In our previous article, we have taken a deep dive into the Kava ecosystem. Through their official Medium page, the platform has announced their product rebranding by introducing the Kava Mint, Kava Lend, and Kava Swap protocols.

The idea behind the Kava protocol rebranding is to impart clear information to the users about the products and their services. So let’s see how the products look now.

- Kava CDP is now Kava Mint. The platform is governed by the $KAVA token, and it allows the users to mint $USDX stablecoin loans by providing collateral.

- Hard is now Kava Lend. This will allow the users to supply and borrow assets and earn rewards from them. It is governed by the $HARD token.

- Swap is now Kava Swap. It will allow users to swap cross-chain assets, provide liquidity into the pools, and earn rewards from it. Kava Swap is governed by the $SWP token.

Setting Up

Before using any products on the Kava protocol, the users need to follow these two steps:

-

Load BNB

You will use this BNB as collateral. Users can access the Kava lending application only through their Trust wallet and Ledger device. Make sure you have a Trust wallet installed on your phone.

Now, send BNB from your Binance exchange account to your Binance Chain address. This will be the BNB address of the multi-coin wallet in your Trust wallet which you have linked to the Kava Desktop App. Now, send BNB from Binance Chain to Kava Chain.

-

Load KAVA

You will need KAVA to pay a transaction fee. Send KAVA from your Binance exchange account directly to the Kava chain.

Thus, by following these two steps, you can load your desired tokens into the platform for further processing. You can now proceed with the minting process.

Kava Ecosystem Products

As mentioned earlier, the Kava platform is now comprised of three main products: Mint, Lend, and Swap.

-

Mint

Minting in Kava means taking a loan from the protocol. The minting process allows you to generate USDX stablecoin loans.

To Mint, visit the website and connect your Trust wallet mobile application with the Kava desktop application via WalletConnect.

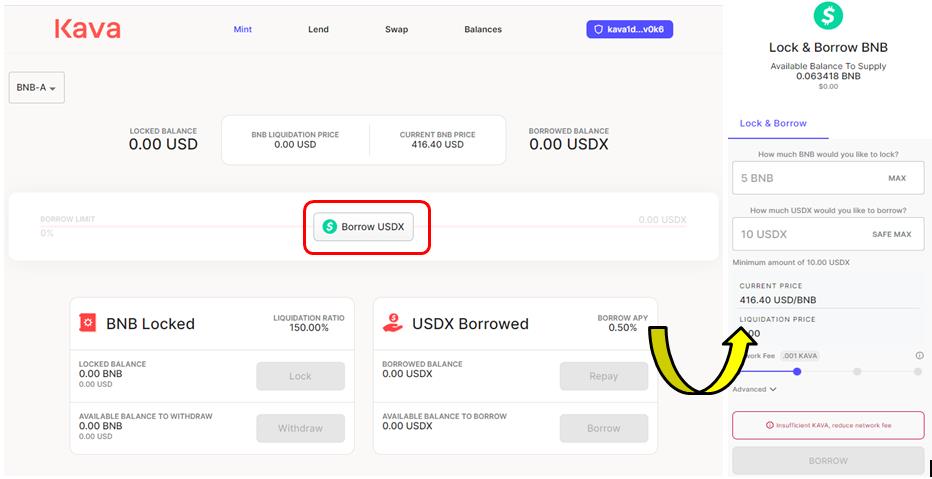

Click on Borrow USDX, and a window will appear where you need to fill the amount of BNB that you are willing to lock as collateral. In the second field, you are required to fill the amount of USDX that you wish to borrow.

For the safer side and to avoid liquidation use, select Safe Max. It shows the max amount of tokens you can borrow without being on the verge of liquidation.

Benefits of Taking Loans Using KAVA

- As Kava is cross-chain, you can use your BNB, BTC, or XRP to take a loan.

- Kava charges a mint APY of 0.5%. This is less compared to mining DAI in MakerDAO (2% stability fee).

- Low fees: You will need approximately 0.001 KAVA to mint USDX.

- Kava blockchain is extremely fast.

