Ponzi schemes are among the biggest consumers of gas on the Ethereum network, heightening already bad congestion and jacking up transaction fees.

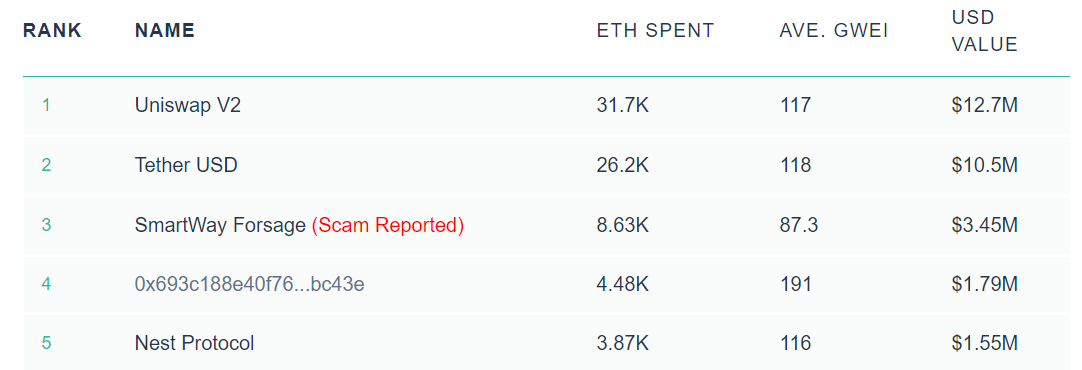

Uniswap and Tether are the top gas consumers on Ethereum with a 30% and 25% share among the top 25 on-chain consumers. The Forsage scam follows closely behind. Together with the emerging Ponzi scheme “Contribute” in the fourth position, both scams take up about 13% of the total gas on Ethereum.

New Ponzi on Ethereum

Contribute, and its “TRIB” governance token, is the newest Ponzi on Ethereum. The project describes itself as “decentralized capital coordination,” which incentivizes early investors to earn more TRIB tokens, as emphasized by the token’s whitepaper.

No information on the composition of the liquidity providers (LPs) has been made public. Additionally, details about the scheme’s publisher, Kento Sadim, are not available online. Apart from the absence of founder details, there are other indicators that the project is a Ponzi, like the “price floor” of the token.

Some of you who have been around for more than 5 minutes will remember Paycoin and the "$20 price floor". Well, now there's a smart contract ponzi called $TRIB (as in conTRIBute) doing the same thing. What could go wrong? pic.twitter.com/s4IKLFZx4e

— Riccardo Spagni (@fluffypony) September 20, 2020

Like Forsage’s “registrationExt” function, which is called for user registration from referrals, the smart contract for claiming TRIB tokens on Contribute is a computationally-intensive process, consuming a great deal of gas on Ethereum. For comparison, TRIB’s smart contract takes up more gas than other complex transactions, like those conducted by Chainlink and 1inch.exchange.

Preston Byrne, a lawyer at Anderson Kill Law, suggests that like Paycoin, Contribute could soon face the Securities Exchange Commission charges for “fraud conviction and a jail sentence.”

These Ponzi schemes hinder the growth of DeFi space by clogging the network and tarnishing the overall cryptocurrency industry’s reputation.

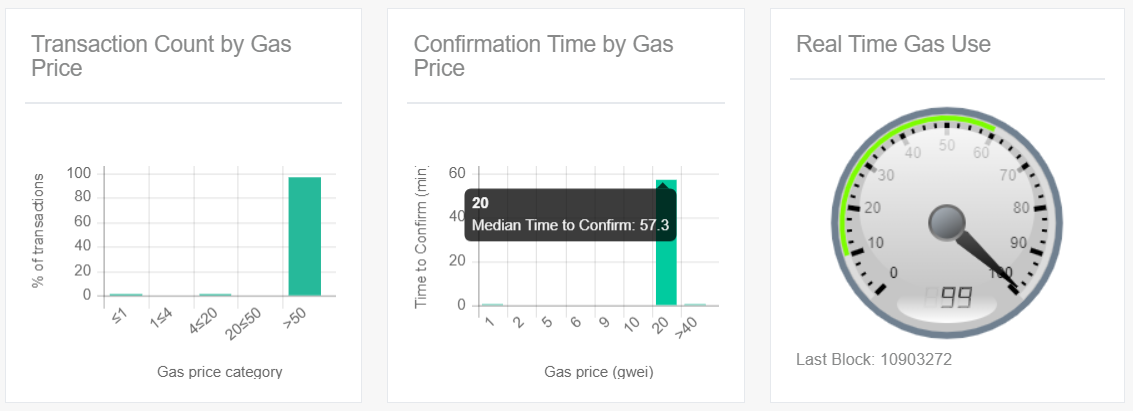

Time is Running Out for ETH

There is no doubt that Ethereum has already reached its capacity limit. Gas limits are at their maximum. A few months ago a transaction would go through in minutes; now, the confirmation time for a single transaction nearly takes an entire hour.

As consumption from apps pushes the gas fees higher, Ethereum is slowly becoming a “whale chain,“ where only high-volume users will be able to afford transactions—similar to Bitcoin during times of congestion.

Nevertheless, ETH remains the top choice for DeFi applications because of its ubiquitous ERC-20 token standard and its ability to easily integrate many other blockchain protocols. Along with USDT issuance on ETH, the network is now being used for more useful financial applications, rather than being driven by games like Crypto Kitties which clogged the network back in 2017-2018.

But the Ethereum network is at its limit. For example, a simple swap transaction converting Ethereum to Dai on Uniswap costs over $20. These exorbitant fees hurt the growth of decentralized peer-to-peer platforms, resulting in a move back to the centralized exchanges these DeFi protocols seek to replace.

cryptobriefing.com

cryptobriefing.com