As economies around the world wrestle with the current global health crisis, upending industries while driving sledge hammers into small companies in need of support and big companies in need of bailouts, Max Keiser argues that sovereign bonds represent the biggest bubble in the economy – not Bitcoin or gold.

On the latest episode of the Keiser Report, co-host Stacy Herbert presents a chart shared on Twitter by Holger Zschaepitz, the senior business editor at German news outlet Welt.

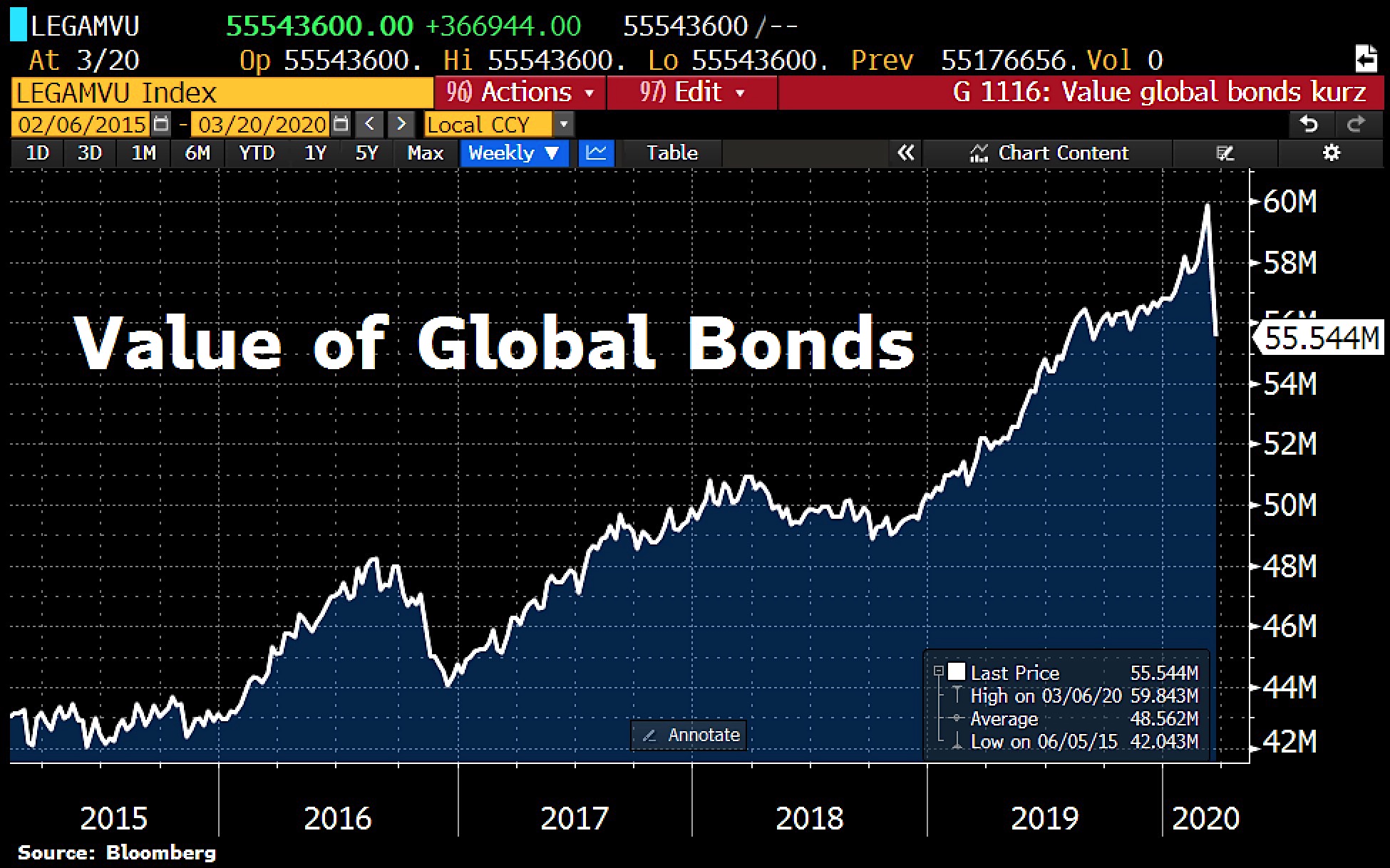

The chart depicts the bond crash in the wake of the global coronavirus pandemic.

Says Herbert,

“[The chart] is comparing the situation in the financial markets, in particular in the monetary policy markets – this is Covid-19 killing off the fiat system. And the bond market, as we’ve always warned – it’s been in a bull market for the past 40-50 years – is the biggest market of all.”

Writes Zschaepitz,

“This is what a bond crash looks like: Value of global bonds has plunged by $5 trillion to $55.5 trillion in the past 2 weeks, equal to the GDP of Japan. Investors fear a tsunami of new debt as governments around the world prepared to release massive fiscal stimulus plans.”

Keiser says it represents the bond bubble popping.

“The biggest bubble in the world economy was not Bitcoin. It certainly wasn’t gold. It was the bond market. The sovereign bond market. And when these countries started to issue negative interest rate sovereign debt, that was your big sign in the sky, like a huge Batman signal in the sky, like this is about to crash…

The bond market of course will revert to the mean. It’ll restore, it’ll go back to its long-term trend of 5-6% on a 10-year sovereign bond. That means a 50-60% markdown in the bond market, which means pretty much every S&P corporation now is going to have to declare bankruptcy, give or take a few.

They’re going to need massive bailouts, massive restructuring, massive layoffs, but this is the price to pay for blowing this enormous bubble. This is a bubble popping.”

dailyhodl.com

dailyhodl.com