Ethereum layer 2 scaling solution Polygon has been seeing a meteoric rise over the past few months. The sidechain currently has over $9.5 billion of total value locked (TVL), up from just $1 billion less than two months back, with 3.71 million in ETH and 26.87 million in BNB.This growth of Polygon has been the result of the Ethereum network working at capacity and rising gas costs. Up until now, there has also been a lack of layer 2 solutions, though popular ones Arbitrum and Optimism have yet to be user-ready. Layer 2 solutions are expected to bring the fees down on layer 1, Ethereum as well; however, according to long-term ETH investor Tetronode,

“L2 will cause L1 fees to go up, not down. Demand for L1 interaction is unlimited and only curbed by what the market is willing to pay. L2 settlements are valuable and worth almost any gas price. Arbing makes L1 fees dependent on value onchain, not TX throughput!”

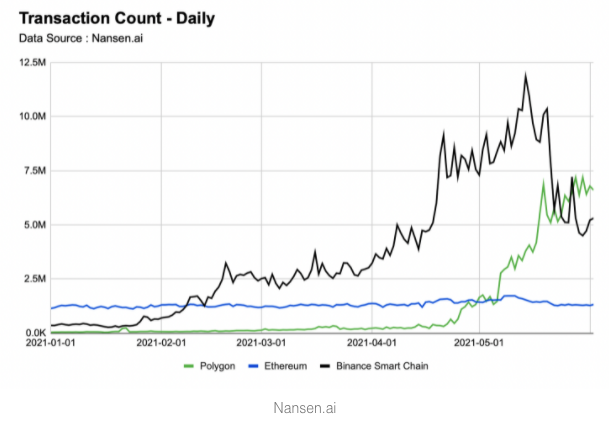

As can be seen currently, the fees on Ethereum are extremely low, the gas price is actually set to tumble into a single digit, but this is actually indicating a lack of activity on DeFi. The gas issue was also what led to the explosion of the Binance Smart Chain (BSC) in the DeFi scene. Hundreds of projects launched on BSC, and the network scaled from under a million transactions a day to more than 11 million at its peak.  Polygon’s growth, in contrast, has been steady. Those already familiar with Ethereum went to the sidechain trying to escape the extremely high cost of transactions on the second largest network. The layer 2 solution has its own variation of Uniswap, QuickSwap, which has risen in popularity. Its rapid growth can be attributed to the fact that it enables over 10,000 swaps, constantly indicating users make use of the lower transaction fees. Additionally, the average value of swaps on this automated market maker (AMM) has risen from just $186 to the north of $30k at its peak.

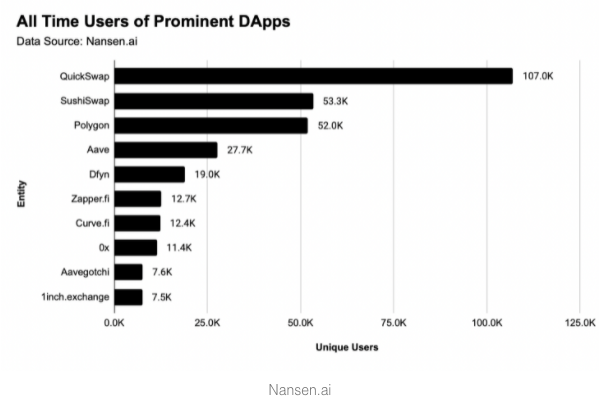

Polygon’s growth, in contrast, has been steady. Those already familiar with Ethereum went to the sidechain trying to escape the extremely high cost of transactions on the second largest network. The layer 2 solution has its own variation of Uniswap, QuickSwap, which has risen in popularity. Its rapid growth can be attributed to the fact that it enables over 10,000 swaps, constantly indicating users make use of the lower transaction fees. Additionally, the average value of swaps on this automated market maker (AMM) has risen from just $186 to the north of $30k at its peak.  Popular lending protocol Aave which currently dominates the DeFi space, is also contributing to the share of transactions on Polygon. Aave was integrated on Polygon for less than a quarter, but the average user on Polygon's implementation of Aave does about 5 transactions on any given day, noted Joel John. The combined gas cost for supporting over 4,000 users as of early June was under $15. In the meantime, Polygon’s $9 billion market cap coin MATIC is feeling the market woes, trading at $1.40, down 46% from its all-time high of $2.62.

Popular lending protocol Aave which currently dominates the DeFi space, is also contributing to the share of transactions on Polygon. Aave was integrated on Polygon for less than a quarter, but the average user on Polygon's implementation of Aave does about 5 transactions on any given day, noted Joel John. The combined gas cost for supporting over 4,000 users as of early June was under $15. In the meantime, Polygon’s $9 billion market cap coin MATIC is feeling the market woes, trading at $1.40, down 46% from its all-time high of $2.62.

bitcoinexchangeguide.com

bitcoinexchangeguide.com