It was another tough month for marijuana stocks in September as public sentiment dipped as a result of the outbreak of serious lung issues associated with THC vaping.

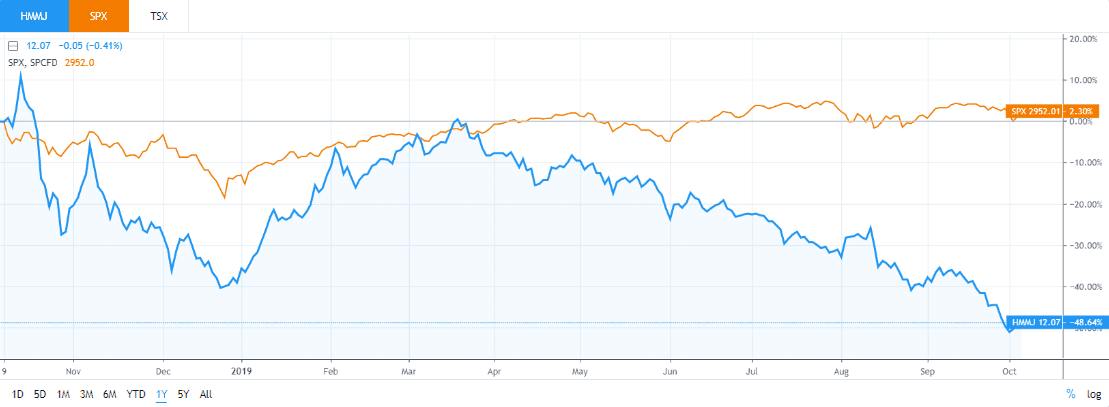

The leading marijuana ETF, Horizons Marijuana Life Sciences Index ETF (HMMJ), saw double-digit losses in September as the 6-month downtrend continued. However, as the knee-jerk reaction to potential inhibitory regulation dies down, some investors are looking to take advantage of the relative discounts on cannabis stocks.

“While the headlines have been negative, not all of the news is bad for companies involved in this segment—and over the long-term, some businesses may actually benefit from the fallout,” said Craig Behnke and Mike Regan, equity research analysts at MJBiz, in a recent report.

Here are three marijuana stocks investors might want to consider buying in October:

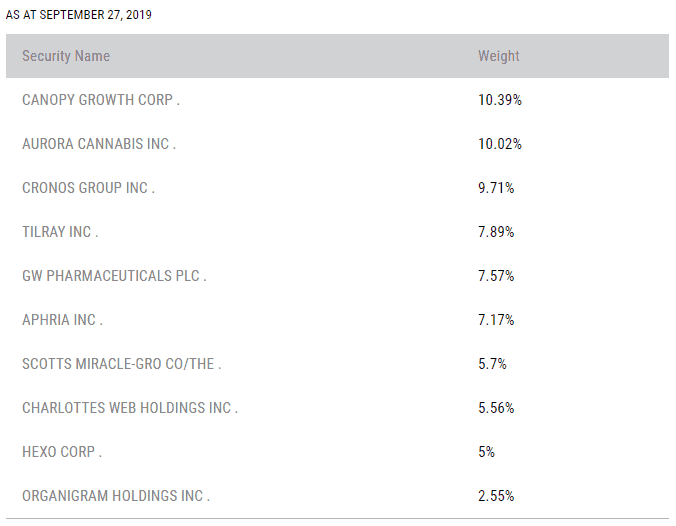

Canopy Growth Corp (CGC): With a market cap of $7.95 billion, Canopy is one of the largest constituents of HMMJ and makes up over 10.3% of the ETF. Notably, the company has a war chest of $2.3 billion in cash and Constellation Brands (STZ), which previously made a $4 billion investment in Canopy, owns roughly 38% of the company. When considering the potential fallout of long-term regulatory headwinds, Canopy is perhaps the best-positioned weed stock to weather the storm.

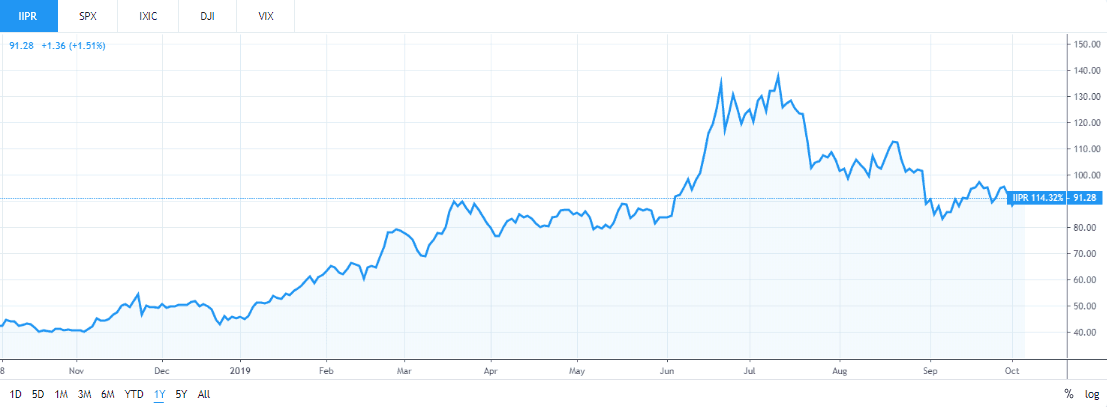

Innovative Industrial Properties (IIPR): When considering the growth potential of the cannabis industry, it’s important to identify the players building the underlying infrastructure. IIPR is just that, providing capital through the long-term ownership of cultivators’ mission-critical facilities. The company currently owns 31 properties in 12 states and pays a generous 3.42% dividend. The market cap currently stands at $1.04 billion, leaving plenty of room for growth.

Charlotte’s Web Holdings (OTC:CWBHF): Charlotte’s Web currently dominates the market for hemp-based cannabidiol (CBD) wellness products. With the FDA rapidly approaching regulatory decisions, there is likely to be some volatility for Charlotte’s Web in Q4 2019 and 2020 but the company continues to add to its retail distribution network, with more than 8,000 stores and chains like The Vitamin Shoppe and Kroger. Charlotte’s Web currently has a market cap of $690.56 million.

Marijuana stocks provide an interesting investment opportunity after a rough 6 months for stocks and an even rougher September for public sentiment. However, continued volatility should be expected through the end of the year and beyond for the upstart sector that relies heavily on favorable regulations.