The crypto credit market was one of the first markets that evolved in Blockchain. Products like Compound enabled lending and borrowing in a decentralized way. Since then Lending and Borrowing have become synonymous with Decentralized Finance. DeFillama gives us good visibility of the TVLs locked in these platforms and also the borrowed volume.

A recent Messari Report (Crypto Theses for 2021) gives us new visibility about the Crypto Credit Market. It shines light in those areas that are not quite visible to normal users and are most likely whale plays. It is important to consider all these points to have a holistic view of the Crypto Credit Market. This article is a summarized extract from the same report.

The CME Group

The CME Group is the major player for Bitcoin Futures and Options in the US. Institutional investors ideally avoid non-regulated Exchanges (This includes Binance, OKEx, Huobi, etc). CME is also used by these users for privately negotiated BTC trades. The two parties negotiate to transfer a futures position to a corresponding spot position and vice versa (also called EFPs). The CME is already making major moves in volume and climbing the ranks compared to Binance, Huobi, etc.

Increase in Credit Wealth

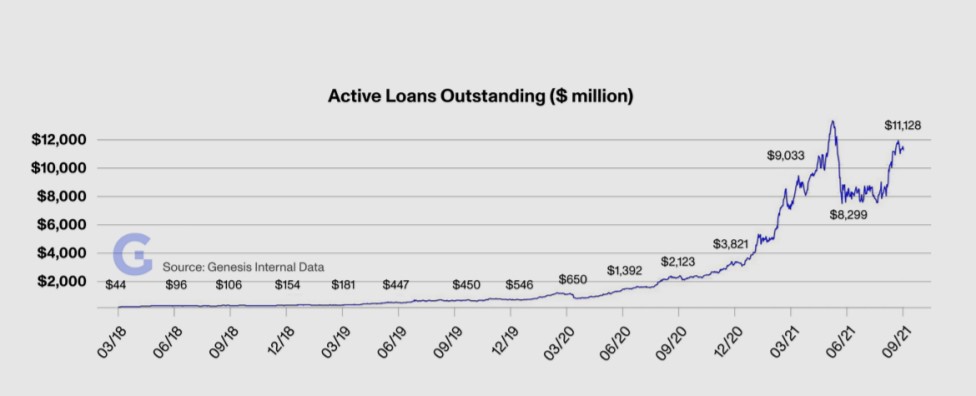

The total value of Credit Wealth is slowly increasing. This is also indicated by the fact that the Active Loans Outstanding has increased. As per Genesis Quarterly Report, the Active Loans Outstanding rose 34% over the quarter to 11.1 Bn from $8.3 Bn in Quarter 2.

Cash Collateralization vs Coin Collateralization

Institutional investors are opting more often for Cash Collateralization. Loan collateralization has taken a major hit. Big exchanges like BitMex have fallen out of favor. There have been 2 primary reasons for this.

1. The regulatory framework is still unclear and the institutions do not want any extra hassle. They don’t care about decentralization. Cash will give them the same result in lending as crypto.

2. Institutions are still worried about the fluctuating nature of crypto. The concept of liquidation in Defi (in the BlackSwan event of 2020 many got liquidated) is not reassuring and it is a huge risk for their balance sheets.

Will this trend last? Crypto has to give them better alternatives. Liquidation-free protocols strongly pegged decentralized stablecoins and above all a clear regulatory guideline.

Legacy Aribrage Brokers entering the industry

The Arbitrage market is one of the open secrets of crypto credits. While traditional brokerage firms like B2C2 and FalconX have done relatively well, traditional brokers have started entering the industry. The inclusion of these companies will help reduce rates and spreads in the market.

Leverage trading disasters

Crypto Trading firms have been greedy and taking riskier investment strategies. Funds have taken short positions, used crypto as collateral to levered longs. Such quick-win steps are usually a recipe for disaster. Firms like Tetras, Adaptive, and Cambrial have closed down. Tetras was once a $33M hedge fund with 60+ customers, had shown 75% loss through repeated underperformance.

altcoinbuzz.io

altcoinbuzz.io