Bitcoin has continued its bearish trend with prices continuing to struggle in the low $40,000s. This has evidently led to fear and panic among investors as indicators turn bearish. However, despite bitcoin’s recent downtrend, it is still not the worst-performing asset in the crypto space. The mining stocks have taken the cake for the most bearish trend as they have recorded an even higher downtrend and indicators point to negative performance in the coming weeks.

Bitcoin Mining Stocks Suffer

Bitcoin mining stocks had a tremendous run-up in 2021 like most of the market, but going into 2022, they have recorded some of the worst performance. These stocks which usually function as a high-beta bitcoin are highly correlated to bitcoin itself, but happen to be more volatile. This makes them more prone to extensive downtrend than the digital asset which they follow.

This volatility is not all bad though as proven in 2021. Just as the stocks are likely to plummet very fast in a short amount of time, they also do incredibly well in times of price surges due to this volatility. The same is true for when the market turns bearish, as is being presently experienced.

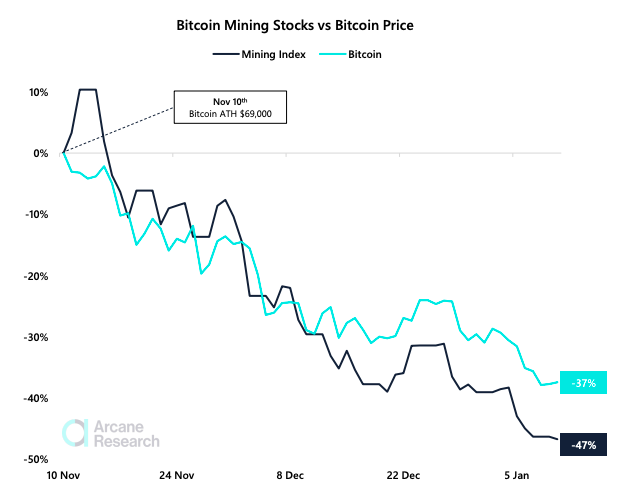

All publicly-traded bitcoin mining stocks have followed the same pattern since the last bull rally. Since then, they have lost about half of their value as the price of bitcoin has dropped, even though the latter has only recorded a 37% loss in the same time period.

Mining index underperforms bitcoin | Source: Arcane Research

In the two months following BTC hitting its all-time high of $69K, the Arcane Research market cap weighted index which includes 15 of the largest publicly traded bitcoin mining companies has recorded an almost 50% decrease.

Companies With The Worst Performance

With the bearish trend, some bitcoin mining stocks have suffered more than others. A few have shown a strong correlation to the pattern of bitcoin, however, the vast majority continue to demonstrate higher volatility.

Marathon, which is the biggest publicly traded bitcoin mining company, has suffered some of the most devastating losses in the space. The company had grown to prominence with the outperformance of its stock in 2021, but just as it had been the highest performer during that time, it takes the lead for the worst performer in the space.

Marathon had extensively underperformed the mining index, recording a 62% drop following the BTC all-time high in November. Regardless, the mining company still remains the highest valued bitcoin mining company in terms of price and hashrate. It aims to increase its hashrate to 13.3 EH/s by July 2022, which would bring its total hashrate growth to 280% in the space of seven months.

bitcoinist.com

bitcoinist.com