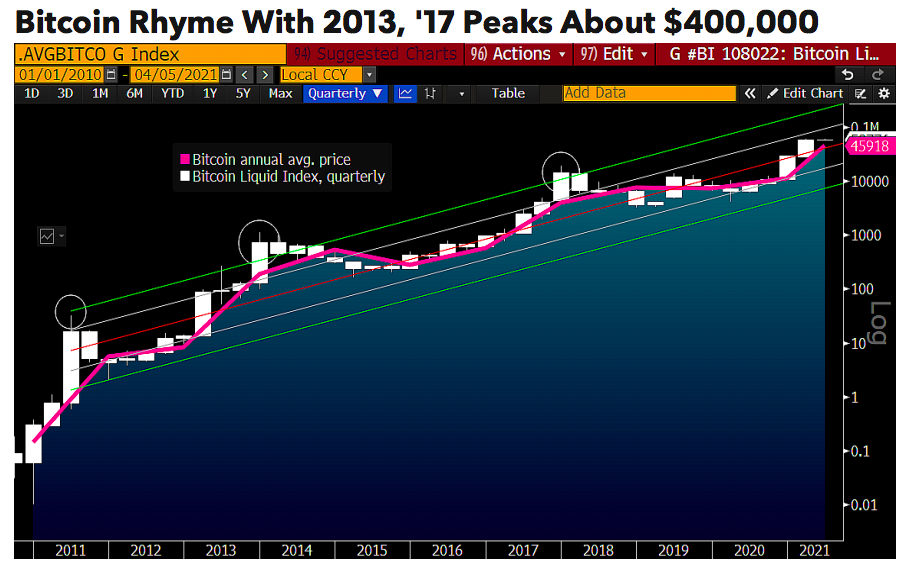

The bitcoin price target has been increased to $400,000 by analyst Mike McGlone in the April edition of Bloomberg’s Crypto Outlook 2021 report.

While BTC price continues to consolidate under $60k, its support has risen toward $50k, with $40k representing more extreme downside risk and resistance around $60k eroding with volatility, reads the report.

With little change with the price, Bitcoin “appears to be a bull market resting for the next leg of its stair-step rally.”

McGlone wrote that a backup to $40k is less likely and a more likely Q2 scenario is to breach $60k resistance and head toward $80k. Overall, the technical outlook for the year, if past patterns repeat, remains “strongly upward.”

Compared to 55x gains in 2013 and 15x in 2017, similar price extremes would take the largest crypto to $400,000 this time, based on the regression since 2011 high.

[caption id="attachment_286675" align="alignnone" width="904"] Source: Bloomberg[/caption]

The bullish factor is that there are few signs of BTC holders looking to sell as coins continue to leave exchanges indicating signs of demand.

According to the Commodity Strategist at Bloomberg, Bitcoin's adoption has been rather sudden than gradual, which is only expected to accelerate with a “rising tide from institutions and individual investors.”

This has the narrative shifting to a small crypto allocation from the risks of missing out on the potential for Bitcoin.

Bitcoin is actually fulfilling the need for a digital reserve asset in a low-yield environment as gold, a traditional safe-haven asset, which has been rather lackluster in its performance, said McGlone.

The largest cryptocurrency is actually “replacing old-guard,” which again is more sudden than gradual.

“The adage that money flows to where it's treated best describes what we see as firming underpinnings for the price of Bitcoin,” states the report. While not bearish for the precious metal, which continues to back into $1,700 support an ounce, most indicators show

Source: Bloomberg[/caption]

The bullish factor is that there are few signs of BTC holders looking to sell as coins continue to leave exchanges indicating signs of demand.

According to the Commodity Strategist at Bloomberg, Bitcoin's adoption has been rather sudden than gradual, which is only expected to accelerate with a “rising tide from institutions and individual investors.”

This has the narrative shifting to a small crypto allocation from the risks of missing out on the potential for Bitcoin.

Bitcoin is actually fulfilling the need for a digital reserve asset in a low-yield environment as gold, a traditional safe-haven asset, which has been rather lackluster in its performance, said McGlone.

The largest cryptocurrency is actually “replacing old-guard,” which again is more sudden than gradual.

“The adage that money flows to where it's treated best describes what we see as firming underpinnings for the price of Bitcoin,” states the report. While not bearish for the precious metal, which continues to back into $1,700 support an ounce, most indicators show

“a shifting global tide that favors the nascent digital currency as a reserve asset.”The report also mentions the dollar's digital dominance eclipsing China’s yuan’s global adoption. The same is happening in the crypto world, where Tether (USDT), defined as “currency to bitcoin's digital gold,” is trading more than the cryptocurrency itself. As for the much-talked-about discount on Grayscale Bitcoin Trust (GBTC), it could be just a normal dip in a strong bull market with appreciation expected to be the most likely outcome.

“The increasing probability for Bitcoin ETFs in the U.S. is supporting the price but contributed to a shift to discount in GBTC.”[deco-beg-single-coin-widget coin="BTC"]

bitcoinexchangeguide.com

bitcoinexchangeguide.com