Coinbase might be picking a fight with the SEC over its (maybe still pending?) Lend product. While the legal/regulatory questions are interesting, the way the San Francisco-bases crypto exchange is approaching this fight is what’s really capturing my attention.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

A security by any other name

The narrative

Coinbase disclosed last week that the U.S. Securities and Exchange Commission (SEC) viewed its proposed Coinbase Lend product as a possible security requiring registration and sent it a Wells Notice, a formal warning.

Why it matters

The SEC’s views on crypto lending extend well beyond Coinbase and its yet-to-be-launched product – several companies already offer such services. The SEC’s view on this specific market may hint that we will see more enforcement actions against the already live products. However, in announcing the SEC’s conclusions, Coinbase is also playing an interesting public relations game that is worth keeping an eye on, even if it’s unclear what sort of effect it might have on the legal questions.

Breaking it down

After Coinbase announced it had received a Wells Notice, the conversation on my Twitter feed generally broke down into two camps: There were non-crypto lawyers who believed that Coinbase Lend was definitely a security, while crypto lawyers were more inclined to view the SEC’s actions as being unhelpful or vague.

There are really two points of interest at play here. The first is the regulatory issue, which we’ll get to. But the other is the public relations game that Coinbase is playing. While this may affect the regulatory issue, the public relations game is its own beast, and this isn’t the first time we’ve seen it. It’s really not clear to me how effective it is, but it is absolutely fascinating to watch.

Coinbase isn’t the first company to proactively announce it may be sued by federal regulators (*cough* the SEC). Ripple CEO Brad Garlinghouse also revealed that Ripple had received a Wells Notice, ahead of the SEC filing charges against the company.

Both Coinbase CEO Brian Armstrong and Garlinghouse are pulling from Kik and Ted Livingston’s playbook, arguably more successfully.

Kik revealed in January 2019 that the SEC had sent it a Wells Notice (basically the regulator’s way of formally announcing it had enough evidence to support a civil enforcement action against a company) to the messaging platform.

Kik ultimately settled after the SEC sued the company, alleging that its initial coin offering violated securities laws.

In December, Garlinghouse similarly published Ripple’s Wells response.

The immediate takeaway could be that these companies are being transparent about their legal challenges. But they’re also, to some degree, mobilizing their customers.

A large number of the Ripple/SEC hearings have been open to the public by way of a phone line for people to dial in to. It’s still been almost impossible to dial in to listen to some of these hearings because they were maxed out. It’s almost as if the company, or its XRP asset, has an army of fans.

Interestingly, while Coinbase revealed it had received a Wells Notice, it has not yet published either the notice or its response, unlike Ripple and Kik. Two different spokespeople did not respond when I asked if it would.

Still, the public response to the SEC’s enforcement actions has been loudly critical. People want to invest in or trade these tokens or products, regardless of the SEC’s legal view.

For its part, the SEC has been typically tight-lipped on how it’s approaching these cases. Garlinghouse and Armstrong are leveraging that silence. Each executive publicly claimed to have engaged with the regulator for months before a Wells Notice was filed.

“The SEC has told us it wants to sue us over Lend. We don’t know why,” reads Coinbase’s blog post, which was written by Paul Grewal, the exchange’s chief legal officer and a former magistrate judge.

It’s a pretty one-sided battle in the court of public opinion (even if the SEC sub-tweeted Armstrong).

How that translates to a court of law remains to be seen.

Under federal law, notes, stocks and certificates of interest can all fall under the definition of a “security,” according to multiple lawyers I spoke to (these lawyers all spoke on background as they sometimes have to interact with the regulator).

The question for the SEC is: Does it consider an interest-bearing account to be, say, a certificate of interest?

“Maybe,” one of these lawyers said.

Another individual said the SEC typically doesn’t issue Wells Notices unless the enforcement attorneys at the agency are confident they can win the case.

However, it’s unusual for the SEC to issue a conditional Wells Notice – the agency is threatening to sue if Coinbase launches this not-yet-active product.

And if Coinbase’s Lend product is a security, it’s possible other crypto-related lending products also run afoul of federal securities laws.

“We asked if the SEC would share their reasoning with us, and yet again they refused. They have only told us that they are assessing our Lend product through the prism of decades-old Supreme Court cases called Howey and Reves. The SEC won’t share the assessment itself, only the fact that they have done it,” Coinbase’s blog post said.

Now, there’s a very real frustration with the SEC over its apparent refusal to publish bright-line guidance that companies can point to and say “yes, this is what we should keep in mind as we build things,” but the court precedents that Grewal mentioned are still well-established. Howey is one we’re all familiar with; we’ve been talking about it since the ICO bubble of 2017.

Reves isn’t a bright line, but courts have still carved out rules for defining when a note is or isn’t a security, said one of the lawyers I spoke to.

All that’s left is to see whether Coinbase still finds a way to launch Lend and how the SEC proceeds on crypto lending more generally.

Maybe the most confusing aspect of the SEC’s requests of Coinbase center around the personal information it wants. Grewal wrote that the agency asked for the name and contact information for everyone on the Lend wait list, but no reason for the request has been publicly made.

