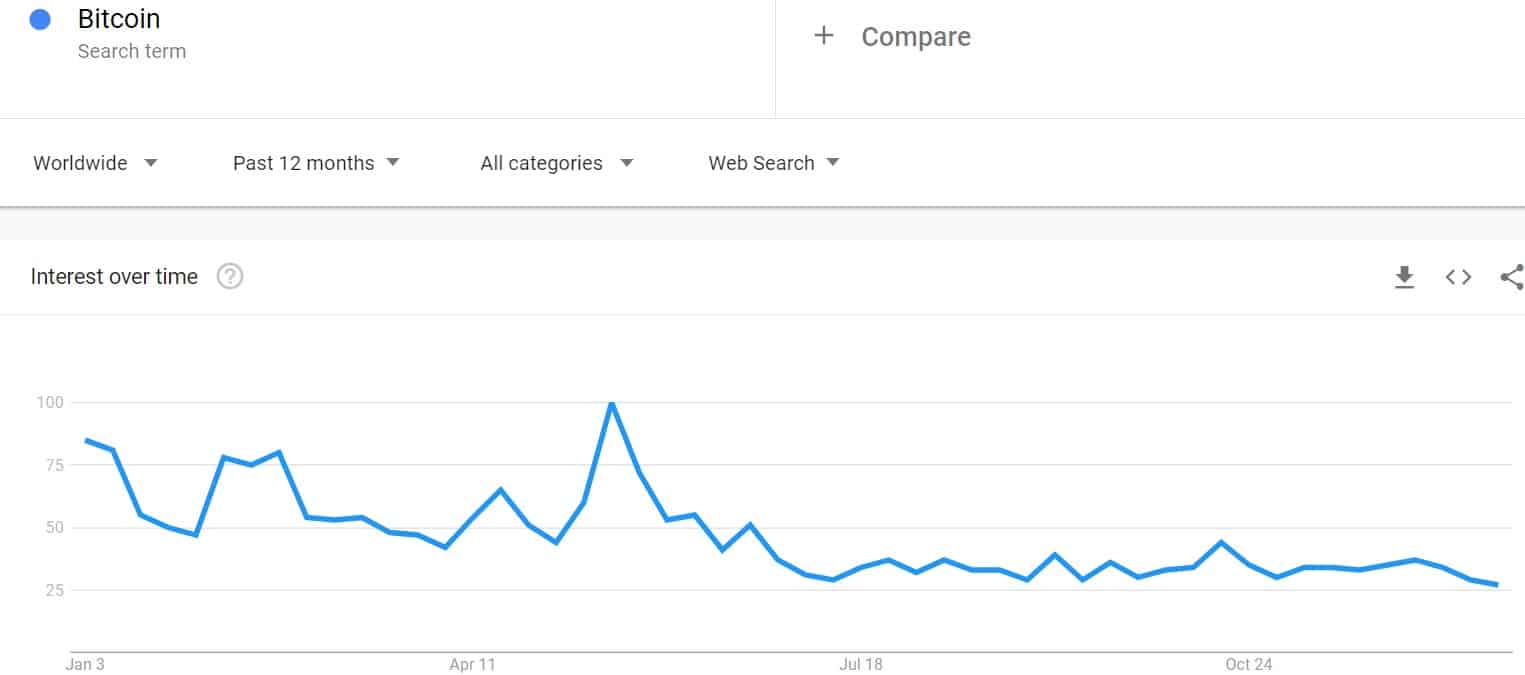

Retail interest in the primary cryptocurrency seems to be fading as the worldwide Google searches for Bitcoin have dropped to yearly lows. In contrast, the NFT queries continue to increase, reaching a new all-time high recently.

BTC Google Searches on the Decline

Google searches are typically a good indicator of the preferences and behavior of retail investors. This is particularly true for the cryptocurrency industry. The number of queries on the world’s largest search engine usually follows the price fluctuations of the ever-volatile digital assets and bitcoin in particular.

However, it has its exceptions. For example, the searches reached a yearly high in mid-May after the asset had already peaked at $65,000 and right around the time when Elon Musk outlined his energy consumption fears and China reiterated its flat-out ban on BTC and mining.

The subsequent price retracement was mimicked by a decline of the searches before they headed upwards during the late October rally and the launch of the first-ever futures Bitcoin ETF in the States.

