The U.S. Federal Reserve could be the surprising suspect that gives Bitcoin a serious price boost in the months and years ahead.

Although the central bank may not directly help the benchmark cryptocurrency, their actions to save the U.S. equities market from seeing a full meltdown appear to be working, leading some analysts to note that a rebound to fresh highs could come as soon as 2021.

If the benchmark indices do recapture their previously established all-time highs next year, this would be a highly bullish occurrence for Bitcoin due to its firm status as a risk-on asset.

U.S. Equities Market Shows Subtle Signs of Strength Despite Economic Turbulence

The stock market is holding up fairly well – considering that the Coronavirus pandemic has brought the global economy to a virtual standstill.

Currently, the S&P 500 is trading down just under 12% from where it began the year, with it posting a notable 10% rebound throughout the past month.

The S&P 500’s strength is emblematic of that of the entire market and has even led smaller outlier markets like crypto to rebound as well, with Bitcoin climbing from its mid-March lows of $3,800 to highs of $7,500.

Amazon – one of the largest companies in the world – has even been able to rally to fresh all-time highs today.

This performance in the face of unprecedented unemployment has shocked some investors, but one economist noted in a recent tweet that it is important to separate unemployment – which marks a single point in time – from the financial markets, which attempt to price in present and future events.

“Unemployment numbers describe a single point in time, while financial markets are discounting mechanisms that attempt to price in *present and future events*. Unemployment numbers are data, while prices are driven by emotions, perceptions and other variables,” he explained.

Bitcoin Could be Boosted by Fed’s Attempts to Bolster Markets

This strength may also stem in part from the massive liquidity injections the Fed has undertaken to boost the economy.

These actions have led one popular analyst to note that the stock market could set fresh all-time highs as soon as 2021.

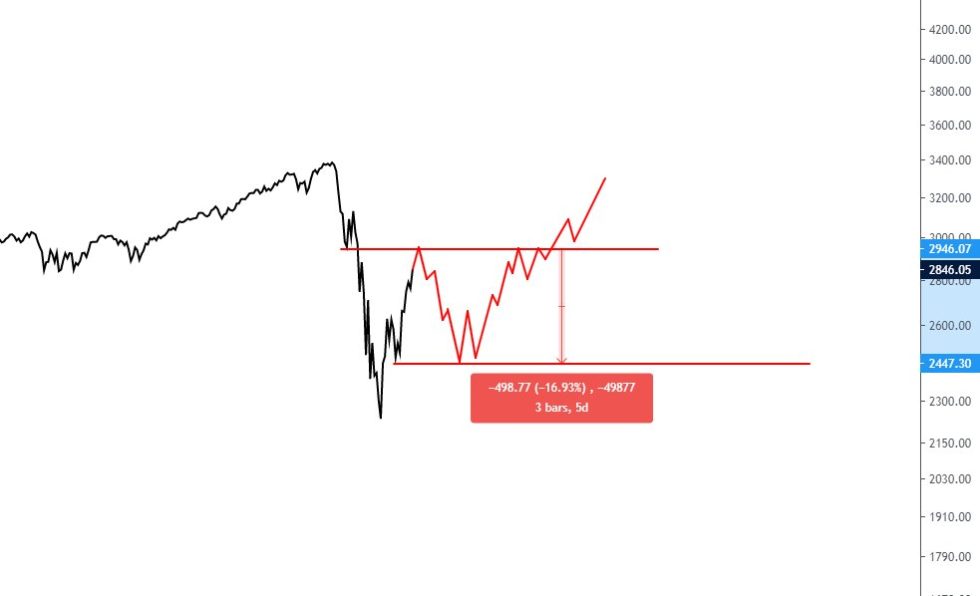

“I would be surprised at this point, given all the FED is doing, if we break market structure majorly again. Do I think we V shape? No, but my thoughts don’t move markets. I think we are looking at something more like this with new ATH in 2021,” he said while pointing to the below chart.

Image Courtesy of Cantering Clark

This possibility – should it play out – would be highly bullish for Bitcoin, as the crypto has established a striking correlation to the traditional markets throughout the past couple of months.

Featured image from Unsplash.

bitcoinist.com

bitcoinist.com