Since the rise in the popularity of Decentralized Finance, Crypto has managed to reach millions of people.

Traders and Holders are now smarter and not just analysis and study but also precautionary ideology has been developed.

Much like with the traditional financial markets, individuals may take out insurance on their assets to protect them from losses.

The DefI projects are trying to protect investors from falling prey to scams or other issues.

The DeFi insurance market is beginning to really take off, although there is still a lot of work to do.

Only a minority of people currently have insured their crypto assets.

As the existence of Defi insurance projects becomes common knowledge and the benefits are explained, more people will get involved.

If you’re thinking

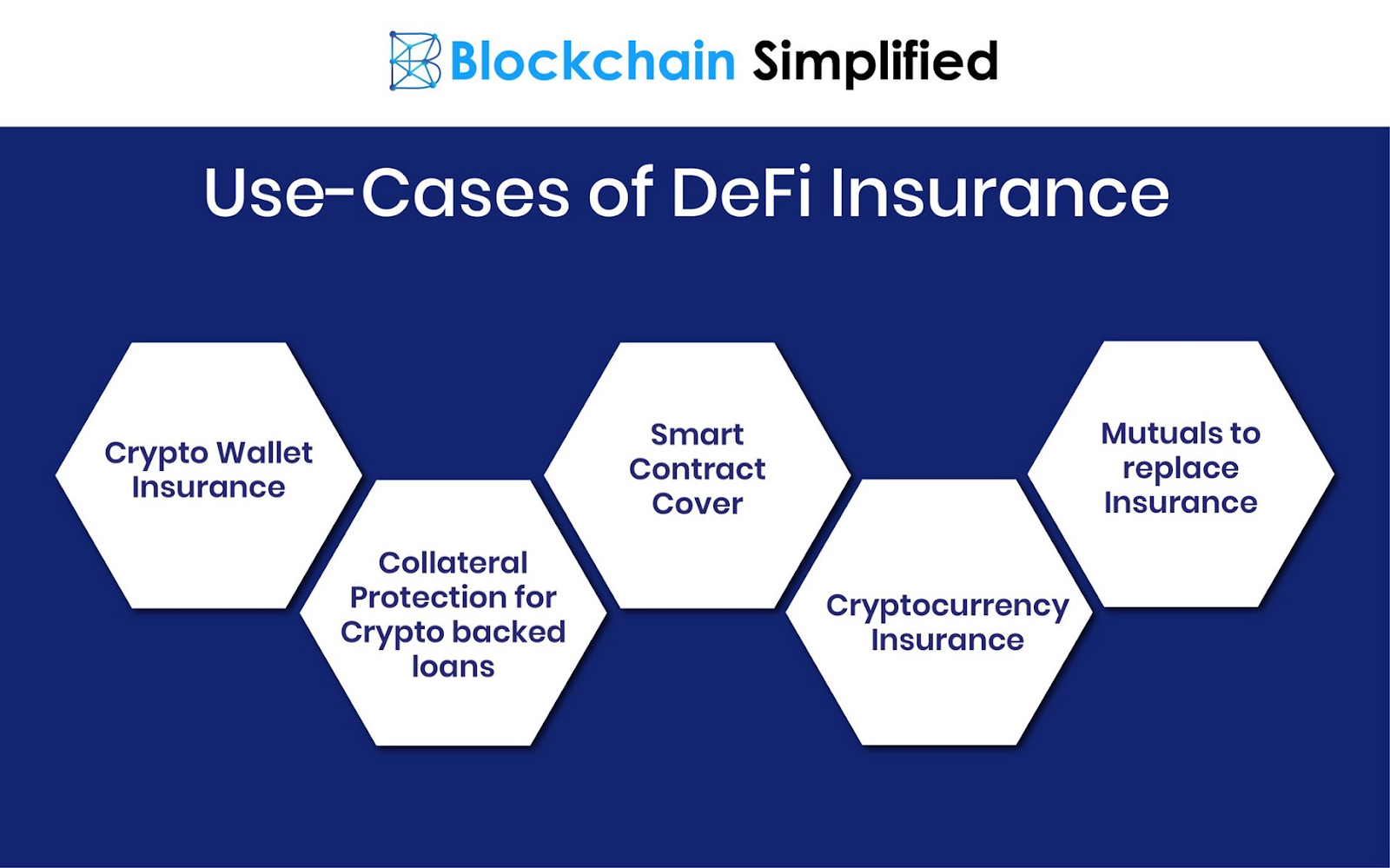

What does this Crypto Insurance can really offer, just like general finance? Have a look at the image below.

We’ve listed on Top5 Defi Insurance Projects to help you know more.

InsurAce.io

InsurAce.io is one of the most exciting new DeFi insurance projects.

Primarily due to the fact that it has been deployed on both Ethereum and Binance Smart Chain in last two months.

The project has been backed by Alameda Research, Defiance Capital, Huobi Labs, and Hashed to name a few, with the overall impact of providing protection to over 50 protocols.

That includes AAVE, Compound, Anchor, mStable, and 88mph, protecting their users from smart contract vulnerabilities.

It is currently the case that less than 2% of DeFi holdings (of $58 billion) are insured and this project is aiming to change that.

The project is leading the sector, offering cover on multiple chains and protecting against centralized exchange risks and IDO risks.

Due to their deployment across several blockchains including Heco, Solana and Polygon, the prices of securing a plan are low.

Sometimes as much as 60% lower than the nearest competitor using a unique portfolio insurance product.

This makes it a lot easier for investors to operate securely in the volatile crypto market.

The project currently provides cover for Smart Contract Vulnerability, Centralized Exchange Hacks, and risks from IDO events, with dPeg and wallet insurance services on the horizon.

Nexus

Nexus Mutual is another example of a prominent DeFi insurance project in the market.

Allowing customers to get covered against the very real threat of exchange hacks and the failure of smart contracts.

This project is not actually in the form of a company but is actually run by its own internal community.

This means that projects decisions are always recorded on the blockchain and are then enforced through the use of smart contracts.

The project has already attracted a large amount of attention in the space.

The project plans to expand into further insurance products in the future like insurance for crypto wallets, and other normal insurance products, like those related to natural disasters.

Cover

Cover is a DeFi insurance project that aims to make insurance a more community-driven endeavor. Also has a peer-to-peer insurance market.

This means that prices are driven by the supply and demand of the different coverage plans.

Also, Users are able to get coverage without providing their identity to the project itself, which is important for those that value their privacy.

Not only can you get insurance for your DeFi portfolio, but this project also allows you to make purchases beyond that scope.

The project uses a community board to establish whether or not an individual has a valid claim under their insurance plan, meaning that it is accountable for the decision-making process for claims.

Nsure

Nsure is an open insurance platform operating in the DeFi market.

The project provides an open marketplace where users can exchange risks, which is based on a similar model that was introduced by Lloyd’s London.

This means that the price of insurance cover is heavily based on the movements of the market, which creates a more dynamic market.

Users of this project are also able to provide their money, or assets to the project in return for NSURE tokens.

Insurance purchases also generate these tokens for the users. These tokens are then automatically mined at an ongoing rate and are automatically distributed.

Bridge Mutual

Bridge Mutual is the final example on this list, with the project providing coverage for a variety of crypto assets.

The project claims that the decision process is fairer and more transparent as it goes through a two-stage voting procedure.

The project is also planning to deploy cross-chain features in an effort to improve the usability of their DeFi insurance project.

The decentralized approach of the platform allows individuals to insure the risks of other individuals.

This also means that the people insuring the risks are able to make a profit from the resulting staking process that is involved.

coinpedia.org

coinpedia.org