Fantom (FTM) is a highly scalable decentralized technology ecosystem. The blockchain is also well-known for its commitment to ensuring its blockchain is both scalable, secure, and truly decentralized.

This article covers in-depth details about the Fantom (FTM) ecosystem. As well as its top three TVL apps. According to DeFi Llama, Fantom’s (FTM) three most important TVL apps include Multichain (formerly Anyswap), SpookySwap (BOO), and Geist Finance.

1. Multichain (MULTI)

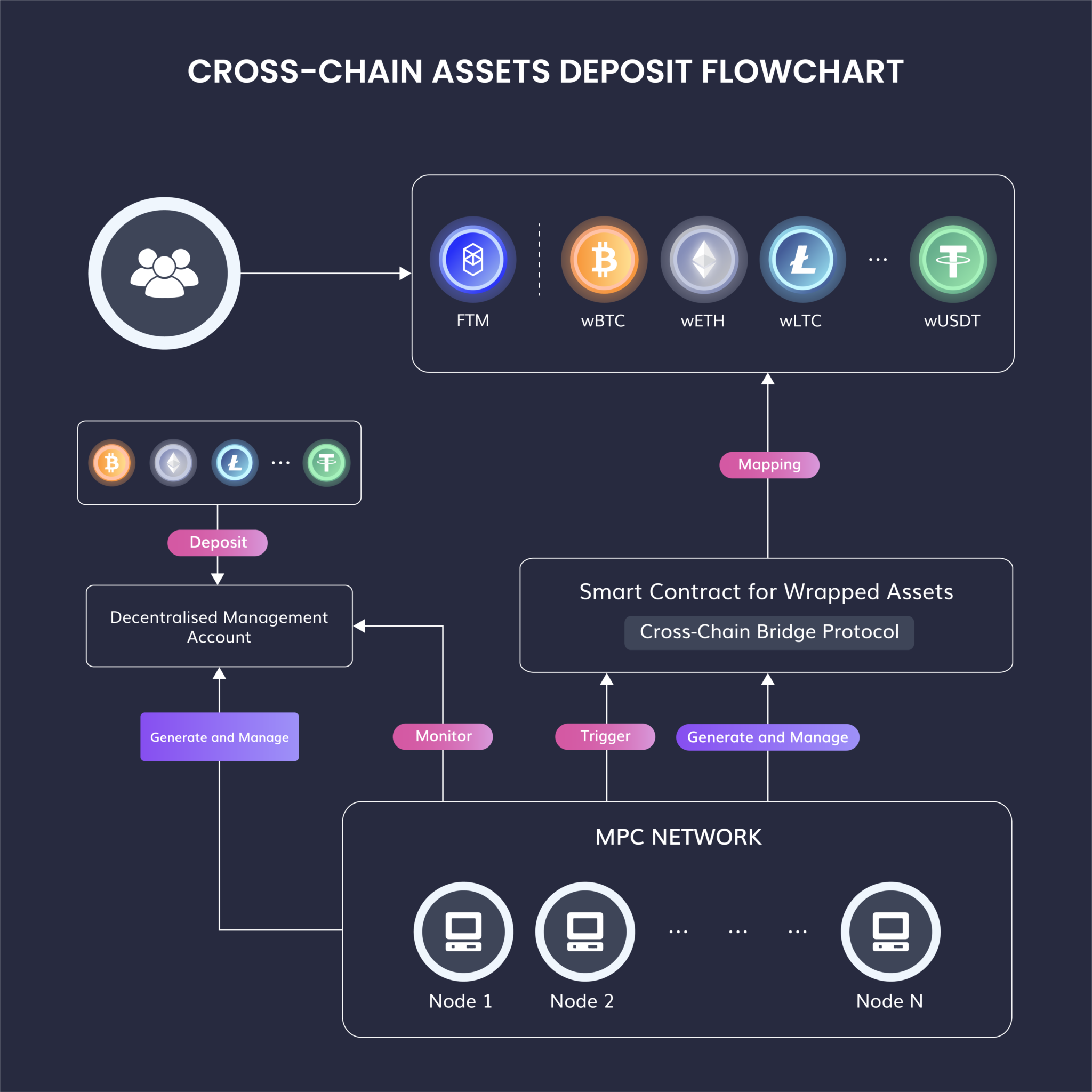

Multichain (MULTI), formerly Anyswap, is a cross-chain router protocol (CRP) touted as the “ultimate router for web3.0.” Anyswap was first launched in July 2020 as a means for blockchains to effectively communicate. In simple terms, Anyswap is a blockchain interoperability platform.

Thanks to its unique features, Multichain can be safely described as one of the most important players in the cross-chain ecosystem. Notably, Multichain is made up of SMPC nodes. Furthermore, these nodes exist separately from any blockchain and sign transactions collectively. However, for them to function, a group of them with only partial knowledge of a particular key need to work together. SMPC nodes are operated by different individuals, organizations, or institutions.

Interestingly, several services make use of the Multichain SMPC network. They include:

- Bridge – A bridge only operates between two blockchains. Currently, there are over 600 bridge assets on Multichain.

- Multichain Router

- anyCall Crosschain Contract Calls

- Crosschain NFT Bridges and Router

The $MULTI token powers the entire Multichain ecosystem. The token also doubles as a governance token giving its holders the opportunity to vote on important network decisions. Interestingly $MULTI has a total supply of 100 million $MULTI.

Source – Multichain Blog

Apart from Fantom, Multichain is also supported by several other chains, namely: Avalanche, Ethereum, Cronos, Polygon, Binance Smart Chain (BSC), Fuse, Fusion, Moonriver, IoTeX, Kucoin, etc.

According to DeFi Llama, Multichain currently has the highest TVL on Fantom network with $2.67 billion.

2. SpookySwap (BOO)

The second app with the highest TVL on Fantom is SpookySwap. SpookySwap is an AMM DEX platform specially designed for the Fantom Opera Network. It has also been described as an all-in-one DEX for exploiting diversified funds across different ecosystems.

The native token of the SpookySwap platform is the $BOO token. $BOO also functions as a governance token.

Since its launch last year, SpookSwap has recorded a number of important updates. Some of these updates include:

- Support from the Fantom Foundation

- Organized and launched an airdrop event with Alpha Finance Labs and Alchemix

- Strategic partnership with Popsicle

- Passed seven (7) proposals

- Audits by CertiK

- Designed and launched a bridge between Fantom and Ethereum, Polygon, Binance Smart Chain, Avalanche, etc.

In Q1 of 2022, we expect to see more upgrades on the SpookySwap platform, including:

- A Secret DEX upgrade

- Expert Trader V3

- Token/LP Zapping

On DeFi Llama, SpookySwap has a TVL of $1.15 billion. Subsequently, SpookySwap is the app with the second-highest TVL on Fantom.

3. Geist Finance

Geist Finance is the app with the third-highest TVL on Fantom. The platform is a decentralized, non-custodial liquidity market platform. Also, it provides interested persons with the opportunity to borrow or lend.

On the platform, depositors are tasked with providing liquidity from which they earn passive income. Borrowers, on the other hand, have the opportunity to borrow funds.

According to DeFi Llama, Geist Finance currently has a TVL of $690.58 million on Fantom (FTM).

FTM Price

At the time of writing, FTM was trading at $2.30 with a market cap of $5,860,538,909. Also, FTM has a 24-hour trading volume of $1,092,839,850. Furthermore, the token price is also down by 17.7% in the last 24 hours.

altcoinbuzz.io

altcoinbuzz.io