity pools.

A liquidity pool is comprised of a pair of NEP-5 tokens, and a user must deposit an equal value for each side of the trading pair. Users who do not have an equal token pair will be able to make swaps to obtain the tokens they need. For example, a user may trade nNEO on Swap for nETH.

After contributing to liquidity pools, users will receive LP tokens that can be redeemed for the original token deposit, as well as allow the holder to collect trading fees.

Weeks 6 – 9

Distribution: 60,000,000 FLM

Week six will see the introduction of FUSD – a NEP-5 collateral-backed synthetic stable-coin pegged to the price of USD. FUSD is minted through the staking of LP tokens in Vault. Approximately 60 million FLM will be distributed to contributors to Swap iquidity pools and those who mint FUSD.

Weeks 10 – 13

Distribution: 60,000,000 FLM

The final module scheduled to be released during Flamingo’s initial roll out is Perp, Flamingo’s AMM-based perpetual contract exchange. Users that deposit their minted FUSD into perpetual contracts to provide liquidity will be entitled to a share of 60,000,000 FLM rewards, alongside Swap liquidity pool contributors and users who mint FUSD.

DAO

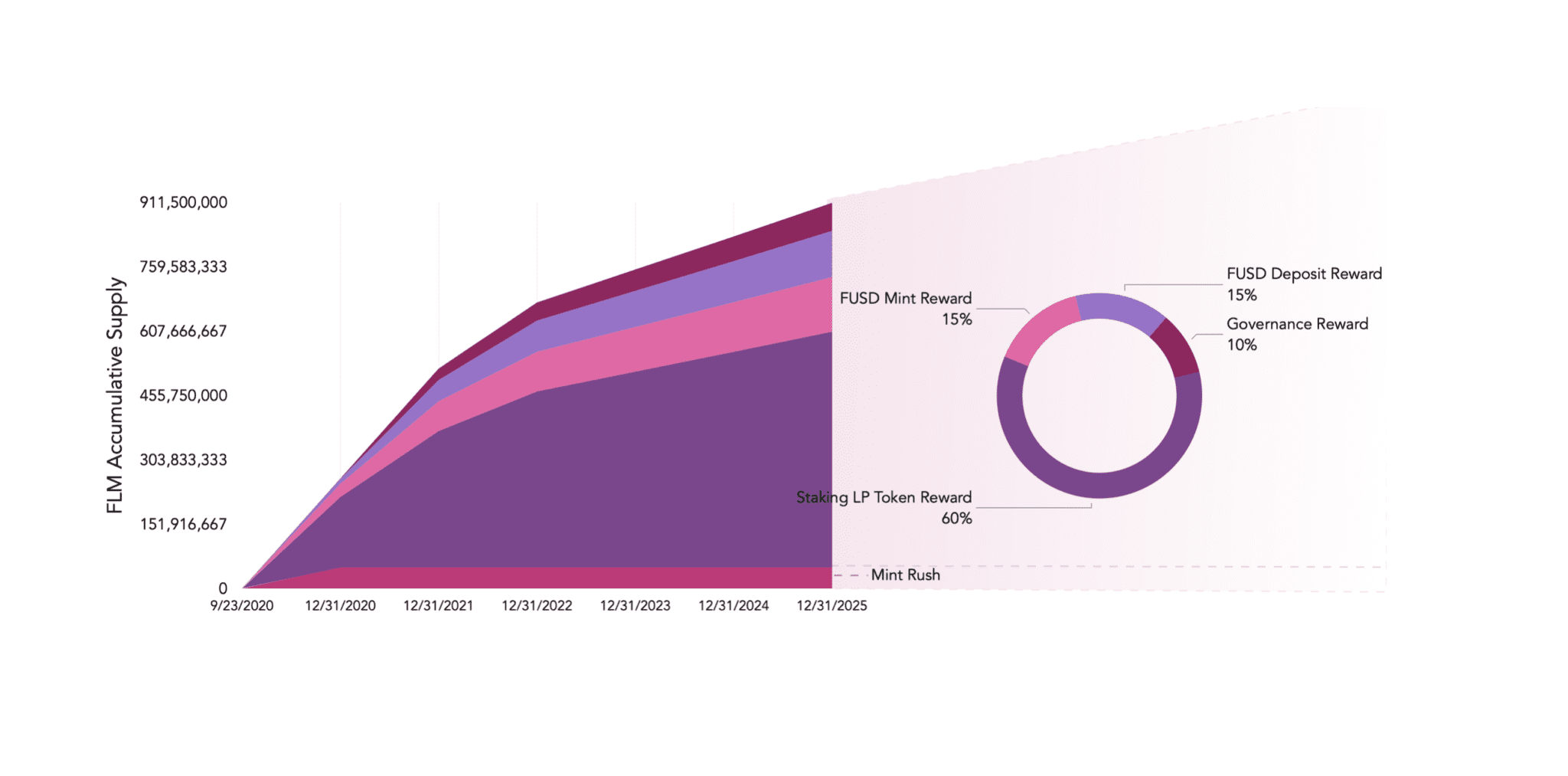

NGD expects a new FLM distribution schedule to be developed by Flamingo’s decentralized autonomous organization (DAO), anticipated for launch in December 2020.

Source: Flamingo Litepaper

Through the DAO, FLM token holders will have the ability to vote on “a safe, stable, and sustainable operation plan” for future FLM token distributions. DAO participants will also be able to vote other issues such as parameter configuration, and functionality improvements or changes. Moving forward, community members who vote on DAO proposals will tentatively receive 10% of all new FLM generated.

In addition to the FLM token distribution schedule, the Flamingo whitepaper also offers an overview of its key modules, project features, scope of governance procedures, and roadmap for the remainder of 2020.

The full Flamingo Litepaper can be found at the link below:

https://docs.flamingo.finance/

neonewstoday.com

neonewstoday.com