Bitcoin has become somewhat volatile as the crypto world gets its first introduction to stock listing.

The currency dropped to $62,600 at one point following an absence of any stock trading once the bell opened at 9:30AM New York time.

Filling the vacuum, Coinbase futures on crypto exchange FXT were taken by some as indicative of the stock price, with such futures falling from $620, to first $550 and currently $475 at the time of writing.

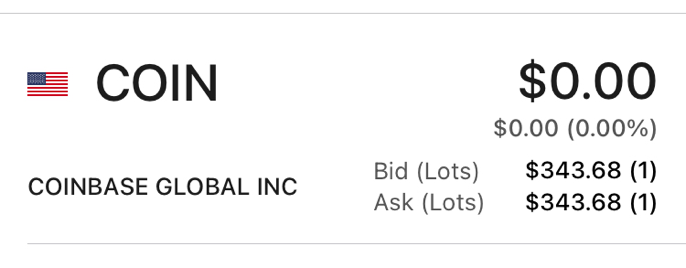

As it happens, however, there still has been no trade at the time of writing, but there has been a bid and ask.

No one can currently buy the share at this current price as we’re still at pre-IPO despite the bell ringing about an hour ago.

It may actually take another hour or so until they figure out opening price in this direct listing as unlike in an Initial Public Offering (IPO) where there’s a fixed price for a fixed number of shares, here current private Coinbase shareholders sell their shares.

In short they have to populate the order book first with a regulatory halt currently in place, so it may be after noon New York time that the first trade occurs.

The $250 initial price therefore was the bare minimum, with the above pictured $343 being its share price in secondary markets.

Some are calling this $343 an indicative opening price, but it remains to be seen at what level the first trade will occur with this indicative price currently being at $349.

So it may well open here, and then the market can set its actual price, but this form of listing is quite unusual as there are no new shares for the public.

That means initial circulating supply is significantly and artificially constrained in already fairly rich VCs, including Barry Silbert of the Digital Currency Group.

Some caution thus would be advised as they can withhold or flood the supply at will, but even at a price of $343, Coinbase would be valued at $90 billion.

That’s almost half ethereum’s market cap, with eth having its own decentralized exchanges like Uniswap that at time handled as much volumes as Coinbase.

In addition usually you’d expect crypto stocks to follow bitcoin’s price rather than the other way around, although of course such crypto stocks also have their own factors with at times little correlation between the crypto stock and bitcoin.

The difference here being we don’t know what Coinbase’s opening price will be and how it might behave in the first hour of trading, so there may be a big move or bitcoin doesn’t care.

The latter may be the case if there isn’t some unexpected behavior, like Coinbase starting trading at $700 and climbing. But since this unusual listing has its own factors, it may be bitcoin’s price is only affected by a small percentage rather than drastically.

trustnodes.com

trustnodes.com