One serial seller with lots of bitcoin to their name decided to divest themselves of a huge chunk of bitcoin just before the crash to $47,400 that happened on Monday. Bitcoin lost around 20% within 24 hours due to the actions of a single whale, according to new research.

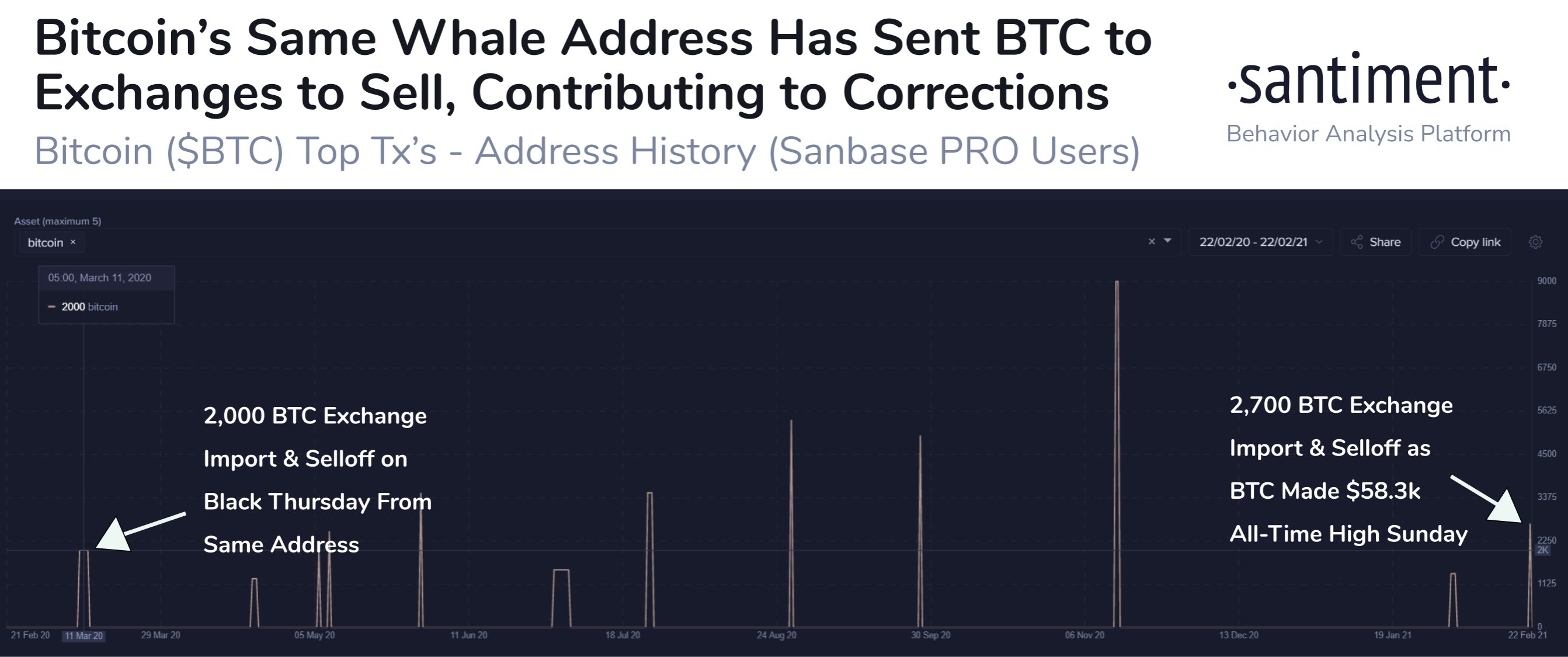

Santiment data published on February 23 indicated that bitcoin dropped to $47,400 after BTC’s second-biggest transaction of 2021 happened.

Bitcoin Sell-Offs Return

The transaction involved 2,700 BTC that was worth $156.6 million at $58,000 per token. This sale piled pressure on the market which resulted in the formation of the biggest one-hour candle in bitcoin’s history. Santiment wrote on Twitter:

“As we noted yesterday, there was an 11x exchange inflow spike that initiated #Bitcoin’s price correction from its $58.3k #ATH. Further data combing revealed that an address was responsible for the 2nd largest $BTC transaction of the year, an import of 2,700 tokens to the wallet before a quick sell-off.”

Findings from Santiment showed exactly what was happening as volatility took over the bitcoin market. The flagship crypto managed to recover to $54,000 before plunging again below $50,000. At the time of writing it is hovering between $45,500 and $48,700.

Some think that the market was overextended, with critics particularly alleging that a bubble-like process had long been underway. Others said that it was just ‘business as usual’ for cryptocurrency trading, but according to previous reports, worries had mounted about strangely high inflows to exchanges.

Santiment discovered that the same address managed to sell immediately before the cross-asset price crash in March last year. At that time, BTC lost nearly 60% of its value and hit a low of $3,600.

