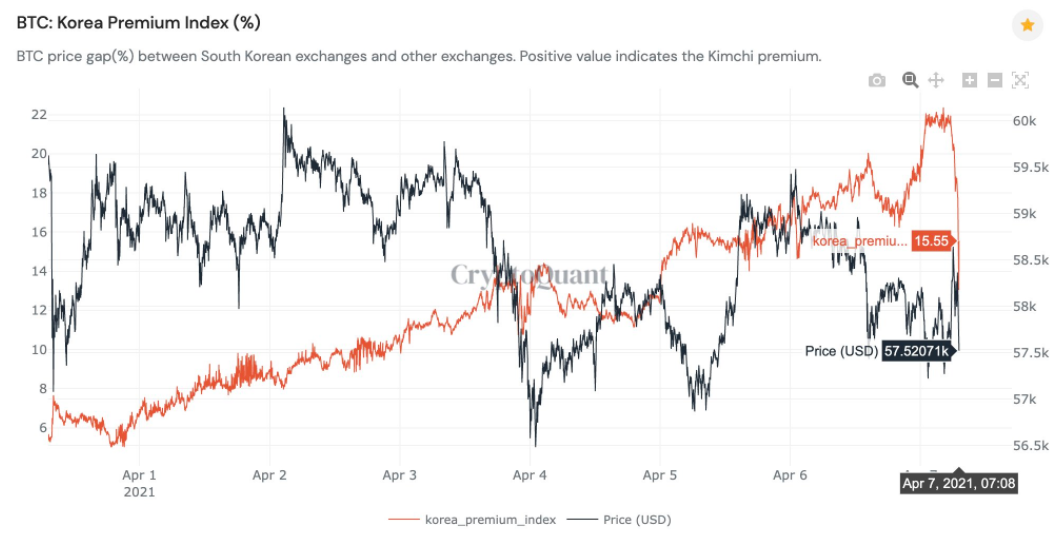

Kimchi premium has been flying high until it wasn’t. Bitcoin prices on South Korean exchanges at one point today were as much as over 22% higher than other cryptocurrency exchanges. But soon it took a big hit and dropped to about 13%. Ki-Young Ju of data provider Crypto Quant noted,

“It seems someone finally figured out how to arbitrage this Kimchi premium opportunity. The trading volume in 30min time frame on Upbit, the largest Korean exchange, was bigger than Binance's. This drop seems related to Kimchi pullback.”As of writing, Bitcoin is trading at $56,740 on Coinbase Pro, $56,824 on Binance, $64,247 on Upbit, $64,469 on Bithumb, and $64,494 on Coinone.

Bithumb, according to CryptoQuant, is seeing an “increasing” inflow of BTC, unlike all the other exchanges which have been seeing a decrease.

A possible reason for the drop could be Upbit announcing a temporary suspension of fiat (Korean Won) deposit and withdrawals and KRW account registration services.

The suspension has been due to an urgent inspection by the KRW deposit and withdrawal service provider. Once this maintenance is completed, the exchange will resume the services. The translated notice reads,

Bithumb, according to CryptoQuant, is seeing an “increasing” inflow of BTC, unlike all the other exchanges which have been seeing a decrease.

A possible reason for the drop could be Upbit announcing a temporary suspension of fiat (Korean Won) deposit and withdrawals and KRW account registration services.

The suspension has been due to an urgent inspection by the KRW deposit and withdrawal service provider. Once this maintenance is completed, the exchange will resume the services. The translated notice reads,

“After the urgent inspection of the KRW deposit and withdrawal service provider has been completed, the KRW deposit and withdrawal and KRW account registration services will be resumed.”However, on South Korean exchanges, the biggest trading assets by volume are a bunch of altcoins, with XRP and BitTorrent (BTT) taking the top place [coin_stats_table symbol="BTT"]. XRP is trading nearly 16% higher at $1.10 on South Korean crypto exchanges than about $0.95 on Bitfinex. [coin_stats_table symbol="XRP"] XRP on these platforms is actually pulling in more than double the volume of Bitcoin [coin_stats_table symbol="BTC"] and Ether [coin_stats_table symbol="ETH"]. For instance, on Upbit, XRP and BTT are the two most traded crypto assets at $2.9 billion and $2.3 billion volume, respectively, versus $1.2 billion on BTC/KRW pair and a mere $428 million for ETH/KRW. Korean investors are also piling into the nation's crypto stocks, driven by Coinbase’s upcoming public listing. Hanwha Investment & Securities Co., which owns a 6.15% stake in Dunamu, is the best performer among Kospi stocks this year, as it uptrends over 210% YTD. Dunamu actually operates Upbit, which local media reported last week has also explored a possible listing on the Nasdaq. Other shareholders in the company are also enjoying an increase in their value. Woori Technology Investment Co. and Kakao Corp., both of which have about 8% stake in Dunamu, saw their share prices increasing by 140% and 38% respectively so far this year.

bitcoinexchangeguide.com

bitcoinexchangeguide.com