Bitcoin and gold have been rising in tandem, as the dollar has been falling. It has also driven the growth of the market cap of digital gold tokens, backed by the precious metal commodity, to record highs.

What exactly has caused this rapid growth in market cap, and does this pose any threat against Bitcoin?

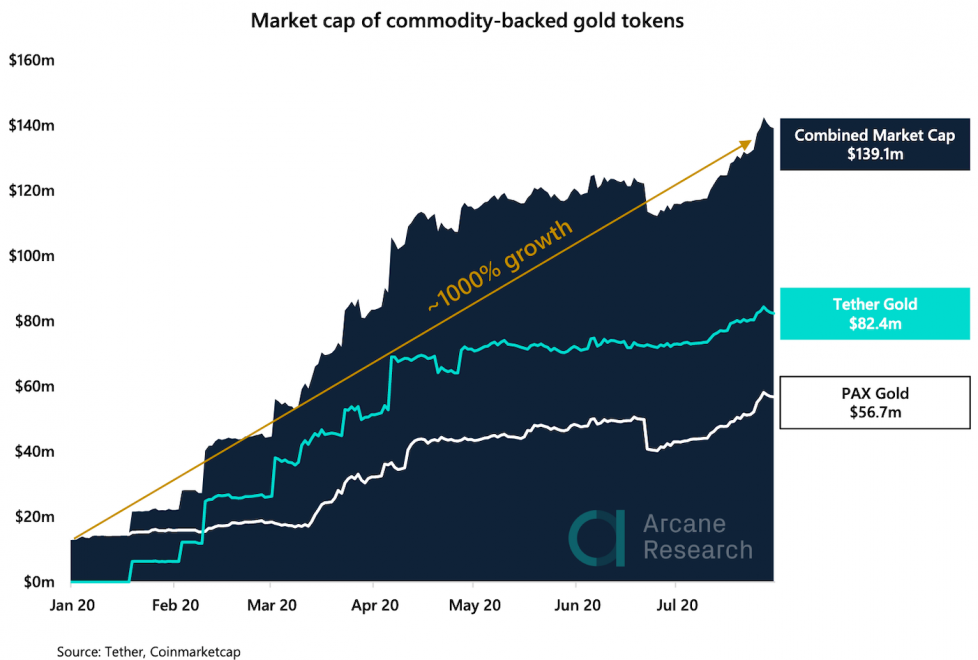

Market Cap of Commodity-Backed Gold Tokens Soars 1000% In 2020

Bitcoin and gold share several key similarities, such as supply scarcity. Bitcoin’s benefits soon begin to outweigh the precious metal, especially in terms of storage and security.

Gold existing in a physical form makes it far less portable and often requires storage in a vault or safe. It also leaves the asset highly vulnerable to theft, unless kept secure in this way.

To alleviate any challenges faced with storing gold and to avoid the high premiums gold bars are currently fetching, a new trend of digital gold tokens has emerged.

RELATED READING | HOW “PICTURE PERFECT” MACRO UNCERTAINTY WILL KEEP METALS, CRYPTO TRENDING

These tokens are backed by a corresponding amount of the commodity, and often represent digital ownership over a real bar stored in a security facility elsewhere.

The recent 2020 gold rush due to the economic uncertainty of 2020 has prompted the market cap of these commodity-backed tokens by 1000% to over $100 million and climbing.

The total gold token market cap has achieved a total of $139 million, with $82 million attributed to Tether Gold (XAUT) and $56 million to Paxos Gold.

Why Commodity-Backed Tokens Pose No Threat To Bitcoin and Crypto

If Bitcoin has long been considered digital gold due to important comparative attributes, then are these commodity-backed tokens competitors to the cryptocurrency?

In a sense, yes. All other tokens and gold itself are all competing against Bitcoin for capital. However, these assets pose no serious threat to Bitcoin.

For one, the combined market cap has only reached $140 million. Bitcoin’s market cap is over $200 billion. Bitcoin also has a hard-capped supply of only 21 million. While gold may be finite, it has an undetermined remaining supply.

Bitcoin is also a decentralized, non-sovereign network, while these gold tokens are backed by a commodity held by a centralized company that is bound to local government laws. The cryptocurrency existing outside of these barriers offers a value precious metals simply cannot match.

RELATED READING | WHY SILVER’S PERFECT STORM SURGE WON’T SPILL INTO CRYPTO

Instead, these tokens are providing investors an alternative to gold, not Bitcoin, as an easier way to store the asset, access the market, or perhaps own a smaller sum. Like other crypto tokens, commodity-backed coins are divisible by decimal points.

Further fueling the growth is the recent increase in security fears from the wealthy. According to recent reports, investors in Hong Kong have been moving their precious metals offshore to Switzerland and elsewhere fearing theft or seizure. Instead, their wealth could be stored digitally, in tokens backed by the same commodity they are sweating over.

It is for reasons like that, that these commodity-backed tokens will continue to grow, but also will continue to pose no threat to the top cryptocurrency.

Featured image from Deposit Photos.

bitcoinist.com

bitcoinist.com