Japanese financial service giant SBI Holdings is planning to establish the country’s “First Crypto Asset Fund” via an “anonymous union.” The new venture is scheduled to begin operation in summer 2020.

According to SBI business presentation material released today, cryptocurrencies are great for investment portfolio diversification since they have low correlations with traditional assets like stocks and bonds.

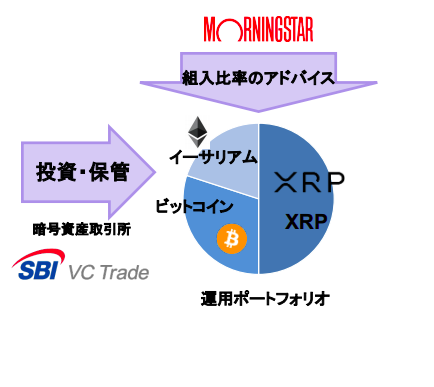

Thus, the firm hopes to provide individual investors with a “crypto asset fund” that brings all of SBI Group’s resources together.

50% XRP, 25% BTC, 25% ETH

SBI crypto assets fund’s investment and storage would consist of three cryptocurrencies, including Bitcoin, Ethereum, and XRP. However, the fund would give more priority to XRP. As much as 50% would be dedicated to XRP alone while the remaining 50% would be shared equally between BTC and ETH.

The apparent reason for that is SBI’s relationship with Ripple. Both firms launched a joint venture in 2016 dubbed SBI Ripple Asia, which was established to promote XRP’s adoption in Asian financial markets.

Since then, Ripple and SBI have been working closely. Coinfomania reported in 2018 that the Japanese financial behemoth announced it would launch a Ripple-powered payment app to foster smooth, fast, and convenient transactions for customers.

SBI to launch STO exchange

In addition to launching a crypto asset fund, SBI has plans to launch an exchange for Security Token Offerings (STO) later this year.

The firm is a member of the Japan STO Association established in April 2020 to promote a sound industry in the country. The association is developing rules for that purpose.

SBI Holdings intends to launch the platform by the end of this year. The company is already preparing products it would offer when the exchange goes live. Also, SBI is currently in talks with other companies who are members of the association to support STO issuance.

coinfomania.com

coinfomania.com