The veteran US-based cryptocurrency exchange Coinbase is looking into adding 19 new digital assets onto its platform. Interestingly, the majority of the coins are representatives of the ongoing DeFi trend.

Coinbase Considers 19 New Coins

The largest digital asset exchange based in the US announced yesterday that it’s currently evaluating 19 new additions to its platform. Those are Ampleforth, Band Protocol, Balancer, Blockstack, Curve, Fetch.ai, Flexacoin, Helium, Hedera, Hashgraph, Kava, Melon, Ocean Protocol, Paxos Gold, Reserve Rights, tBTC, The Graph, THETA, UMA, and WBTC.

Coinbase noted that “as part of the exploratory process, customers may see public-facing APIs and other signs that we are conducting engineering work to potentially support these assets.”

However, the company also asserted that although it’s examining these coins, it doesn’t necessarily mean that all (or even some) of them will be indeed added. Each digital asset will have to comply with a comprehensive “technical and compliance review.”

“We, therefore, cannot guarantee whether or when any above-listed asset will be listed on a Coinbase product in any jurisdiction. We will add new assets on a jurisdiction-by-jurisdiction basis, subject to applicable review and authorizations.” – reads the statement.

Nevertheless, Coinbase said that customers can expect similar announcements in the future. The company’s ultimate goal is to allow clients to access “at least 90% of the aggregate market cap of all digital assets in circulation.”

DeFi Anyone?

Prior to this announcement, Coinbase said in mid-June that it was looking into listing another set of 19 coins. It’s worth noting that most of the coins from the two statements were representatives of the decentralized finance (DeFi) field – the latest trend in the cryptocurrency space.

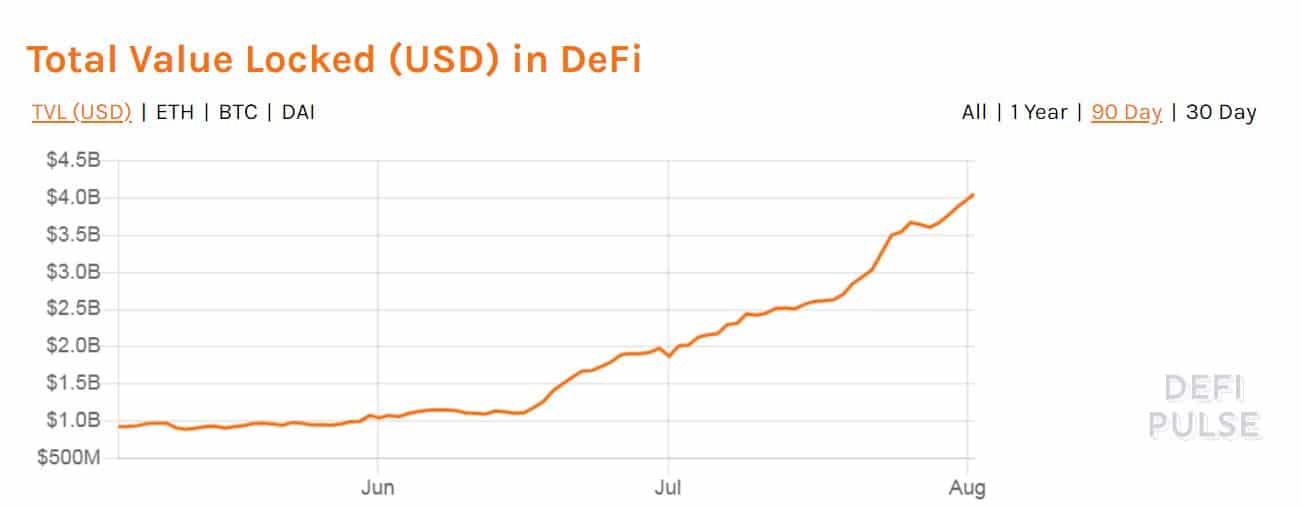

The interest in the DeFi sector has been rapidly growing for a few consecutive months. The statistic that exemplifies the rising demand arguably most accurately is the total value locked in DeFi. Ever since the TVL crossed $1 billion in late May/early June, it has been surging at a fast pace. As of now, it has jumped to over $4 billion, according to data from defipulse.

As a result of the increased demand, numerous projects have become attractive to cryptocurrency exchanges for listings.

cryptopotato.com

cryptopotato.com