The general market sentiment is positive, as operators and traders expect Bitcoin to perform as it has in the past. Bitcoin’s value increased by 5 percent as a result of strong gains. BTC price is on course to break through $65,000, it’s an all-time high.

Aside from that, the majority of big altcoins are also gaining traction. ETH is up about 5.5 percent and has broken over the $3,600 barrier zone. Although XRP is gaining, it is still below the $1.20 resistance level. ADA Price is seeking a break above the $2.20 resistance on the upside. Both coins are trading in green.

Bitcoin’s surge to a new all-time high had a little setback on October 12, but the world’s most popular cryptocurrency is back on pace, rising about 5% on Wednesday, October 13, and trading at around $58,000 on Thursday morning.

BTC has broken through the resistance levels of $57,200 and $57,500. It is currently trading above $58,000, indicating that it is on the upswing. An initial resistance level on the upside is near $58,500. The next major resistance level is about $59,000, above which the price might rise to $60,000.

On the downside, a key support level is at $57,500. The next key support is near $57,200, and if the price falls below that level, it might return to $56,500.

Also Read : Ethereum(ETH) Price Consolidation To Continue, Yet $4000 Target Remains Unchanged!

BTC holders & their behaviour:

The Chinese writer Colin Wu explained the behavior of bitcoin holders and their most recent attitude towards the commodity using data from the blockchain analytics startup Glassnode.

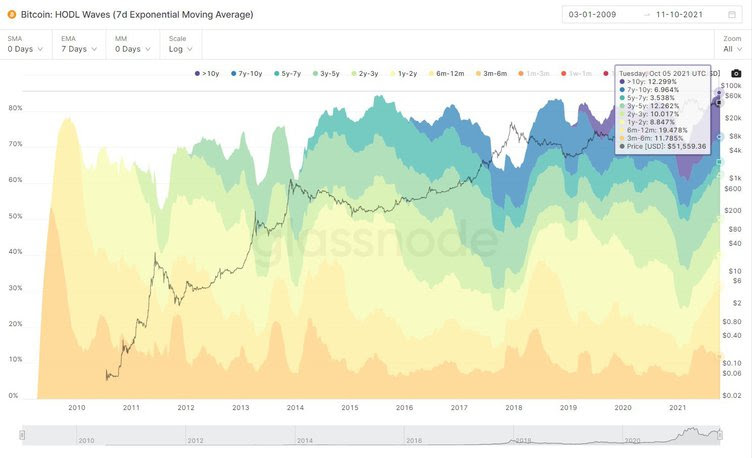

The percentage of bitcoin holders who have not transferred their bitcoin in more than ten years is 12.3 percent, as seen in the graph below. As a result, the tokens are considered dormant.

Those who haven’t transferred any BTC holdings between two and three years and between three and five years are 10% and 12.26%, respectively.

Surprisingly, individuals who have held their money for six to twelve months account for the highest number of those who have refused to shift them – 19.5 percent. In the end, 85.14 percent of bitcoins have not changed hands in at least three months, a new high.

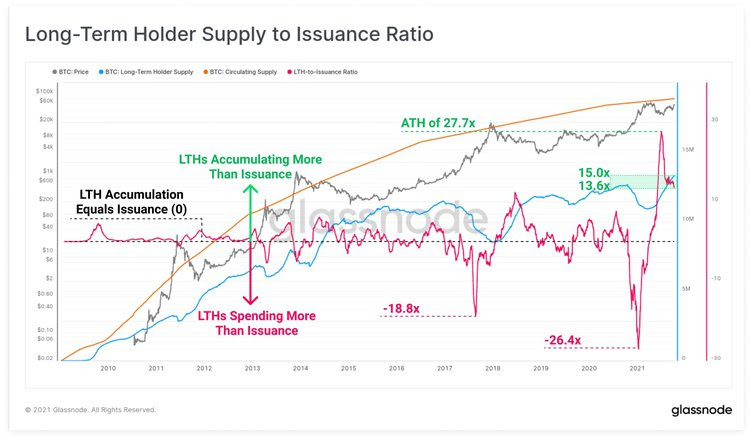

According to another recent data from Glassnode, the Long-Term Holders Supply continues to grow at breakneck speed, accounting for between 13x and 15x the new bitcoin issuance.

“Over the last 7-months, HODLing behavior has dominated, and over 2.37 million BTC have migrated across the Short-to-Long Term holder threshold (~155 days). To put this into context, only 186K BTC have been freshly mined in the same period.”

coinpedia.org

coinpedia.org