- There is no vault opening charge. MakerDAO charges $25 for vault opening.

- Minters earn KAVA rewards. The amount of KAVA each week distributed as rewards will vary by collateral types (BTC, XRP, BNB, etc.). The total amount you receive as rewards will be determined by what collateral you use and how much USDX you mint.

-

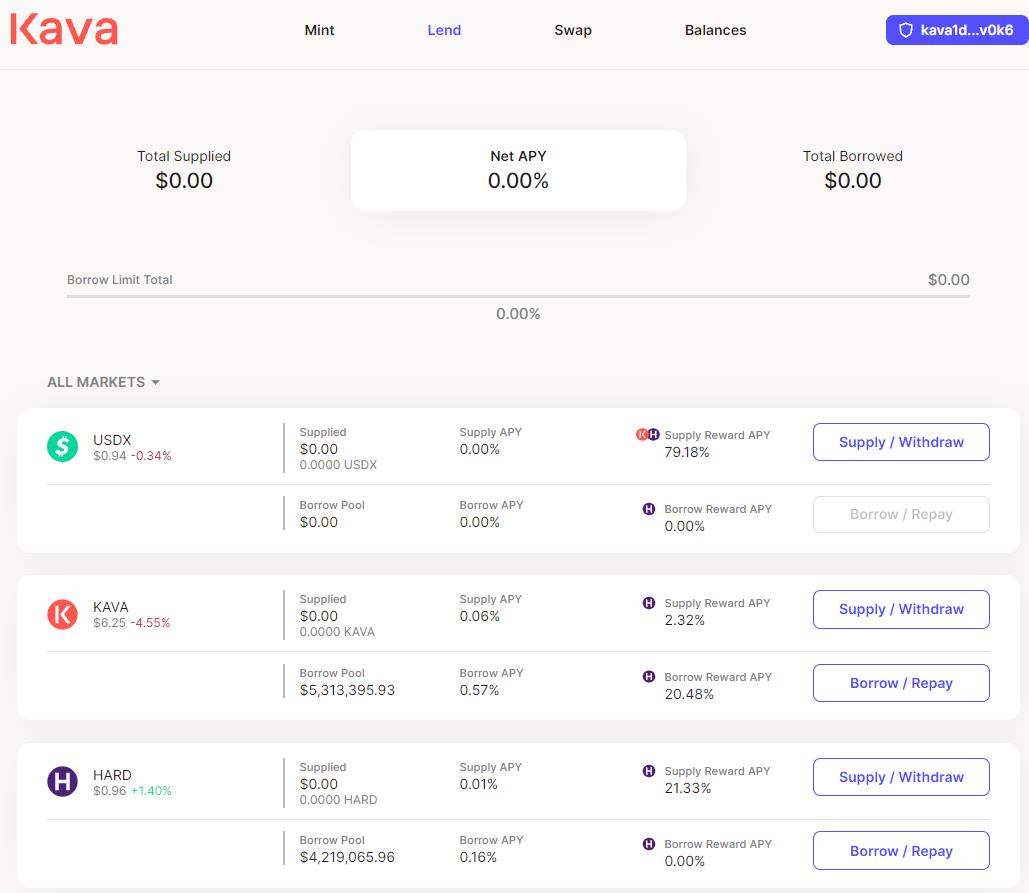

Lend

Using Lend, users can lend their crypto assets and earn a reward on them. They can also borrow different cross-chain assets at a low APY of 0%.