Biden’s rule

Changing of the guard

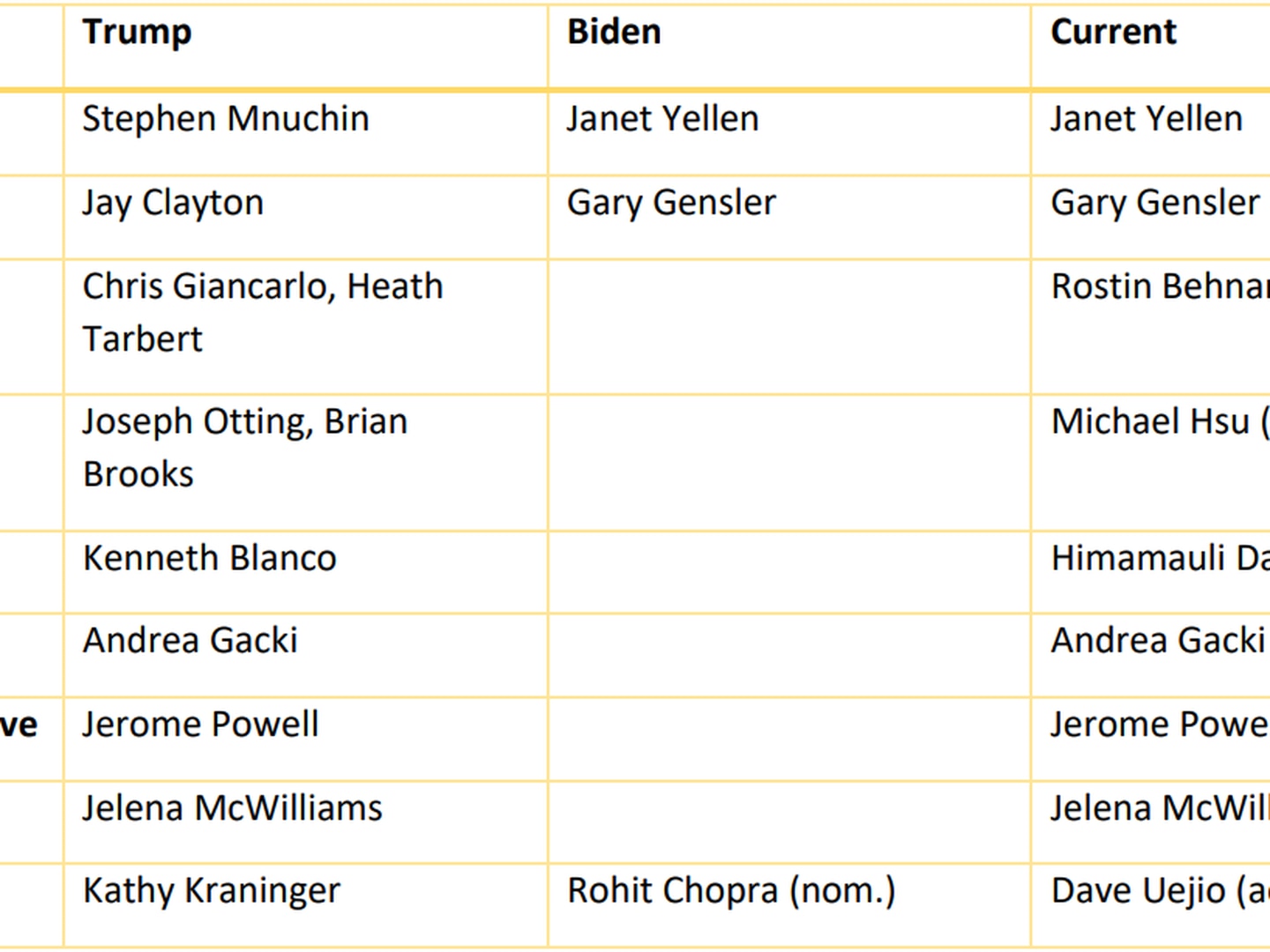

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

President Joe Biden has officially announced he will nominate Rostin Behnam, the acting chairman of the Commodity Futures Trading Commission, to serve a full term running the agency. He also plans to nominate Kristin Johnson, a law professor at Emory University specializing in “complex financial instruments,” and Christy Goldsmith Romero, a government official who is also an adjunct at the University of Virginia teaching cryptocurrency law, to be commissioners at the federal agency.

This comes after Commissioner Dan Berkovitz announced he plans to depart next month. Brian Quintenz, who left the CFTC on Aug. 31, has also accepted an advisory role at Andreessen Horowitz.

Elsewhere:

-

IRS Makes New Crypto Broker Guidance a ‘Priority’ in 2021-22 Plan: This is not related to the infrastructure bill, necessarily. The Treasury Department announced in May that expanding crypto broker reporting requirements was one of its priorities, particularly with regard to foreign accounts. Last week, the Internal Revenue Service included that plan in its list of priorities through next year.

-

SEC Sets November Deadline for Final Decision on VanEck Bitcoin ETF: Will the SEC approve this application for a bitcoin exchange-traded fund? SEC Chairman Gary Gensler’s recent remarks around bitcoin futures ETF applications suggest this first effort will be rejected. But we’ll know for sure in about two months.

-

Here’s How the US’s Infrastructure Bill Crypto Tax Provision Might Be Implemented: My colleague Sandali Handagama reached out to a number of tax experts to discuss the infrastructure bill and try and map out how exactly it might be implemented, should the House approve it at the end of September.

Beyond CoinDesk:

-

(Protos) Hamster? Hamster.

-

(Politico) Coinbase has tapped Andrew Olmem, a former Trump administration official, as a new lobbyist on tax and financial regulation issues, Politico reports.

-

(New York Magazine) NYMag’s Jen Wieczner interviewed Gensler for its Intelligencer news division. It’s worth a read, especially before Gensler’s testimony before the U.S. Senate’s Committee on Banking, Housing and Urban Affairs later today.

-

(Thomson Reuters Foundation) This is an actual headline by Reuters: “Bitcoin craze: Seven places that want you to spend your virtual currency.”

See ya’ll next week!

coindesk.com

coindesk.com