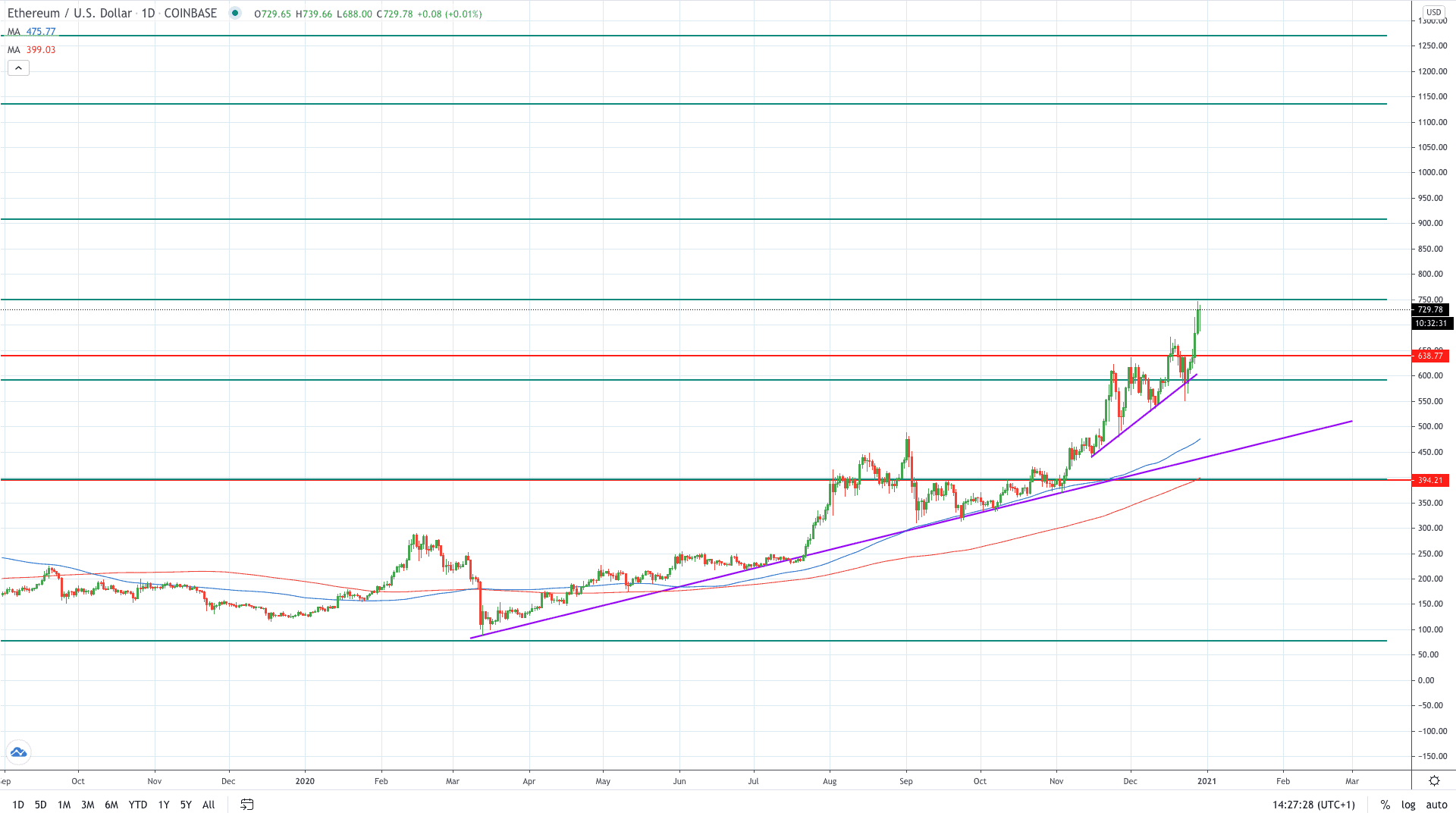

Ethereum (ETH) price has continued to move higher in the recent days with the price action now approaching the 50% level of the Dec 2017 – Dec 2018 sharp drop.

Fundamental analysis: PoS transition

Staking has become a driving force in the crypto world in only a year. Apart from the rollout of Ethereum 2.0, which represents the biggest staking event of this year, data shows that proof-of-stake (PoS) networks have thrived over the past year. Out of the top 9 crypto assets by market capitalization, four are set to transition to PoS.

At the moment, proof-of-stake accounts for about 15% of the entire crypto market cap. The significant growth in proof-of-stake blockchains this year including Ethereum, Polkadot, Solana, Cardano and others was one of the main driving forces behind developments in crypto this year.

As PoS continues to expand in developer engagement, analysts expect a frenzy of user-facing projects and apps in near future. On the other hand, proof-of-stake still faces persistent criticism that it is only theoretical and some in the industry still believe the PoS blockchain is set to fade away.

The launch of Ethereum 2.0 gave a strong boost to proof-of-stake, even though the rollout was delayed several times. And while the new upgrade of Ethereum was a key event for PoS adoption, many other PoS networks have recorded a big success as well.

To be more specific, Polkadot, the biggest PoS blockchain right now, has over $3 billion staked. Furthermore, the 5th largest crypto asset by market cap, Chainlink, also said it will make a transition to PoS. By the end of next year, the majority of the most popular blockchains will have shifted to different staking systems.

Technical analysis: Fresh multi-year highs targeted

Ethereum (ETH) price gained almost 60% in November, before adding over 18% in December so far. This bull run has resulted in the price coming close to $750.00, where the 50% retracement of a drop from all-time high is located.

Given the scale of this resistance, it is likely that the price action will pause at these levels before continuing higher. A break, on the other hand, would result in a major bullish development for Ethereum buyers with the next major target placed at $900.00.

Summary

Proof-of-stake has seen a massive boost in adoption this year, a trend which analysts expect to continue going ahead. The launch of Ethereum 2.0, which brought a transition from PoW to PoS, was the largest contributor behind this adoption success, with many more expected to follow.

invezz.com

invezz.com