Synthetix started as a stablecoin but soon pivoted to satisfy the needs of DeFi users. Nowadays, it serves as one of the leading DeFi projects offering the trading of currencies, commodities, stocks, and other assets.

Trading stocks is still dominated by traditional financial centers, being heavily regulated, and hard to automate. The same applies to commodities such as gold and silver.

There are platforms that offer a minimal online experience that allows you to buy and sell your commodities. However, take into account trading fees, storage costs for storing gold, and selling fees. All those hidden costs eat up the profits you’ve accumulated.

Therefore, Garth Travers will explain to us how Synthetix accomplished trading synthetic assets on the Ethereum blockchain and how they leverage oracle technology to track the price of real-world assets while eliminating any bureaucracy or fees associated with those assets.

Tracking Real-World Assets such as Gold or Silver

First, let’s determine what synths are. A Synth is a synthetic asset that copies the price of a real-world asset and makes it liquid, tradeable on the Ethereum blockchain.

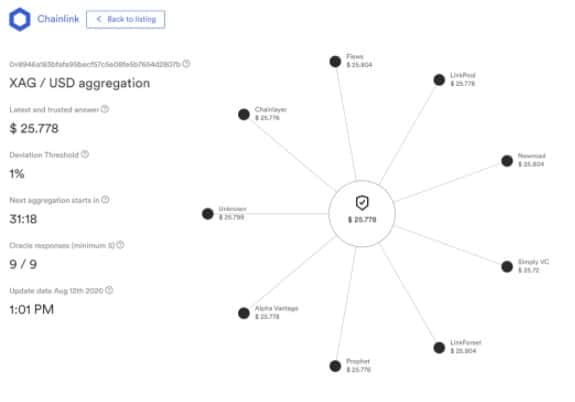

Garth explains that “the prices of real-word assets are pushed on-chain by a network of decentralized ‘oracle’ providers. The Chainlink project helps with the aggregation of all oracles to provide a single, average price to the Synthetix contract for a particular Synth such as Silver Ounce (sXAG).”

These prices are used to determine the value of individual tokens in the Synthetix protocol, which represent different synthetic assets such as currencies, commodities, cryptocurrencies, indices, and, eventually, stocks.

Furthermore, Travers explains the importance of the liquidity pool for Synthetix.

“There’s an underlying liquidity pool of these synthetic assets, which is supplied by stakers in the Synthetix protocol. This allows people to trade between these synthetic assets with infinite liquidity and without slippage.”

In other words, you don’t trade against a counterparty while using Synthetix — instead, you trade against the contract. Under the hood, all SNX stakers providing liquidity act as the counterparty. This makes for a superior trading experience, as people don’t need to wait for their orders to be filled, as well as the “infinite liquidity” feature.

You don’t trade against a counterparty while using Synthetix — instead, you trade against the contract.

What’s the importance of Chainlink’s technology for Synthetix?

Chainlink’s network of decentralized oracles is extremely important as the Synthetix protocol relies on its price feeds.

Synthetix is currently in the process of moving all its assets to use Chainlink’s feeds, and once that migration occurs, then all new types of assets will entirely rely on Chainlink.

“We’re currently working with Chainlink to find the best way to generate the price data for assets that predominantly rely on futures markets, beginning with a synthetic oil Synth.”

Here’s an example price feed page for XAG/USD oracle aggregation provided by Chainlink that feeds data to the sXAG contract.

Understanding the Benefits of Trading Synths

Garth shared with us three main benefits of trading synths instead of real-world assets. Let’s take a look.

a. Liquid and Instant Filling

As mentioned, you don’t trade against a counterparty while using Synthetix — instead, you trade against the contract. Under the hood, all SNX stakers providing liquidity act as the counterparty. This makes for a superior trading experience, as people don’t need to wait for their orders to be filled.

b. Availability (24/7)

Travers explained that “as long as the Ethereum network runs, anyone from any country can access trading commodities, stocks, and cryptocurrencies without having to hold the actual asset. It’s a permission-less asset, that’s 24/7 tradeable.”

c. Avoid Trading and/or Storage Fees

Lastly, as mentioned before, many platforms charge fees for buying and selling a particular asset. Besides that, certain types of assets such as gold or silver, require you to pay for storage costs. Trading Synths allows you to not lose your profits on those “extra costs.” Nonetheless, you still pay gas fees when trading Synths.

However, this opens up more possibilities, such as tracking the price of expensive wine bottles, removing the need to pay for wine cellar storage, and cooling costs. The problem here is to find reliable price data providers that assist with tracking the price of this particular asset.

Jumping on the DeFi Hype: What’s the sDEFI Token Synthetix Created?

Travers explains that there are also custom Synths that aren’t available anywhere else, such as the sDEFI token.

“The sDEFI token allows people to gain exposure to a variety of DeFi ecosystem tokens by simply holding one asset.”

In other words, the sDEFI token helps people save time by not having to learn about all those protocols in-depth, analyzing the risks for each, but also spending time following up on the projects. “With the sDEFI token, you gain exposure to multiple underlying DeFi protocols without having to learn about all the underlying details and requirements.”

What’s the purpose of the Synthetix token (SNX)?

The SNX token is staked as collateral to mint sUSD – the synthetic USD Synth. Collateral is pooled together to back the entire pool of Synths, and any profit or loss made by Synth traders must be covered by the entire pool of SNX stakers.

“For taking on this risk, SNX stakers are rewarded with trading fees and inflationary SNX tokens.” Garth explains that Synths are overcollateralized at a ratio of 750%, though this can be adjusted in the future via community governance. This is to ensure there is a limited chance of Synth under-collateralisation via price shocks to SNX.

Synthetix Foundation Decommissioned – DAO-fiction of Synthetix

Recently, Synthetix tweeted that they had decommissioned the Synthetix Foundation and handed over the control over the protocol to three distinct DAO’s. (More information about the decommissioning can be found in this blog)

Travers told us that “the goal behind implementing several DAOs to control the protocol is to get it to a point where it is resistant to capture, whether from a nation-state or an individual malicious actor. By putting it in the hands of several DAOs for different purposes, Synthetix will be far more robust and significantly reduce the trust required in the core contributors.”

Further, we asked the Synthetix team what the associated risks are of moving to the DAO-fiction of Synthetix.

“There are some risks, but our approach has always been to move transitionally to ensure that control is ceded gradually, despite some people calling for on-chain voting to be implemented over a year ago. Coordination is not easy or quick, so our approach has focused on ensuring the protocol can be built out rapidly while moving towards the DAO structure.“

High Hopes For Synthetix Future – Leveraged Positions and Decentralization Upgrades

“We recently published a roadmap update for the second half of the year, describing how for the rest of the year we’re working on synthetic futures for leveraged trading positions, allowing ETH and BTC as collateral, as well as a host of other product and decentralization upgrades.”

Synthetix has been an upcoming project throughout 2020 and will continue to grow as it adds more Synths but also more complex functionality, such as leveraged trading positions for Synths. In short, we expect a lot from Synthetix!

Further reads? The Synthetix litepaper is a great place to start, and if you’ve got any more questions, then there’s the Synthetix community on Discord. Besides that, there’s a recent high-level post about the current state of Synthetix.

cryptopotato.com

cryptopotato.com