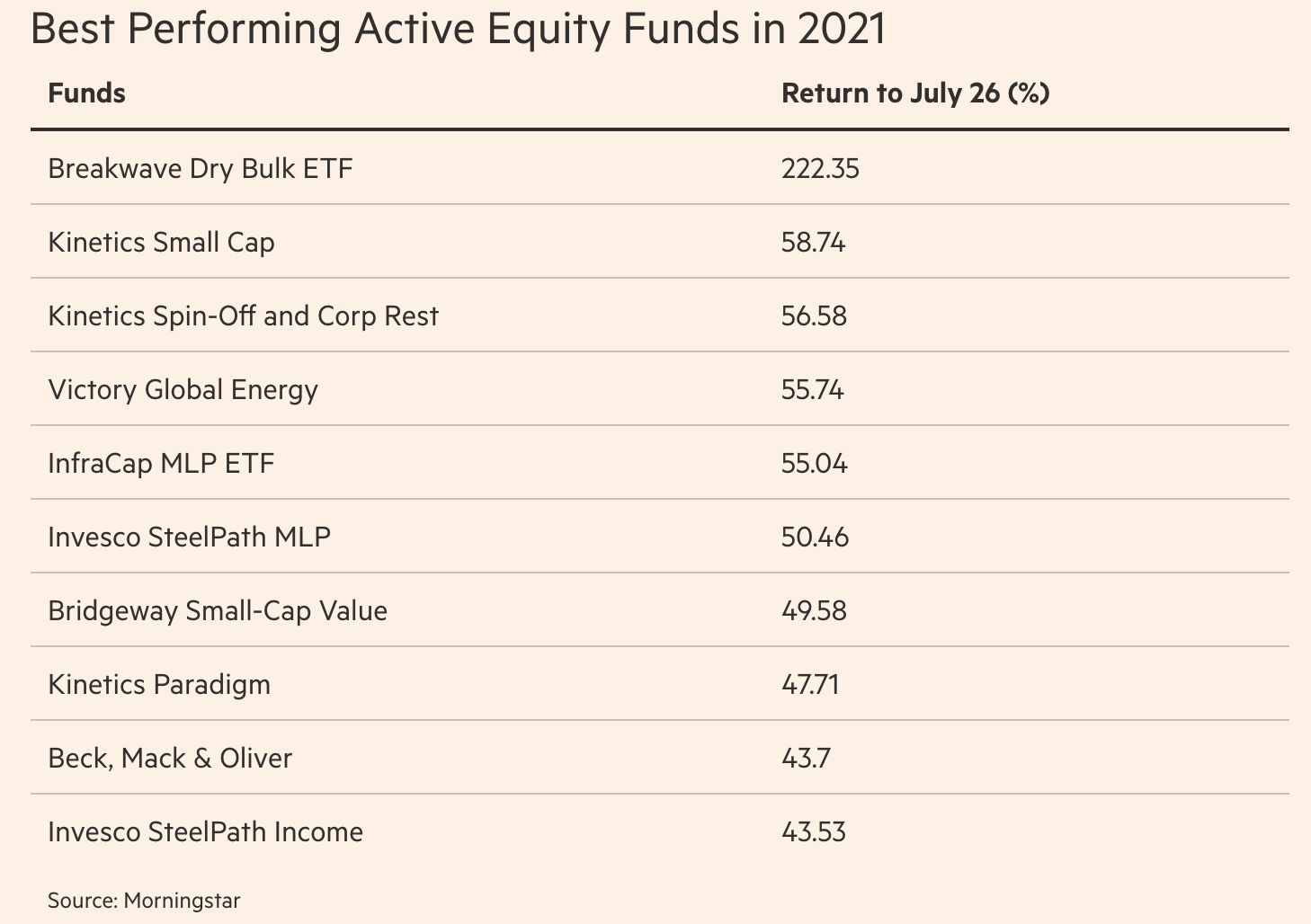

With three funds in the top ten performing active equity funds for 2021, the US fund manager Horizon Kinetics is so far successfully shielding its investors from the ravages of currency debasement and rising inflation.

According to an article published today in the UK-based Financial Times, Horizon Kinetics is a $7 billion company headed by three veteran managers, Murray Stahl, Steven Bregman and Peter Doyle. According to Doyle:

“There is no turning back after the pandemic and globally there is a debt problem and it means either default or currency debasement,”

Massive currency printing carried out over the last couple of years is adding to the sharp rise in debt levels over the previous decade. This has led to investors seeking outside of the financial system for hedges that will protect them from the ensuing inflation.

In the view of Horizon Kinetics, the best hedges are generally a mix of commodities, real estate, cryptocurrencies, and companies with well-structured business models.

On cryptocurrencies specifically, Doyle says “People should have exposure to the asset class,”. He goes on to explain that Bitcoin has scarcity because of its limited supply, which is completely the opposite of what is happening with fiat currency, which is sharply losing value as more and more of it is printed into existence.

Horizon Kinetics initially allocated 1% of its portfolio to Bitcoin through the Greyscale Bitcoin Trust in 2016. Since then, the allocation has risen to 10% of their Paradigm fund.

This fund has recorded nearly 48% gains this year, while the other two Horizon Kinetics funds in the top ten best performing according to MorningStar, are Kinetics spin-off and corporate restructuring, with 56.6%, and Kinetics small cap, with 58.75%.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

cryptodaily.co.uk

cryptodaily.co.uk