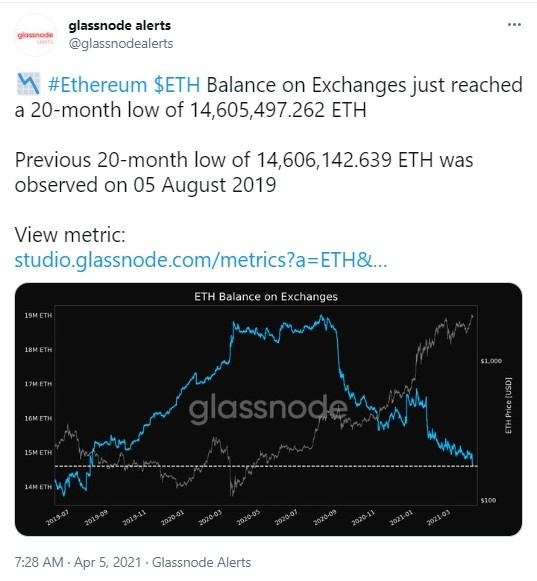

Glassnode analytics company has tweeted that the balance of Ethereum on crypto exchanges has reached a 20-month low with ETH remaining above the $2,000 level.

Investors keep moving ETH into cold storage

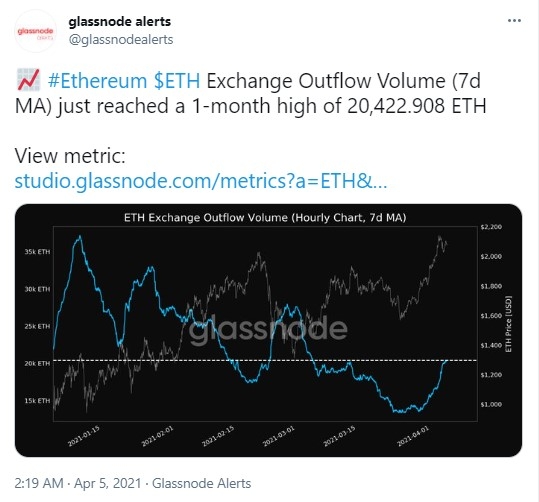

As per recent tweets shared by Glassnode, users have been actively withdrawing ETH from digital exchanges.

The outflow of the second largest cryptocurrency has hit a one-month high of 20,422.908 ETH (seven-day moving average). That is the equivalent of $41,595,132.

Meanwhile, the ETH balance on crypto trading platforms has dropped to a 20-month low, totaling 14,605,497.262 ETH. This represents a whopping $29,735,185,820 in fiat.

The amount of ETH transactions has also surged to a one-month high, totaling 52,239.506.

Ethereum remains above $2,000; here are possible drivers

The second-biggest digital asset surged above the $2,000 level on Friday last week, along with the king crypto, Bitcoin, going above $60,000.

ETH also reached a new all-time high of $2,152 on the same day.

As of this writing, ETH is changing hands at the $2,050 level, showing almost 20 percent growth over the past week.

The major factor that pushed ETH to its new all-time high was the fact that the billionaire Mark Cuban disclosed his ETH investment.

Until recently, Cuban was an eager Bitcoin critic and slammed crypto in general, saying that he prefers bananas to BTC since bananas are edible.

Now, it turns out that Cuban has allocated 60 percent of his portfolio into Bitcoin, 30 percent into Ethereum and the rest in altcoins. Other institutional investors are also showing rising interest in Ethereum and Bitcoin—via investment funds such as Grayscale.

At the moment, Grayscale holds 3.17 million ETH.

Besides, the zero phase of ETH 2.0 continues developing as the total value of ETH locked in the deposit contract reached $7,658,232,113.59 on Saturday: a new all-time high.

u.today

u.today