The coffers of Pickle Finance, a decentralized finance (DeFi) protocol with a native token that looks suspiciously like Pickle Rick, of Rick and Morty fame, were drained today of $20 million in what appears to be a hack.

Pickle Finance shifts investors’ money around different DeFi protocols to maximise returns, a little like a traditional robo-advisor.

In addition in the second invocation for swapExactJarForJar there were passed a target and doing a delegate call to CurveProxyPool 😢

Really complex and is not using at all FlashLoans!https://t.co/6HetsSmdbm pic.twitter.com/RVVyy39IAG

— Emiliano Bonassi | emiliano.eth (@emilianobonassi) November 21, 2020

Yesterday, Pickle “deployed a new strategy” to maximise returns from DAI, a decentralized stablecoin pegged to the US dollar, “Larry the Cucumber,” a team member for Pickle, posted in a Discord chat, according to “statelayer.eth.”

$pickle had just deployed a new strategy for the DAI jar strategy yesterday according to one of their team members 🤔 https://t.co/Jum2aSHUKY pic.twitter.com/N6oDiXN3WM

— statelayer.eth (@statelayer) November 21, 2020

Today, someone drained that wallet of $19.7 million in DAI.

Specifically, someone drained Pickle Finance’s cDAI jar. cDAI are the tokens that decentralized lending protocol Compound issues its customers when they deposit DAI, a decentralized stablecoin pegged to the US dollar.

But it doesn’t appear to be the kind of flash loan attack we typically see associated with protocol hacks on this scale. “Normally you'd see the tx calling Aave, Uniswap, or dYdX for the flash loan,” crypto analyst Nick Chong told Decrypt.

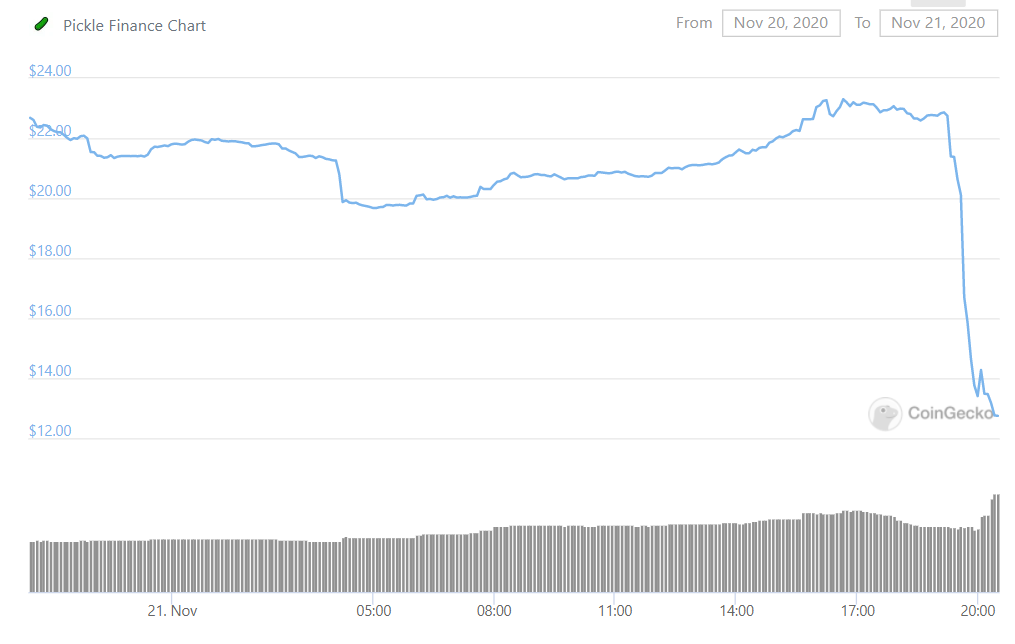

Following the hack, the price of Pickle Finance's token, PICKLE, fell by 43.8%, according to Coin Gecko, to $12.75.

Until it works out what’s going on, Harvest Finance, a rival DeFi protocol that last month was hacked for $30 million, has moved all of its DAI, as well as stablecoins USDC and USDC, “ to the safety of its vaults until the attack vector is understood,” tweeted Smokatoke, a community rep for Harvest Finance.

decrypt.co

decrypt.co