Kava Swap

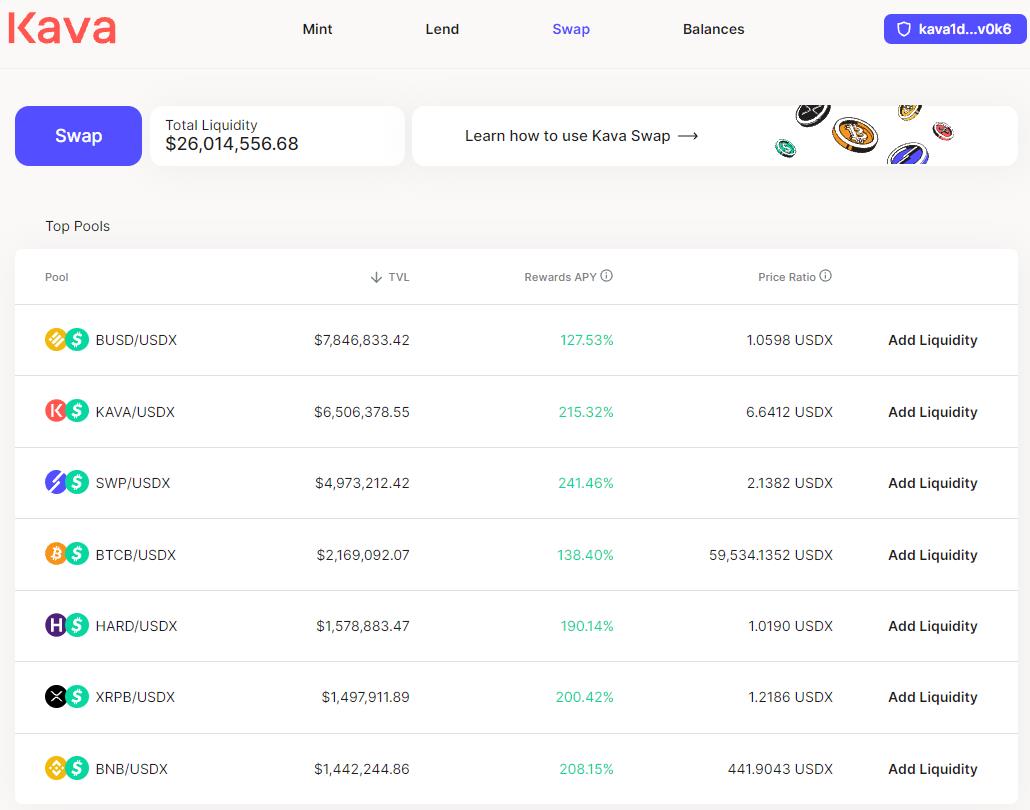

Kava Swap is a cross-chain Autonomous Market Making (AMM) protocol that leverages the Kava platform’s DeFi infrastructure, cross-chain bridges, and security. It delivers users a seamless way to swap between assets of different blockchains and deploy their capital into market-making pools where they can earn handsome returns.

The platform currently allows you to swap BNB, USDX, BTCB, BUSD, HARD, SWP, KAVA, and XRPB.

Users can also provide liquidity into the supported pools shown below and earn rewards.

Benefits of Kava Swap

- Low fees

- High rewards. Some of the liquidity pools are offering 242% APY (see screenshot above).

Challenges

-

Difficulty to enter a new chain

As Kava uses its native chain, any new entrant will face the hurdle of transferring to a new blockchain.

- You can set up the Kava blockchain in Trust wallet, and then you can link it with the Kava app using WalletConnect. Sometimes WalletConnect is buggy. In case you face challenges, do reach out to their Telegram group.

- You will need to transfer KAVA for transactions and the coin, let’s say BNB, that you wish to use as collateral to the Kava Chain. Be very careful while transferring these. Kava has not built any bridge solution yet, and yes, transferring from Binance is preferable.