Now, though, the queries have dropped to their lowest position this year. This comes amid BTC’s lack of success in reclaiming $50,000. At the same time, the “buy bitcoin” searches have also declined and are a long way away from the January and February peaks.

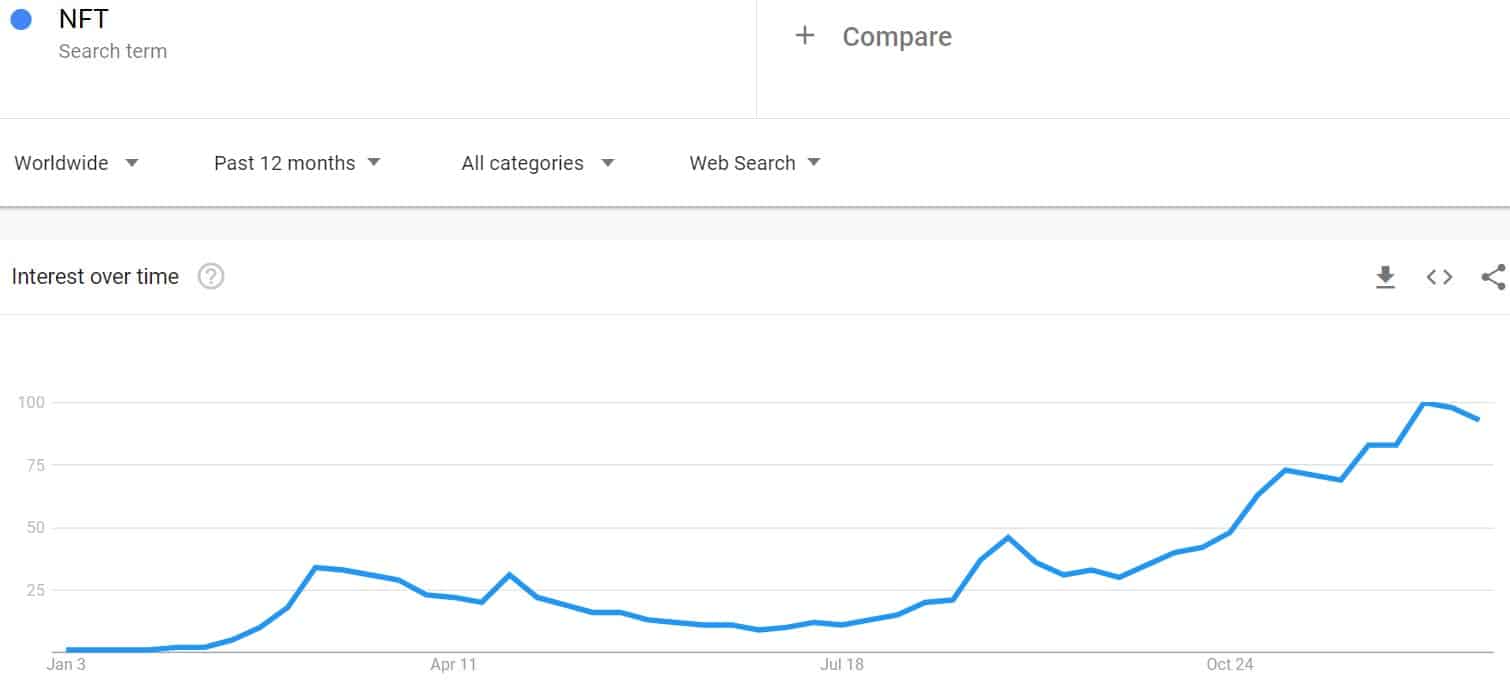

Everyone on NFTs?

While the interest in bitcoin seems to be missing, non-fungible tokens have taken the main stage. The industry is arguably the most improved one in terms of adoption, investments, new products, and everything in between.

It has seen the entrance of countless prominent individuals and businesses outside of the cryptocurrency space, from musicians and actors to politicians and sportspeople.

As it allows for fans to enhance their engagement with their favorite celebrities, it’s no wonder that the NFT Google searches have been on the uptrend for the majority of this year. They reached a new all-time high just recently, as CryptoPotato reported, and have remained at such a high level ever since.

cryptopotato.com

cryptopotato.com