Alex Saunders, the CEO of NuggetsNewsAU, is convinced that the tensions between the U.S. and China are going to boost cryptocurrency-based capital flight.

Bitcoin and stablecoins are expected to benefit the most from if China weakens its yuan peg.

How Bitcoin reacts to US-China tensions

With only five months left until the highly-anticipated 2020 election, U.S. President Donald Trump is expected to ramp up his animosity towards China, making it one of the key elements of his re-election campaign.

Apart from trading barbs with Beijing over the pandemic response, Trump has also moved to re-escalate the long-lasting trade war between the U.S. and China by threatening to impose new tariffs.

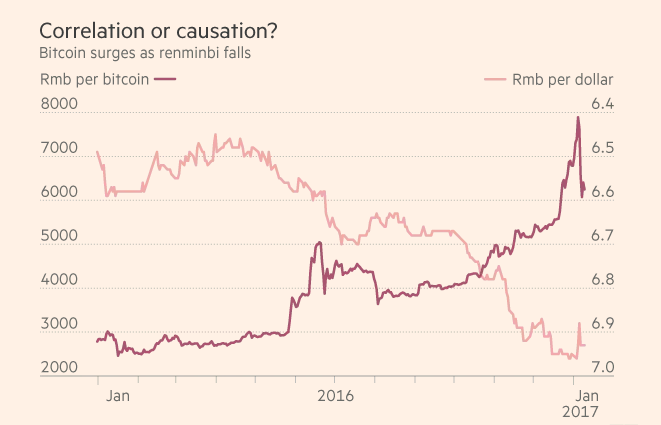

Historically, there has been a strong inverse correlation between the price of Bitcoin and the renminbi. When the latter depreciated big time in 2016, BTC enjoyed more than a 140 percent rally against the cryptocurrency.

After Trump slapped China with a 25 percent tariff in early May 2019, the price of Bitcoin witnessed a 40 percent rally in a little more than a week.

Crypto-based capital flight

Despite China banning cryptocurrency exchanges in 2017, the country’s citizens still rely on Bitcoin to circumvent draconian capital controls.

Under Chinese law, it’s prohibited to transfer more than $50,000 abroad in one year to prevent high-net-worth individuals from moving money from the country.

In January 2020, research firm Peckshield published a report, which shows that crypto flight capital from China reached $11.4 bln in 2019.

Tether, the world’s leading stablecoin, is also a popular choice for sending money abroad among Chinese nationals.

u.today

u.today