Key highlights:

- Bitcoin dropped a sharp 11% today as it settles around $51,000 - beneath the 100-days EMA.

- The coin had dropped as low as $46,000 during the session before rebounding.

- The sharp drop was caused by Tesla making a U-turn on accepting BTC payments.

Buy Bitcoin on Binance

| Bitcoin price | $50,694 |

|---|---|

| Key BTC resistance levels | $51,000, $52,360, $55,000, $58,000, $60,000 |

| Key BTC support levels | $50,000, $48,000, $47,000, $46,000, $45,850 |

*Price at the time of writing

Bitcoin saw a disastrous 11% price drop today as it slips from yesterday’s $58,000 high to reach as low as $46,000 today. It has since rebounded slightly back above $50,000 to trade around $51,000 but is facing resistance at the 100-days EMA level.

The cause for the price drop is primarily due to the fact that Elon Musk sent out a Tweet stating that Tesla is no longer accepting Bitcoin as payments for purchases on their electric vehicles:

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Musk stated that the company is concerned about the rapidly increasing use of fossil fuels for mining Bitcoin to facilitate transactions. They elaborated further, saying that Coal fuel was used in particular, which has the worst emissions of any energy.

Bitcoin started to tank after the Tweet was sent out as fear spread throughout the market. Musk did state that Tesla would be selling any Bitcoin, and they would be integrating it again as soon as mining transactions were using a more sustainable form of energy. Additionally, he stated further that they are looking at other cryptocurrencies that use less than 1% of Bitcoin’s energy for mining - probably PoS coins.

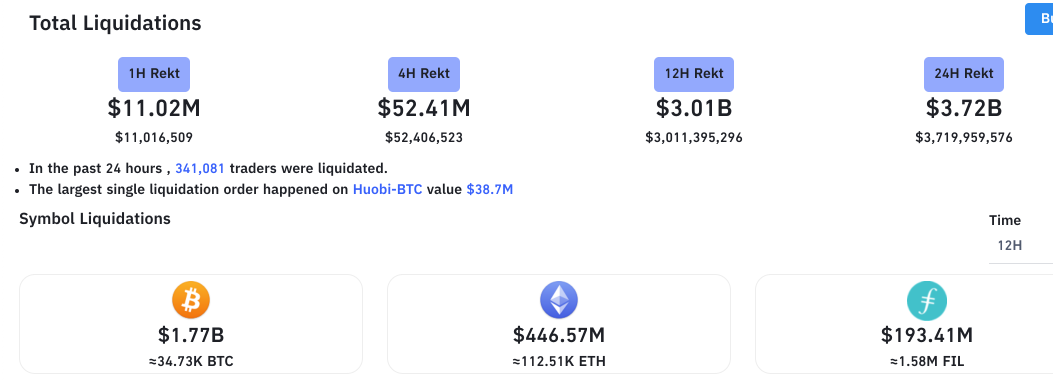

The price drop was quite severe, and it ended up causing over $2 billion worth of crypto futures long positions to be liquidated in the hours after the Tweet came. Since then, the total amount of people being liquidated over the past 12 hours alone has surged to $3 billion. $1.77 billion of that was from Bitcoin with $446 million worth of ETH futures also being liquidated:

Source: bybt.com

To make matters worse for Bitcoin, there is a potential “Ada, & Eve” double-bottom forming on the US Dollar chart:

As you may be aware, one of the primary driving forces behind 2021’s major Bitcoin rally was a falling US Dollar. The US Dollar started to decline as the US Government increased stimulus measures to combat the effects of the COVID-19 pandemic - pumping trillions into the economy.

With the purchasing power of the Dollar eroding, many institutions were forced to look for a hedge against the inflation. Some large institutions, including Tesla, elected to buy up Bitcoin as a means to hedge the inflation, which caused BTC to surge.

However, with a potential double-bottom forming on the US Dollar, it could be the first signal that the downward might be coming to an end. If this is true, institutions would not need to look for a hedge against inflation, and their BTC buying spree might dry up.

The price drop caused the market cap of Bitcoin to fall beneath 1 trillion dollars again as it now sits at around $950 billion.

Let us take a quick look at the markets and see where we might be heading.

Bitcoin Price Analysis

What has been going on?

Looking at the daily chart above, we can see that Bitcoin had rebounded from support at $47,000 toward the end of April as it started to push higher again. As May started to trade, BTC struggled to break resistance at the $58,000 level for the first few days. When it finally did manage to break above $58,000, it was stopped by a falling trend line at around $59,000 and could not break above it.

As a result, Bitcoin rolled over from there and started to fall at the beginning of this week.

The sharp price fall seen at the start of yesterday saw BTC falling from $58,000 to reach the support at around $50,000 as the candle closed. However, in today’s trading session, BTC continued even further lower as it plummeted beneath $50,000 and hit as low as $46,000.

It has since rebounded back above $50,000 but is struggling to climb back above resistance at the 100-days EMA - around $51,000.

Bitcoin price short-term prediction: Neutral

Bitcoin has to be considered neutral in the short term. It is in danger of turning bearish in the short term if a daily closing candle is produced beneath the $47,000 (April lows) support. On the other side, it would need to rise and break above $60,000 to turn bullish in the short term.

If the sellers do push lower, the first support lies at $50,000. This is followed by support at $48,000, $47,000 (.5 Fib Retracement), $46,000 (today’s low), and $45,850.

Additional support can then be expected at $44,720 (downside 1.272 Fib Extension), $44,000, $42,800 (.618 Fib Retracement), and $42,000 (200-days EMA).

Where Is The Resistance Toward The Upside?

On the other side, the resistance at the 100-days EMA at around $51,000 will prove to be difficult to climb back above. Bitcoin has not closed beneath the 100-days EMA since October 2020, and this is a significant level break.

Above $51,000, resistance lies at $53,260, $55,000 (50-days EMA), $56,000, and $60,000.

Where Are The Technical Indicators Showing?

The indicators do not look entirely gruesom, which could be a signal that there is more pain on the way. The RSI is beneath the midline, indicating the bears are in control of the market momentum, however, there is much room for the bearish momentum to further increase before becoming extremely overbought.

Keep up-to-date with the latest Bitcoin Price Predictions here.

Previous BTC analysis

At CoinCodex, we regularly publish price analysis articles focused on the top cryptocurrencies. Here's 3 of our most recent articles about the price of Bitcoin:

- Bitcoin Sees 7% Price Drop And Breaks Beneath 50-day EMA, Are We Heading Back To $50,000? (Bullish)

- Bitcoin Dominance Analysis - BTC Dominance Trading In Long Term Ascending Triangle - Is Altseason 2.0 Being Pushed Further Back? (Bullish)

- Bitcoin Meets Resistance At $57,270 But Remains Inside Ascending Price Channel - Will The 50-Days EMA Hold? (Bullish)

coincodex.com

coincodex.com