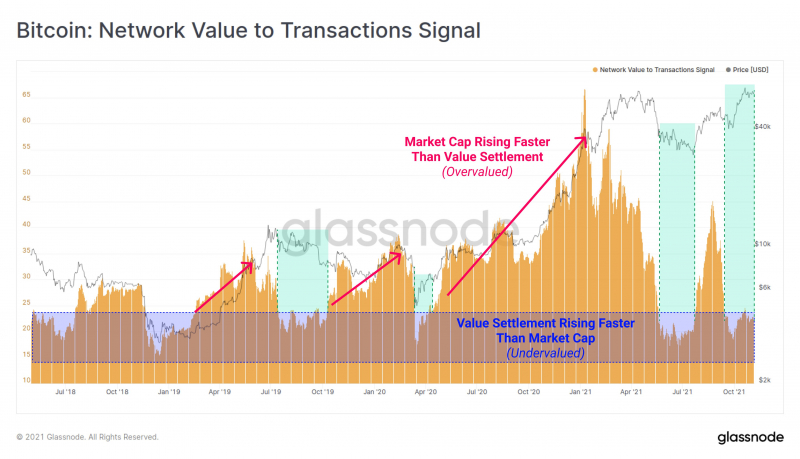

Bitcoin is considered historically undervalued according to the Glassnode Network Value to Transactions Signal indicator, which is now significantly lower than in January this year. The most recent spike in value settlement took place back in May.

How the metric functions

The presented indicator is a modification of the popular NVT metric, which was initially calculated by dividing the market cap by transactional volume in USD. The NVT Signal indicator uses the 90-day moving average of the transactional volume in USD.

By implementing the moving average, the indicator can be used more as a directional tool by removing unnecessary noise and random volume spikes that appear due to be technical mistakes or other problems.

What indicator shows us

Currently, the Value Settlement is staying below the value of 25, which is considered "undervalued." The low ratio indicates that the market cap is significantly higher than the transactional volume in U.S. dollars.

Drop in network activity is tied to the rapid decrease of exchange inflows and a shift in market exposure. With more investments entering the industry by using futures-backed ETFs and regular futures contracts, the market receives funds indirectly.

At press time, Bitcoin is trading at $61,558 and is not showing any signs of undervaluation, according to technical indicators like the Relative Strength Index, which is currently moving around the value of 55—considered a healthy market value.

u.today

u.today