-

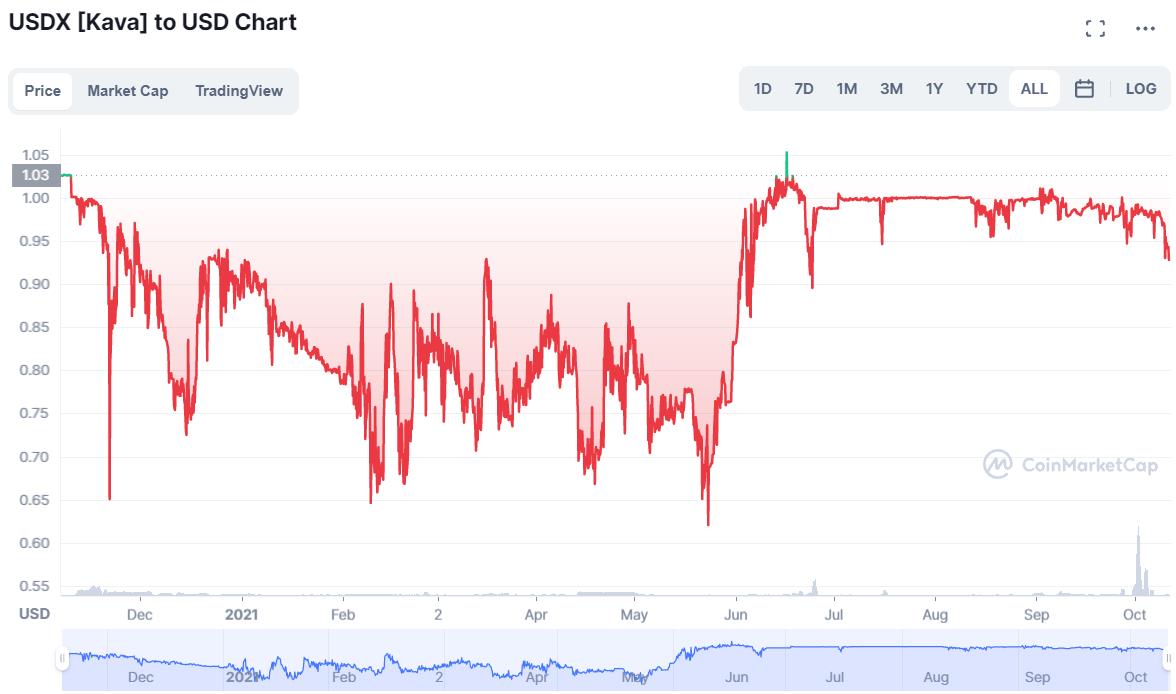

USDX Peg

USDX is a decentralized stablecoin, just like DAI. It is not backed by dollars directly. As a result, Kava does not guarantee the stability of USDX. As per Kava, “There is nothing inherent to the USDX digital asset design which itself guarantees it trade in markets around 1 USD, or even that it will trade in a stable range.”

This means that you do not have the comfort of a fixed value when you borrow. A closer look at the performance of USDX reveals that it has fallen to as low as $0.68 previously.

Kava has, however, mechanisms to bring up the price.

User Adoption

From an adoption perspective, the daily volume of USDX ($258,192) is pretty low as compared to DAI ($465,601,968)

Kava vs MakerDAO

- Kava is an integrated (minting, lending, borrowing) platform. MakerDAO is only used to mint DAI. To get lending and borrowing features, you need to move to Compound.

- The above point also justifies Kava multi-token architecture. However, the platform remains easy to use as all features can be accessed in a single platform.

- Kava supports BTC, BNB, XRP, etc. MakerDAO mainly supports Ethereum-based tokens like Ethereum, Chainlink, and Yearn.

- Stability fees in MakerDAO (2%) are higher as compared to Kava (0.5%)

- The liquidity of Kava is less as it is listed in only a few exchanges. Fortunately, Kava is listed on Binance.

- Kava has strong market competition like MakerDAO, AAVE, Compound, etc.

Conclusion

Kava protocol aims to break the monopoly of the Ethereum-based DeFi protocols like Aave, MakerDAO, and Uniswap by offering cross-chain support to lend, borrow, swap, and mint all under a single interface. It offers a low transaction fee at a high speed. These two factors can help the platform to gather enough attention as the users are currently overburdened with high gas fees in the Ethereum network. The platform is now focusing on expanding the Kava platform’s scale, performance, liquidity, and bridge service. The 2021 roadmap looks promising, and if they continue to maintain the development pace of 2020, the platform will mark a huge spike in terms of TVL and user base.

Resources: KAVA

Read More: How to Stake Axie Infinity ($AXS) Tokens

altcoinbuzz.io

altcoinbuzz.io