Uniswap is the world’s premier decentralized exchange and liquidity provision service, relying on an orderbook-less trading mechanism through liquidity pools. Since it’s introduction, it has facilitated billions in trading volume through it’s three iterations or version updates. It also constantly ranks as a leading revenue generating DeFi protocol, second only to the Ethereum base layer itself. Here’s how to overtake it and the description of the one trick that most DeFi projects miss.

@SovrynBTC continues to rise through the ranks of DeFi projects.

— Yago (@EdanYago) June 9, 2021

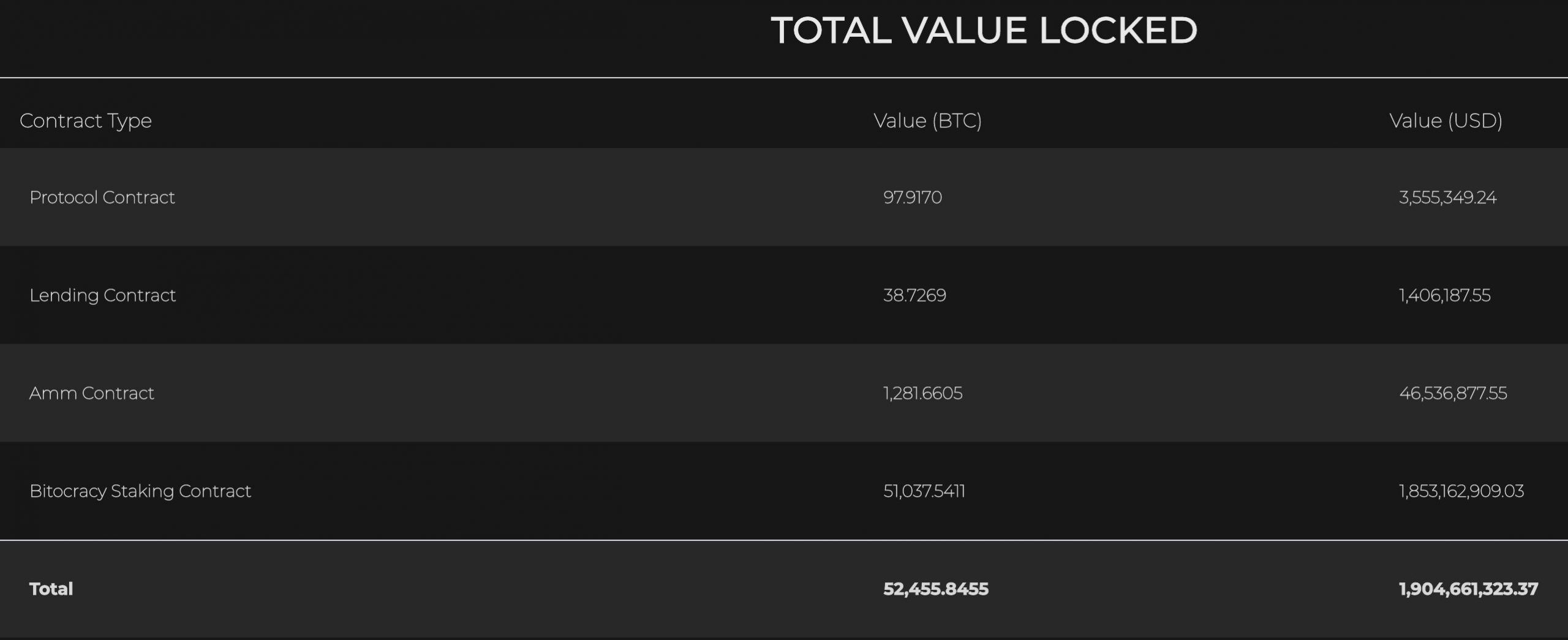

Currently ranked 14'th by TVL on @DefiLlama with $1.9B.

