Kraken, one of the leading cryptocurrency exchanges, has just released its latest report on the upcoming Bitcoin halving.

It has estimated that the global mining revenue is going to lose $3 bln in annual revenue after the highly-anticipated event due to the 50 percent supply reduction if the BTC price were to stay at the $9,300 level.

Earlier this February, TradeBlock concluded that the BTC price has to be at least $15,062 after the halving for miners to break even. Otherwise, their exodus will lead to a sharp drop in the hashrate.

The most important question of 2020

While it's logical to assume arguably the most important event that was coded in the Bitcoin blockchain has been already priced in, history shows that it might not be the case.

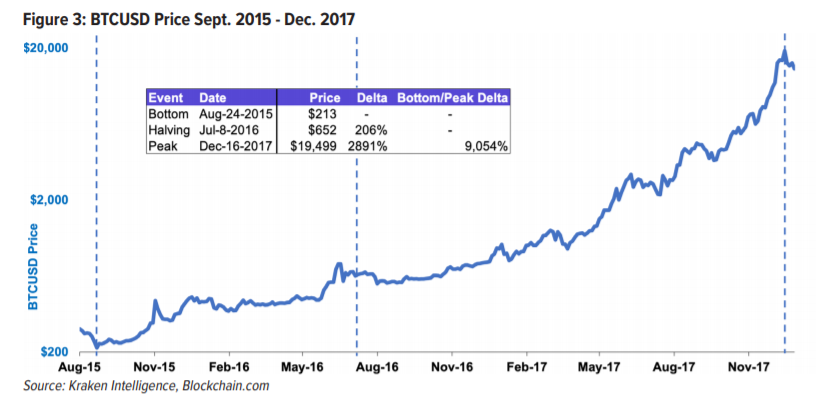

Kraken states that Bitcoin appreciated more than 9,000 percent during its previous bull run. BTC reached its current all-time high of $19,499 18 months after the halving event.

Solidifying the store of value narrative

Kraken states that this halving is particularly significant because Bitcoin's inflation rate will be reduced by 1.8 percent, which is lower than the 2 percent target adopted by most central banks.

Disinflationary assets like Bitcoin and gold serve as a store of value. Both of these assets are valued because of their scarcity that can be measured with the help of their respective stock-to-flow models. BTC will surpass the SF of the lustrous metal after its fourth halving in 2024.

u.today

u.today