Ethereum has seen some rather lackluster price action in recent times, hovering around the $200 level as its buyers and sellers largely reach an impasse.

This price action has not been emblematic of the cryptocurrency’s underlying fundamental strength, however, and one analyst is noting that there are a few major factors that suggest a massive bull trend exists just around the corner.

This trend comes as analysts note that the cryptocurrency could also be strong from a technical perspective as well, with one even offering a lofty near-term price target for the cryptocurrency at $250.

Here are the Fundamental Factors That Suggest Ethereum is on the Cusp of a Massive Uptrend

Although Ethereum’s price action has been rather lackluster as it hovers within the lower $200 region, there are a few key fundamental developments that suggest the crypto is poised to see a major uptrend in the near-term.

Spencer Noon, the Head of DTC Capital, spoke about this in a recent tweet thread, explaining that he sees a host of factors that signal ETH is poised to rally.

Of all the factors he discusses, two of the most bullish – in terms of direct correlation to the crypto’s price action – can be seen while looking towards its institutional inflows and massive net outflow of ETH away from exchanges.

With regards to institutional adoption, Noon explains that the growth of the Grayscale Ethereum Trust (ETHE) over the past three weeks shows that institutions are either investing in ETH, or are locking up their existing holdings at a rapid pace.

“1 million new shares of [Grayscale Investment’s] ETHE have been issued in the past 3 weeks – a sign that institutions are either investing in ETH or locking up their existing holdings at a pace of roughly $1 million per day,” he explained.

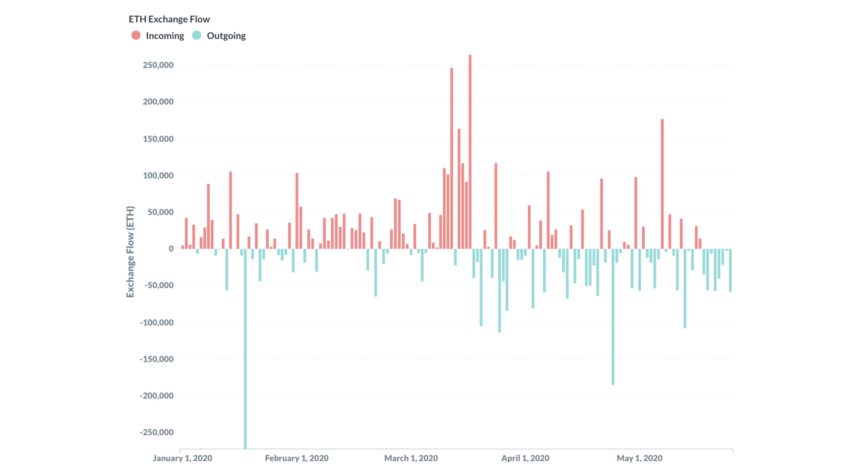

Noon also points to the massive outflow of ETH away from exchanges as a reason why the crypto is fundamentally strong, noting that this is a sign of accumulation.

“Post-Black Thursday (March 12) there has been a net outflow of ETH from exchanges, with 62% of days showing net outflows – a sign of accumulation,” he said while pointing to the below chart.

Image Courtesy of Spencer Noon

Where Could This Potentially Imminent Uptrend Lead ETH’s Price?

As for how high this potential uptrend could lead Ethereum, one analyst recently noted that he is watching for a movement up to $250.

This target is labeled on the chart seen below, and it appears to coincide with a descending trendline that has been formed in the time following the cryptocurrency’s rally to highs of $290 in mid-February.

Image Courtesy of Galaxy

In order for Ethereum to push to these highs, it is imperative that the aggregated cryptocurrency market garners greater upwards momentum.

Featured image from Shutterstock.

newsbtc.com

newsbtc.com