Just above Uniswap V3. #Bitcoin DeFi isn't coming. It's here. pic.twitter.com/F7PqzE9Lk6

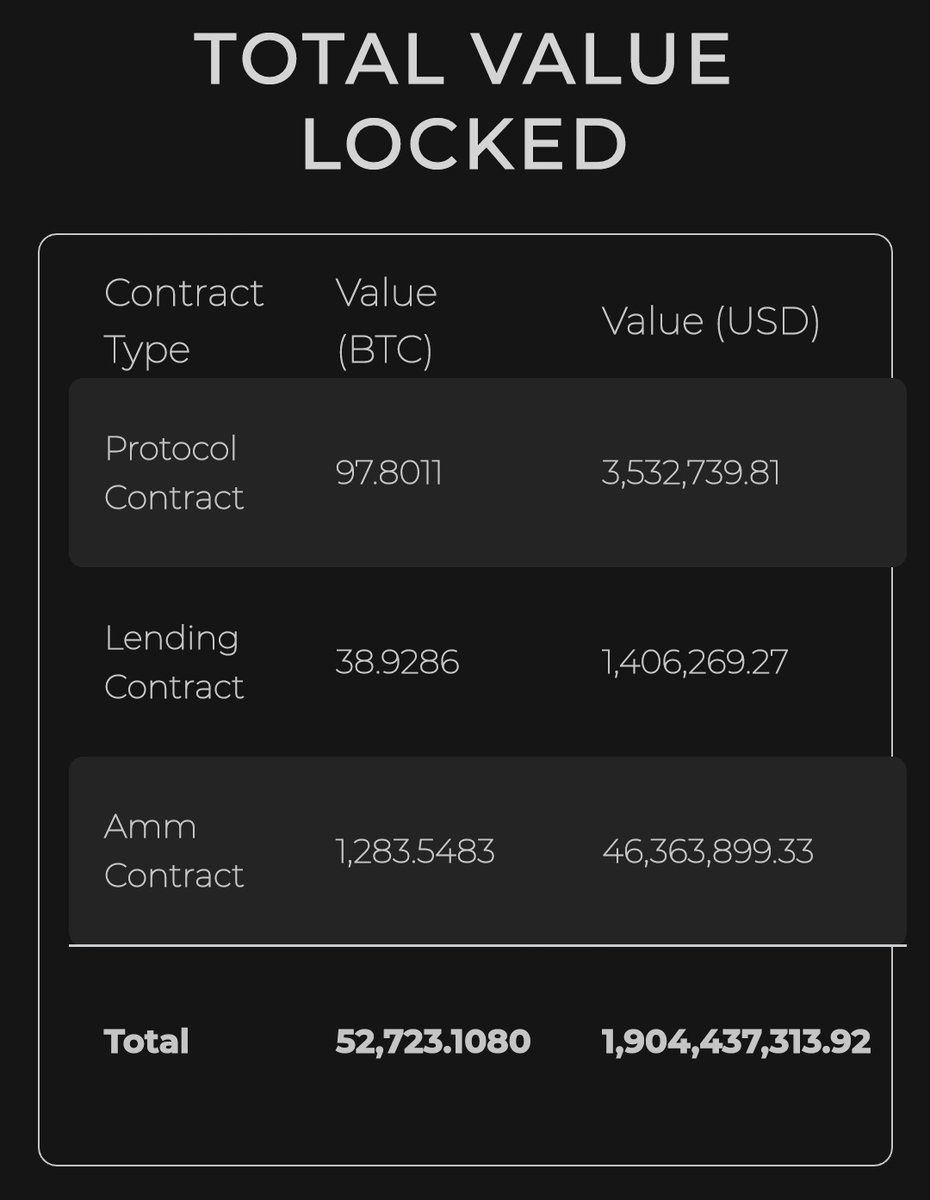

Sovryn – a RSK side-chain based project with EVM compatibility recently discovered this trick, after the team claimed that they had overtaken the Total Value Locked (TVL) in Uniswap v3. The claim was viewed with skepticism / disbelief as the project is still new, relatively unknown and has no prior record of competing with Uniswap on any level.

