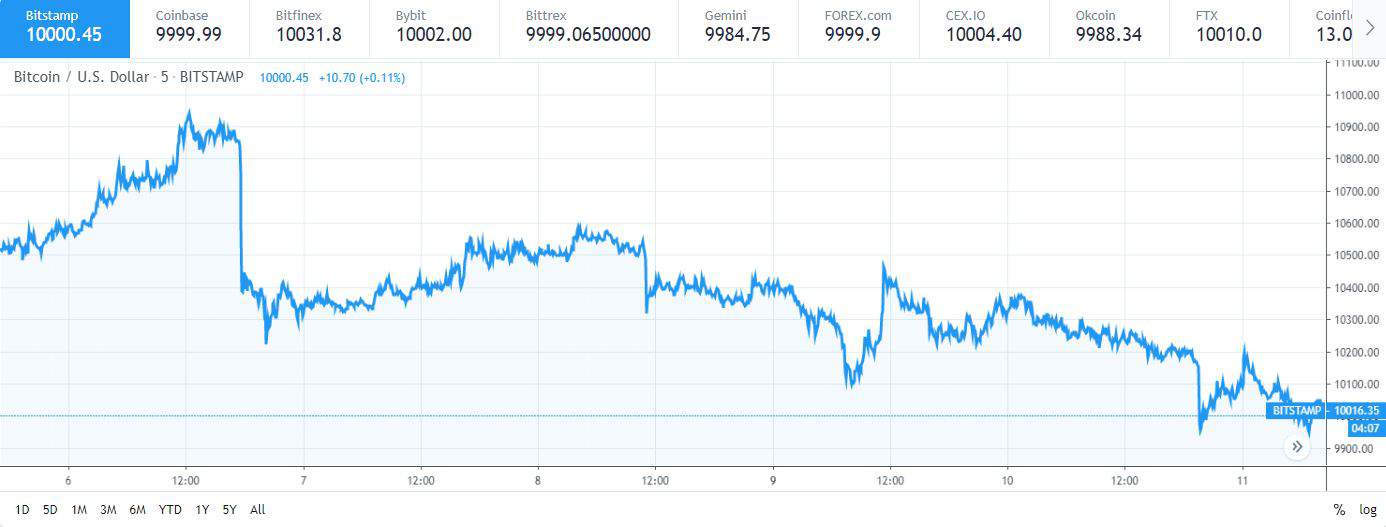

Bitcoin marks a slight decrease of less than 2% in the past 24 hours but its price remains above $10,000 for now. Things are looking relatively as the 30-day volatility has reportedly dropped to a low seen back in May 2019. Yet, if history is any indicator, it’s usually times like this that predicate a violent move.

Bitcoin Trading Between $10,000 and $11,000

For the past 8 days, Bitcoin has been trading in the range between $10,000 and $11,000, while its dominance index hovers around 70%.

Reportedly, however, the past 30 days have seen relatively low levels of volatility, last observed four months ago, back in May.

As CryptoPotato reported back in June, Bitcoin’s volatility, especially when raging, is a double-edged knife. It can be a good thing according to some, because it shakes out the weak hands of the market and it guarantees that BTC goes to the strongest holders. At the same time, it’s also a function of the cryptocurrency’s scarcity because as the supply is static, the price can be volatile.

On the other hand, it also brings quite a bit of downside. It’s commonly associated with price and market manipulation. This is among the reasons for which the US Securities and Exchange Commission (SEC) hasn’t yet approved a Bitcoin ETF.

Bitcoin’s volatility also makes trading a lot riskier. Expert traders, typically, see this as an advantage because they capitalize on the sudden price moves, but those who are less advanced can experience serious losses because of the frequent swings.

Calm Before The Storm?

It’s worth noting that Bitcoin’s fundamentals are looking stronger than ever. The hash rate is increasing rapidly which could be tied to increased network security. At the same time, we are anticipating the launch of Bakkt on September 23rd, which is one of the most awaited events within the crypto community. Bitcoin’s halving is less than 250 days away. It will decrease the supply of bitcoins on the market in half which should, in theory, drive its price higher as it has always done historically.

In other words, it’s also possible for the current range-bound trading pattern to be failing in reflecting these underlying factors, among many others.

Back in May, when volatility levels were as low as they are now, the price marched forward and it almost doubled up in June. Of course, it’s also possible that should any violent price swing be in the wait, it could be in the opposite direction.

cryptopotato.com

cryptopotato.com