NFTs have been around for several years. However, the non-fungible token explosion that took place in early May transformed a niche marketplace into a global industry.

Since then, non-fungible markets have cooled off. Still, many analysts agree that the true potential for non-fungible token technology has yet to be tapped. Therefore, getting into the market as a creator early could pay off down the road.

If you’re thinking of creating an NFT, here are five of the most important things to consider.

1. Where will your NFT be sold?

It doesn’t really matter what kind of a non-fungible token you want to make: people have minted tokens from songs, digital images, photographs, memes, even their own gaseous emissions– and they’ve managed to make good money.

However, you might want to consider where your NFT will be sold. While some NFT marketplaces allow anyone to make non-fungible tokens, a growing number of reputable platforms have a vetting process for NFT creators. This often involves an application process or a recommendation from another artist.

While it may not ultimately make a big difference where your NFT is created or sold, NFT marketplaces that have more extensive artist-vetting processes may attract more serious collectors than marketplaces that can be used by anyone. Therefore, depending on your needs as an NFT creator, it may be useful to shop around for a platform that does or does not have a process for vetting artists.

Beyond artistic vetting, you may also want to consider using an NFT platform that offers some level of identity verification for artists. When your identity is verified, NFT collectors can be sure that they are purchasing their non-fungible tokens from the source. This can also protect artists against plagiarism and identity theft.

2. Costs & Fee Structure

“There’s no such thing as free lunch”: the adage is just as true in the world of non-fungible tokens as it is anywhere else. Therefore, while some NFT creation platforms offer the ability to create NFTs for “free”, someone’s gotta pay the price–eventually.

For example, some NFT platforms offer their users the ability to create non-fungible tokens without paying any costs upfront. However, their fees may be structured so that the buyer of the NFT must pay the transaction fees used to mint the token when it is bought. Some platforms collect a cut of the NFT every time it is sold after that point.

Depending on your needs as an NFT artist, these kinds of fee structures may or may not be suitable for you. For example, a non-fungible token creator who wishes to create hundreds or thousands of NFTs based on a single work of art may wish to engage with a platform that would allow them to do so without any upfront costs. Otherwise, they may be subject to tens of thousands of dollars in gas fees.

Alternatively, if a creator is only seeking to make a single “master copy” of an NFT, they may prefer to engage with a platform that charges upfront but does not collect any fees (or minimal fees) later on.

The costs of creating an NFT can also vary greatly depending on which blockchain the marketplace is based on. For example, users of Ethereum-based NFT marketplaces may find themselves paying $20-80 per transaction (at press time), while users of a BSC-based NFT marketplace may only pay a few cents for a transaction.

3. The Environmental Debate over NFT Production

It wasn’t long after non-fungible tokens became a cultural phenomenon that they started receiving huge amounts of backlash–mostly over their environmental toll.