It was also worth noting that just 24 hours ago, the protocol’s own statistics module reported a TVL of only $51M. Somehow, it suddenly started showing a $2B TVL figure first without any explanation (right image), directly counting numbers to arrive at a “value” and later by adding a mysterious column of “Bitocracy Staking Contract” (left image). So, how did this happen?

This is incorrect. TVL does not included governance tokens staked in governance.

— 𝚂𝚌𝚘𝚝𝚝 𝙻Ξ𝚠𝚒𝚜 🌾 (@scott_lew_is) June 9, 2021

Sovryn TVL is $51M, give or take.

which is great, but not all that close to $2 Billion. https://t.co/T1PGX7PA5h

The answer was as simple as inflating the TVL numbers by counting the value of the team’s held SOV governance tokens outside circulation and including it in the final TVL count. Sovryn’s own vesting schedule showed that these tokens were locked until next year. Surprisingly, the team doesn’t count these tokens in it’s circulating supply on the website to give the illusion of low token supply and lower market cap, but includes them in TVL calculation.

1) Tokens staked in governance don't count to TVL e.g. you obv won't see Sushiswap count xSUSHI to TVL or AAVE count stkAAVE. Without this number, real TVL would be $55m

— Hasu (@hasufl) June 10, 2021

These tokens were merely present inside this contract and didn’t serve any economic activity, being not available for lending and borrowing actions. A strict no-no for any credible DeFi protocol and not a legit practice.

Bigger problem: At $36.87 per SOV, the $1.85 billion in the staking contract amounts to ~50 million SOV tokens.

— Rob 🦇🔊 (@rob_mose) June 10, 2021

But according to the emissions schedule published 07 Jan, 50 million tokens won't even be emitted until month 18 of the token rollout…https://t.co/phCpC9MpsB pic.twitter.com/I7GVDYqRT3

Somehow, the protocol utilized TVL data by incorrectly counting the Fully Diluted Value (FDV) of SOV tokens more than 13 times it’s original marketcap!

I found it:https://t.co/wwukaRRs6L

— tratium (@tratium) June 9, 2021

So lets be clear here — There is not $1.9b of staked BTC. There is 49,032,315 staked $SOV — which I believe you folks would call a “shitcoin” — valued at $1.9b.

How interesting.

SOV tokens are utilized Sovryn governance, don’t have a significant trading volume and carry limited liquidity. A completely different scenario than Uniswap UNI token. At around $150M total market cap for the token, the ~ $1950M addition to the TVL would have meant one thing – 98% of the locked tokens somehow making up for the ~97% of the Total Value Locked (TVL). A practice, which remains unknown to Uniswap protocol.

2) But the bigger offense is that you redefined what "staking" means to include almost 2B$ of unvested (team?) SOV tokens.

— Hasu (@hasufl) June 10, 2021

You're basically adding SOV's entire fully-diluted market cap to your TVL using an accounting trick (some would call it accounting fraud)

After the controversy drew the irk of the community, DefiLlama the aggregator data that Sovryn team used to advertise their abnormally high TVL to feign dominance over Uniswap reported the following. They had simply relied on the data forwarded by the protocol’s API.

A quick recap on Sovryn:

— DefiLlama.com (@DefiLlama) June 9, 2021

– We use their API to pull TVL data

– They updated their API to include staking on their TVL, increasing it by 40x

The reason we use their API is that atm none of our price sources (eg: coingecko) have prices for the tokens used in Sovryn

Since then, the DeFi aggregator has modified the TVL data to exclude staking data, being used to inflate numbers. However, Sovryn’s own website still uses the same metrics for obscure reasons, a suspicious practice after it was determined that the counting method wasn’t legitimate.

Regarding the recent controversy on Sovryn:

— DefiLlama.com (@DefiLlama) June 9, 2021

1. We've removed staking from their TVL

2. We'll issue an update to the site that allows anyone to choose whether they want staking to be included or excluded on TVL

3. We'll re-add sovryn staking after the update

cryptoticker.io

cryptoticker.io