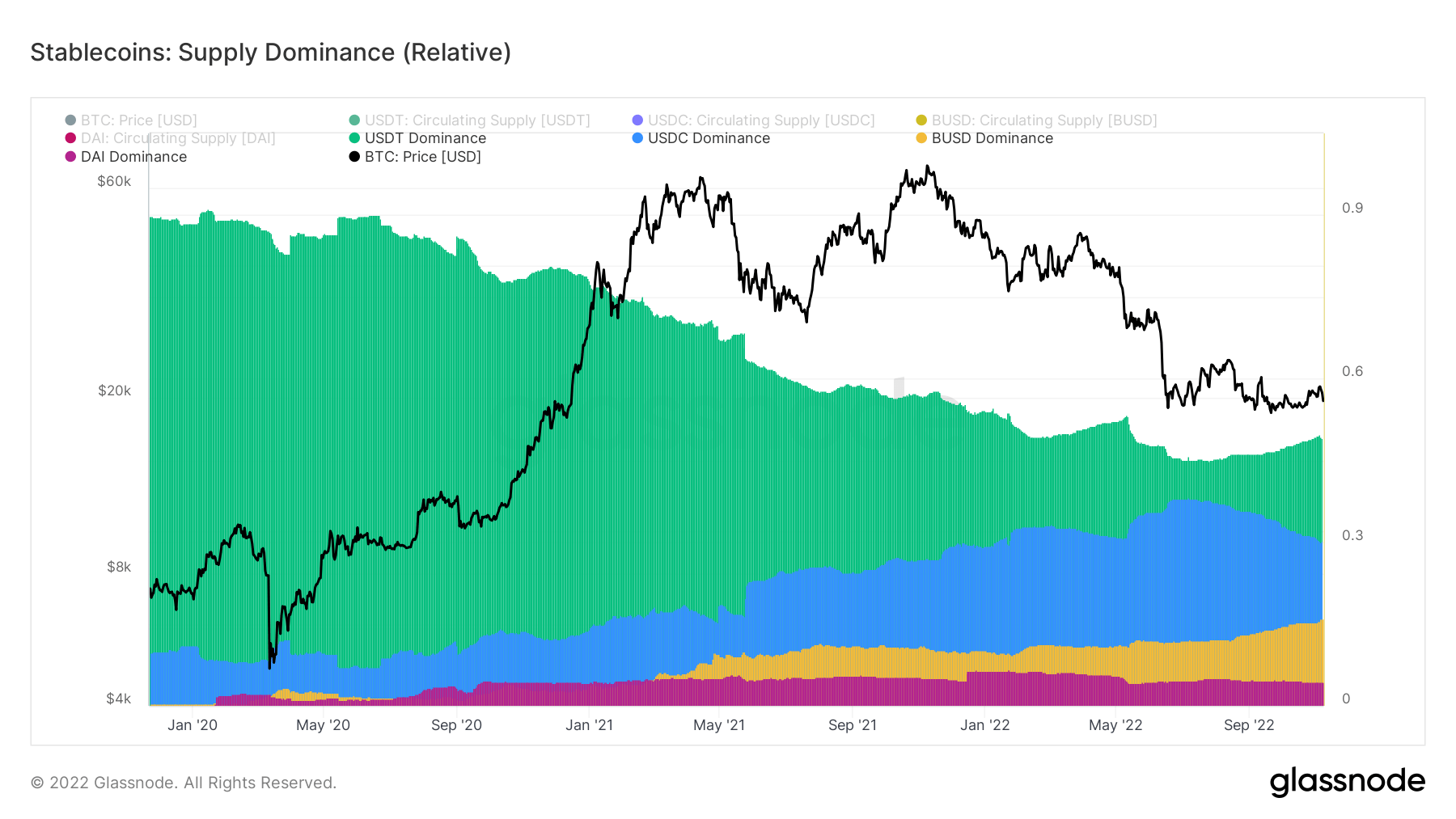

Binance USD (BUSD) is the best-performing stablecoin among the top three stablecoins, as its supply dominance increased by 6% on the year-to-date metrics to 16%.

The Binance-backed stablecoin has seen its supply grow from $18 billion at the start of the year to $22 billion as of press time. Its growth was largely pushed by Binance’s decision to convert the USDC balance of its users into BUSD.

Tether supply dominance drops

Glassnode data, as analyzed by CryptoSlate, showed that Tether’s USDT saw its dominance cut to 50% from 54%. Tether’s market cap started the year at over $78 billion, peaking at $84 billion in early May.

Terra’s UST implosion during this period severely impacted trust in other stablecoins and the broader crypto market.

During this period, USDT experienced a mini bank run that saw it honor about $10 billion in redemptions over two weeks. The stablecoin also temporarily lost its peg as many questions were being asked about its reserves.

While Tether has strongly recovered from this period, growing its supply from a low of$62.17billion to $69 billion, it is still down from its May peak of over $84 billion.

USDC remain unchanged

The second largest stablecoin by market cap, USD Coin (USDC), saw its dominance remain unchanged at 30% on the year-to-date metric.

USDC survived the Terra route unscathed and briefly ate into Tether’s dominance as its supply grew from $42 billion recorded at the beginning of the year to a peak of $55.90 billion in July

However, its supply has shrunk by $10 billion from that peak to $43 billion following Binance’s decision to convert its users’ balance in USDC, TUSD, and USDP to its native stablecoin BUSD.

Meanwhile, USDC’s issuer Circle has continued to make several moves to regain its former glory. Circle announced its euro coin (EUROC) stablecoin would be supported on the Solana blockchain by 2023. Apart from that, it also started transferring USDC reserves into a Blackrock-managed fund.

cryptoslate.com

cryptoslate.com