New data shows that the DeFi industry is booming and is recording a new ATH smashing total value locked of $105B. The jump is somehow following the price jump of Bitcoin that recorded a new all-time high yesterday.

It seems that more people are looking to lock their assets in DeFi platforms hoping for more rewards or benefiting from financial services. The current stats show that lending protocols are still among the top in terms of locked values and Ethereum is still dominant in terms of hosting blockchain for DeFi platforms.

Attractive Alternatives

DeFi services are still among the most popular products of blockchain technology. More people every day come to the platforms and use them for various reasons. Some people lock their assets to earn from staking or lending opportunities. Some others do their swappings on the decentralized exchanges, and many more are liquidity providers. After all, the platforms are experiencing considerable growth in terms of total value locked and the metric has shown a new all-time high recently reaching about $105B.

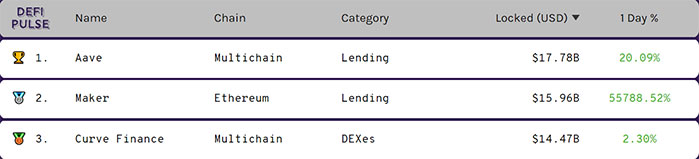

The top platforms considering the total value locked are Aave, Maker, and Curve Finance. The first two are lending protocols, and the third one is a decentralized exchange. The interesting fact is that Maker has shown huge growth in the last day with a whopping 55788.52% growth in TVL (source).

DeFi platforms have the power to attract more users in the coming months. Many mainstream users are now seeing the growth of Bitcoin and recording a new ATH. Many of them are looking for opportunities to earn more from this market but feel like being late. Because many experts believe that investing in Bitcoin may not have that many earnings from now on compared to altcoins and other strategies, so, many users may consider investing in other platforms and DeFi is a great way to start, especially for those who are seeking a passive income.

There are numerous opportunities in the DeFi sector for investors. They can provide liquidity for pools or stake their assets and receive rewards. As more people are using DEXs or borrowing money from lenders like Maker to trade in the market, these liquidity providers may earn more in the coming months.

After all, the data shows that the DeFi boom isn’t going to decline anytime soon. More people are locking their assets in the platforms and it seems the amount and the number of users is going to go higher with the launch of new competing services.

crypto-economy.com

crypto-economy.com