A new decentralized finance (DeFi) asset which touts itself as a “tokenized risk protocol,” is getting the attention of crypto traders after erupting 140x from its initial offering price in a span of 24 hours.

The newly-launched crypto project Barnbridge is turning heads as its governance token, BOND, has shot from its seed round value of $1.33 to as high as $185 on launch day – representing an increase of more than 13,800%.

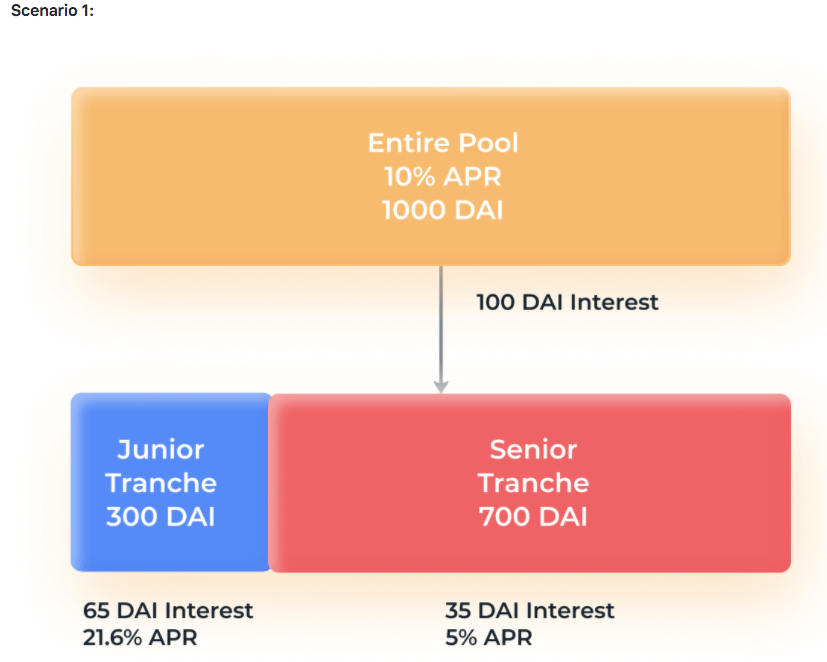

According to the protocol’s whitepaper, Barnbridge aims to change the existing variable interest rates being offered by current DeFi platforms with products that promise to structure yield into fixed rates. Users will also have the option to invest based on their risk appetite as Barnbridge splits interest rates into risk tranches.

“Upon sending the funds to participate in the pool, the user decides the risk tranche.

Assume the entire loan has an interest rate of 10%. The senior tranche tokens are sold for a fixed interest of 5% with the junior tranche having a variable interest rate. Assuming the entire porfolio has a return rate of 10%, for a total of 100 DAI, after repaying the senior tranches 5% interest on their investment of 700 DAI first (35 DAI), we have 65 DAI of proceeds for the junior tranches.”

As BOND’s value erupts, CoinGecko co-founder Bobby Ong warns his followers that the token is ripe for profit taking.

I've been observing @barn_bridge token price since it started trading on Monday morning. The price seems to be going only up and at $185, it is nearly 140x seed round price of $1.33. I am fully anticipating the price to go down next week so do be careful. Thread below 👇

— Bobby Ong (@bobbyong) October 27, 2020

Ong says that BOND’s system of releasing proceeds to users at the end of every week has created a void in the supply. According to Ong, the low sell pressure has catalyzed BOND’s strong ascent. In addition, the crypto data aggregator executive suggests that BOND is currently overvalued with its market cap of over a billion dollars.

“At $160/BOND, Barnbridge will have a Fully Diluted Valuation of $1.6b. In my opinion, this is too high for a project that does not have a working product, although the idea & team seems promising. When Week 2’s harvest is ready from Pool 1 & 2, farmers may decide to take profit.”

At time of writing, BOND is trading at $152 according to CoinGecko.

Featured Image: Shutterstock/AleksandrMorrisovich

dailyhodl.com

dailyhodl.com