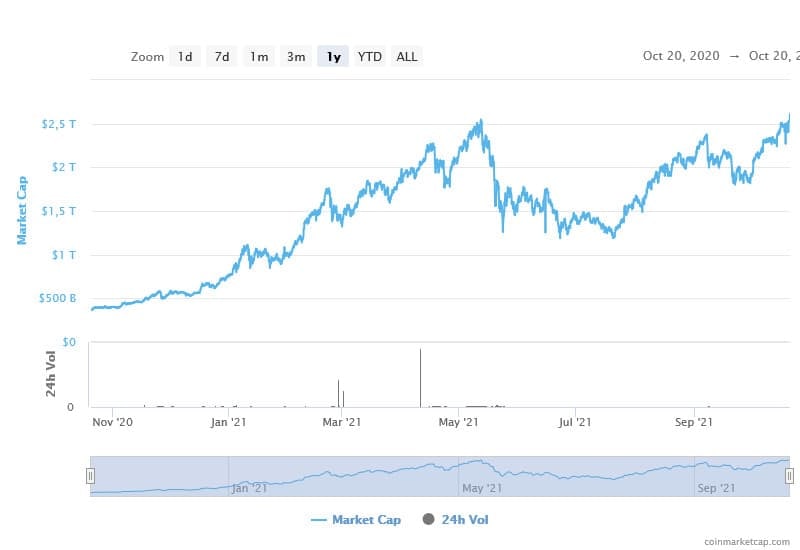

For the first time in history, the cryptocurrency market has surpassed the $2.6 trillion barrier in terms of market capitalisation amid Bitcoin’s (BTC) rally, which soared to new all-time highs ahead of the second day of trading for the massively popular ProShares Bitcoin Strategy exchange-traded fund (ETF).

Indeed, the global crypto market cap has already reached $2.613 trillion, representing a 5.6% gain over the previous day. Furthermore, the overall market volume over the past 24 hours has increased to $94.75 billion, representing a 4% increase, according to the data from CoinMarketCap.com.

In addition, the entire volume in DeFi is now $12.07 billion, accounting for 12.74% of the total 24-hour volume in the cryptocurrency market. In contrast, the volume of all stable currencies is currently $71.81 billion, representing 75.78%.

Bitcoin sets new all-time high

Moreover, Bitcoin has helped the crypto market break through the $2.6 trillion level in terms of market capitalisation for the first time ever as the flagship digital asset hit a new all-time high on October 20, 2021, following the success of ProShares Bitcoin futures ETF trading on the stock exchange for the second day in a row.

Indeed, after a spectacular comeback from a July collapse that saw the asset fall below $30,000, the cryptocurrency has reached a new all-time high propelling the BTC into the realm of price discovery.

Consequently, BTC price movement has re-entered unknown territory after breaking over the last barrier of $64,900 set April 14, 2021. Currently, the flagship digital currency is up 7.76% in the last 24 hours and 19.56% over the previous seven days, with Bitcoin now trading above $66,800 at the time of publication.

MicroStrategy CEO Michael Saylor commented:

“Don’t bet against #Bitcoin.”

Meanwhile, renowned pseudonymous crypto trader PlanB simply tweeted:

New #bitcoin ATH 🚀🚀🚀 pic.twitter.com/agaF0u8cS3

— PlanB (@100trillionUSD) October 20, 2021

Notably, Bitcoin appears to be following the traders stock-2-flow chart, which he earlier tweeted about back in June.

Bitcoin is below $34K, triggered by Elon Musk's energy FUD and China's mining crack down.

— PlanB (@100trillionUSD) June 20, 2021

There is also a more fundamental reason that we see weakness in June, and possibly July. My worst case scenario for 2021 (price/on-chain based): Aug>47K, Sep>43K, Oct>63K, Nov>98K, Dec>135K pic.twitter.com/hDONOVgxH1

SHIB fails to capitalise on current market momentum

Meanwhile, decentralized token Shiba Inu (SHIB), despite being the most used non-stablecoin on the Ethereum (ETH) network, is currently changing hands at $0.00002763

down 2.4% in the last 24 hours and 5.65% over the previous seven days.

However, this is particularly notable given the fact that, apart from stablecoins, every other currency in the top 20 cryptocurrencies by market capitalisation is now trading in the green.

Buy & sell crypto

What we like:

Highly credible broker

Perfect for beginners

Protected by insurance

80+ cryptocurrencies to invest

Rating

Visit Now Read full review finbold.com

finbold.com