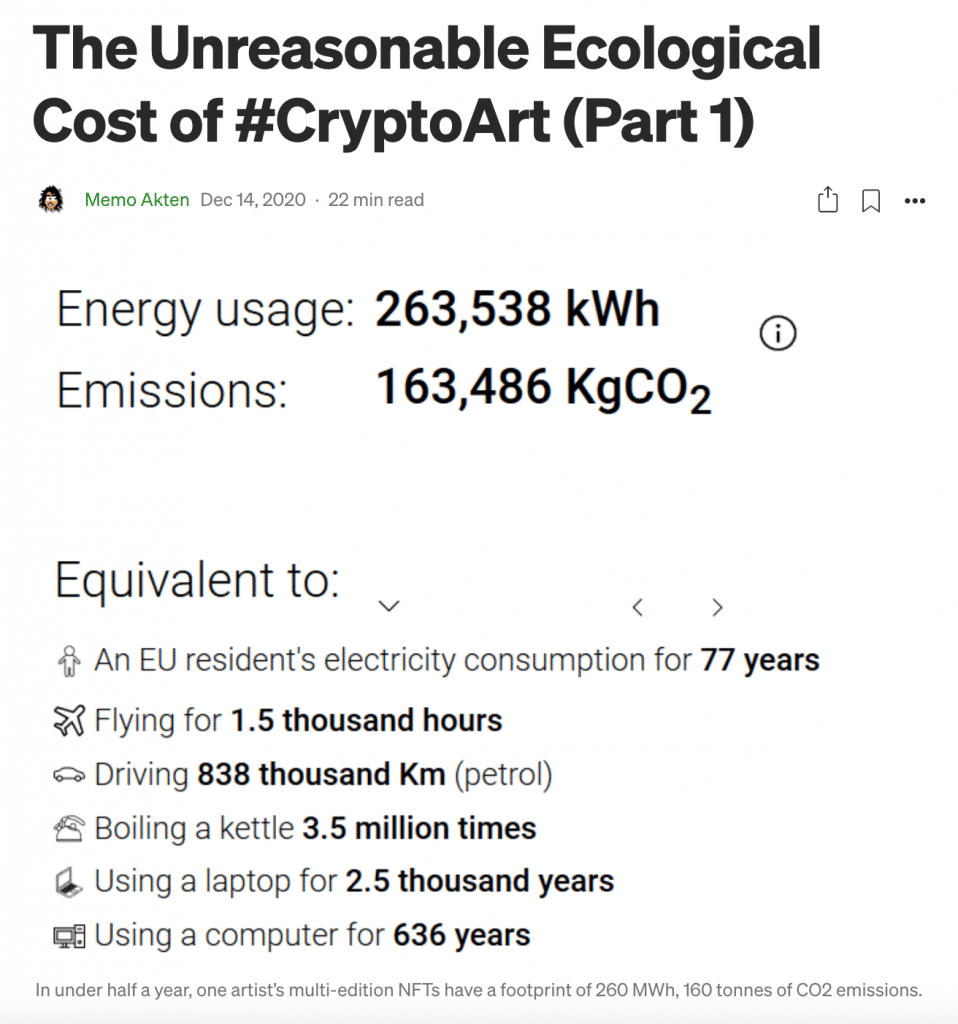

Critics argue that creating a non-fungible token has a hefty carbon emission. They say that that the process of NFT creation is so toxic for the environment that it should be avoided altogether. Artist Memo Akten compiled data showing that an artist who regularly creates NFTs can emit more than 163,000kg of CO2 in a single year.

However, advocates of the technology have pointed out that the NFT world’s environmental conundrum is a nuanced issue. For example, not all blockchains are created equal–while the Ethereum blockchain (which is home to the largest NFT ecosystem) does have a large carbon footprint, other, less energy-intensive blockchains also support NFT creation.

Other NFT proponents have also pointed out that even though the Ethereum blockchain does consume a lot of energy, the relationship between transactions on the network and the network’s carbon footprint isn’t necessarily clear-cut.

In a blog post published earlier this year, NFT platform SuperRare explained that “it is important to note that Ethereum has a fixed energy consumption at a given point in time.” In other words, “While the network is constantly processing transactions (financial trades, NFT minting, et cetera) these transactions do not actually increase or affect the energy consumption of the network.”

Additionally, the Ethereum network is currently in the process of upgrading to Ethereum 2.0, a newer version of the network that will have a much lower carbon footprint than Ethereum’s current iteration. Some artists are reportedly choosing to wait for the upgrade to be completed before delving into the NFT world for the first time.

4. Market Volatility

When NFTs first exploded onto the scene in early March of 2021, all eyes turned to the non-fungible token space. Suddenly, everyone was making them. When the NFT market peaked in the first week of May, $170 million in NFTs were transacted in seven days. However, during the seven-day period at the end of the month, there were just $19.4 million in NFT sales. Altogether, the decrease amounted to a 90 per cent collapse.

As the NFT market has cooled, prices have also taken a turn toward the ground. Investors who may have paid top-dollar for NFTs when the market peaked have been left holding the bag. As a result, interest in non-fungible tokens seems to be dwindling–and it’s unclear when (or perhaps if) it will recover.

Therefore, when you’re thinking about creating a single NFT or a series of tokens, it’s important to consider the risk-to-reward ratio. While your risks as a creator may be minimal compared to the level of risks that investors take on when they purchase non-fungible tokens, the amount of time and money that you put into NFT creation may not necessarily result in piles of cash.

One strategy for alleviating the possible effects of market volatility on your NFT sales is to build strong relationships with the fans and investors who purchase your work. While The Powers That Be will always play a role in any kind of financial market, building a community around the things that you create can help strengthen your personal economy in the face of uncontrollable market forces.

5. Fraud, Security, and Identity

Like any nascent market, the NFT space still has a few problems to work out. In addition to the environmental concerns about non-fungible token creation, the issues of fraud and plagiarism are a major concern for artists in the space.

Unfortunately, there have been many instances of malicious actors copying the work of small artists and using it to create NFTs that they profit off of. While identity verification on some platforms has alleviated this problem to a degree, work is always at risk of being copied.

Worse yet, there may not be much that affected creators can do about it. Moish E. Peltz, Esq, the Chairman of the Intellectual Property Practice Group at Falcon Rappaport & Berkman PLLC, told Finance Magnates that when this happens, “it could be incredibly difficult or perhaps even impossible to have it taken down (or to otherwise enforce your intellectual property rights),” Peltz explained.

“To the extent that the token is listed on a platform, it is unclear to what extent traditional takedown mechanisms such as the DMCA apply to NFT platforms, and how different platforms will respond to such infringement submissions,” he continued.

“Additionally, it may be extremely difficult, impossible, or just not economically feasible to pursue random copycats duplicating your intellectual property within an NFT. However, to the extent you can identify an infringer, it may still be possible to apply traditional IP rules to remedy infringement of your work.”

Therefore, If someone in the NFT world is impersonating your work, your best bet may be to contact the platform on which the NFTs are being sold immediately.

financemagnates.com

financemagnates.com