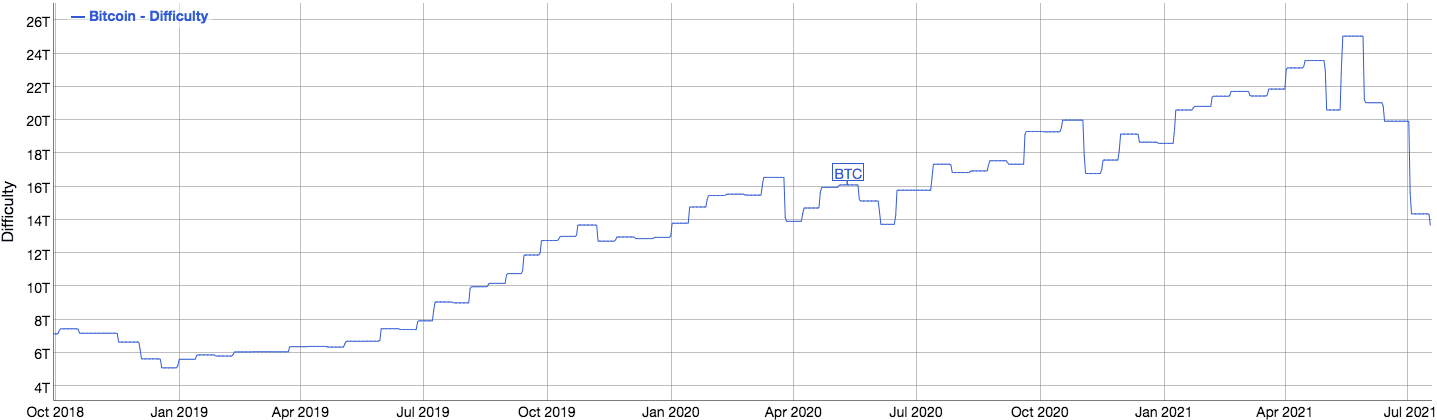

This past weekend, Bitcoin mining difficulty had yet another downward adjustment of just under 5% to 13.673 trillion, last seen in early January 2020, following the most significant drop in Bitcoin’s history two weeks ago. At the end of May, the mining difficulty was at its all-time high of just above 25 trillion. Since then, four downward adjustments have been recorded in a row, representing a drop of 45.6% due to a decline in hash rate caused by China’s crackdown on cryptocurrency mining. These downward adjustments in difficulty are helping the hash rate recover from its 68 Th/s low at the end of June to now around 100 Th/s, with Viabtc, Antpool, Poolin, F2pool, and Btc.com being the top mining pools accounting for 59.4% of global hash rate followed by Binance, Foundry, and Slushpool which has captured nearly 22% hash power. Bitcoin hash rate surged to its peak at 197.6 TH/s in mid-May after miners increased the overall hash power to capitalize on the booming market. Though orders for the new ASIC machines soared at the time, the total capacity was not installed due to supply chain disruption and semiconductor shortage. "The hash rate about doubled in the past year. But if all the machines on order had been installed, it would have gone up a lot more," said Alex de Vries of Digiconomist, which tracks Bitcoin's energy usage.

“Same vibes” as of December 2018

The downward adjustment in difficulty made a record drop in 2011 between August to November when it dropped 11 times in a row. At the time, the fall was 51.4%. Back in 2018, at the end of the bear market, we recorded four consecutive difficulty drops between October and December; during this time, the BTC price found its bottom. At the time, the drop was only 31% to a six-month low. Price-wise, trader Loomdart of eGirl Capital is also getting the “same vibes” as of December 2018. The drop in difficulty means mining Bitcoin has become much more manageable. Mining Bitcoin has already been profitable and became more of a windfall for miners in the US, Canada, and Russia after China’s crackdown.

These Chinese are now moving to other parts of the world where production is more active such as Kazakhstan, Russia, Malaysia, and Texas, and Tennessee in the US.

“At $28,000 per coin, electrical usage could rise by 30% above the level before China shut down, and the miners would still make good money,” said de Vries. “If it goes back to $65,000, the miners would double their power usage from before China unplugged.”

Bitcoin mining operations like Bitfarms in Quebec are particularly enjoying the abrupt shutdown in Chinese mining operations. The BTC price above $31k and hash rate needed to capture/mine new coins down by 51% from two months back.

According to Bitfarms' public disclosures, its "mining costs" per BTC in Q1 2021, consisting of the cost of supplies, labor, and electricity, was $8,500. It mined 598 BTC in Q1, amassing $28 million with the production cost of just $6 million.

"On July 3, the Bitcoin network experienced the largest difficulty drop in history due to recent macro developments in China. This has resulted in Bitfarms producing significantly higher quantities of Bitcoin at a lower cost per Bitcoin." founder and CEO Emiliano Grodzki explained in the company's production-update report. “Bitfarms has nearly doubled its market share,” he added.

[deco-beg-single-coin-widget coin="BTC"]

The drop in difficulty means mining Bitcoin has become much more manageable. Mining Bitcoin has already been profitable and became more of a windfall for miners in the US, Canada, and Russia after China’s crackdown.

These Chinese are now moving to other parts of the world where production is more active such as Kazakhstan, Russia, Malaysia, and Texas, and Tennessee in the US.

“At $28,000 per coin, electrical usage could rise by 30% above the level before China shut down, and the miners would still make good money,” said de Vries. “If it goes back to $65,000, the miners would double their power usage from before China unplugged.”

Bitcoin mining operations like Bitfarms in Quebec are particularly enjoying the abrupt shutdown in Chinese mining operations. The BTC price above $31k and hash rate needed to capture/mine new coins down by 51% from two months back.

According to Bitfarms' public disclosures, its "mining costs" per BTC in Q1 2021, consisting of the cost of supplies, labor, and electricity, was $8,500. It mined 598 BTC in Q1, amassing $28 million with the production cost of just $6 million.

"On July 3, the Bitcoin network experienced the largest difficulty drop in history due to recent macro developments in China. This has resulted in Bitfarms producing significantly higher quantities of Bitcoin at a lower cost per Bitcoin." founder and CEO Emiliano Grodzki explained in the company's production-update report. “Bitfarms has nearly doubled its market share,” he added.

[deco-beg-single-coin-widget coin="BTC"]

bitcoinexchangeguide.com

bitcoinexchangeguide.com