“This same address also made a 2,000 $BTC import last March right as the Black Thursday correction took place. In total, it’s made 73 transactions in its one-year existence, for a total of 91,935 $BTC imported, with all tokens moving away within minutes after arrival.”

Whales In Focus

Suspicions had been directed on whales that had profited from the small wallets selling in the previous price dips all through the recent bull run.

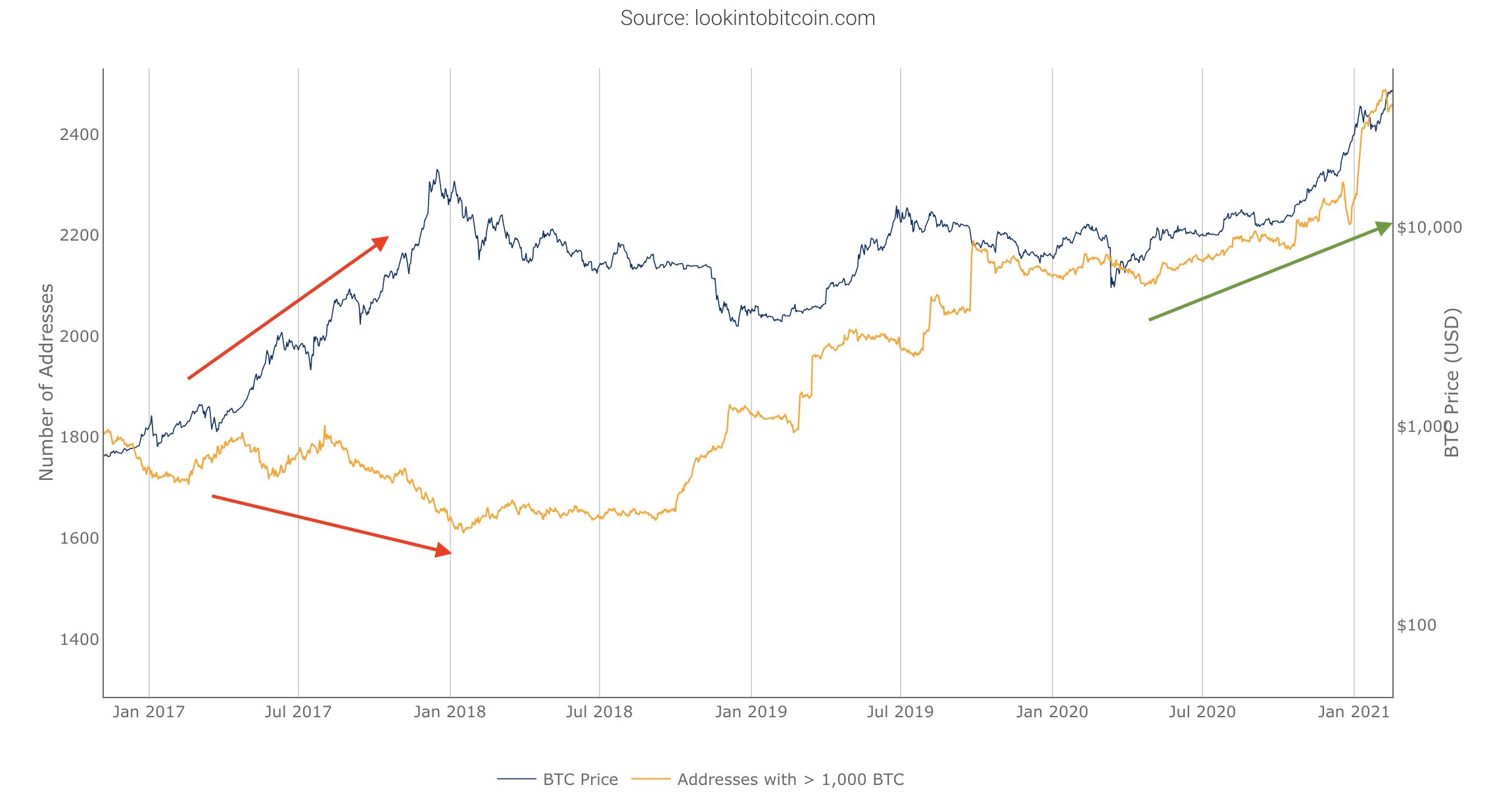

The total number of whale-sized wallets had been growing while the smallholders had been dropping. Primitive founding partner Dovey Wan tweeted in the past week while comparing the 2017 and 2021 bull runs:

“The most interesting side by side tells you how Bitcoin investor profile progress – ‘whales’ diminished as price elevated in the last cycle; new group of whales just keep popping up this time, while shrimps are the weak hands who sold too early. THE GREAT WEALTH TRANSFER.”

In the meantime, some of the responses to the research noted that the wallet in question had been mainly responsible for a fraction of total trading volume. Hence, its influence should be limited. Santiment concluded:

“We don’t believe that one address alone triggers the price retracement of the largest crypto asset in the world, so we certainly wouldn’t want you to believe it either. Was this address activity a contributing factor though? Yes.”

cryptovibes.com

cryptovibes.com